Confirmation that credit default swaps on Credit Suisse have not been triggered has cleared the way for the next big derivatives play linked to the troubled lender: betting that its CDS spreads will converge with those of UBS ahead of the merger between the two former rivals.

The cost of default protection on Credit Suisse fell sharply following an industry ruling against a CDS trigger on Monday – the second such decision in less than a week. Five-year CDS spreads traded at 125bp on Friday, according to S&P Global Market Intelligence, down from 161bp a week earlier.

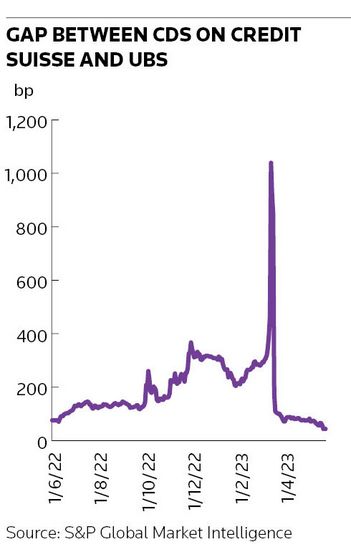

The gap to CDS on UBS, meanwhile, narrowed by 20bp to about 45bp – the slimmest difference in at least a year. That gap had ballooned to more than 1,000bp in mid-March before Swiss authorities brokered UBS’s emergency rescue of its ailing rival.

The market moves will cheer funds betting on a convergence in CDS spreads between the two Swiss lenders. If the merger completes as planned, the Credit Derivatives Determinations Committee, a group of banks and investment funds that rules on CDS market matters, will probably be asked to rule on whether a succession event has occurred. That is when CDS contracts referencing one entity are transferred to another.

Monday’s ruling that CDS on Credit Suisse had not been triggered looks to have provided the fuel for the rapid narrowing in spreads between the two lenders. That was the second time that the CDS committee voted unanimously that the takeover had not resulted in a credit event.

The committee decided the previous week that a government intervention credit event had not occurred following the wipeout of SFr16bn (US$17.8bn) in Credit Suisse’s Additional Tier 1 debt during its rescue. That came after hedge funds, including Diameter Capital and FourSixThree Capital, had loaded up on CDS that would pay out if the contracts were triggered. The committee then had to rule on a separate bankruptcy credit event last Monday – a question experts had considered even less likely to trigger derivatives contracts.

Still, the steep fall in Credit Suisse’s CDS spreads following that decision suggests lingering concerns over a potential trigger may have kept the cost of default protection on Credit Suisse at elevated levels in recent weeks. With those questions now in the rear-view mirror, the convergence trade with UBS looks set to take centre stage.