Bond markets are quiet. Perhaps a little too quiet considering the US is facing the very real prospect of defaulting on its debt – an event that would send shock waves through the financial system.

In an increasingly reckless display of brinkmanship, Congressional Republicans and Democrat President Joe Biden are still struggling to reach a deal that would allow the Treasury to continue paying its obligations.

Markets most closely linked to the outcome of those negotiations, such as Treasury bills, are flashing red. But they are still the outlier in what feels like an otherwise eerily calm atmosphere pervading broader debt markets.

"The bottom line is it looks very much like business as usual in the bond market,” said Raj Paranandi, chief operating officer for Europe and Asia-Pacific at bond trading platform MarketAxess. “All eyes are on the US at the moment, but for the time being everything is looking broadly normal."

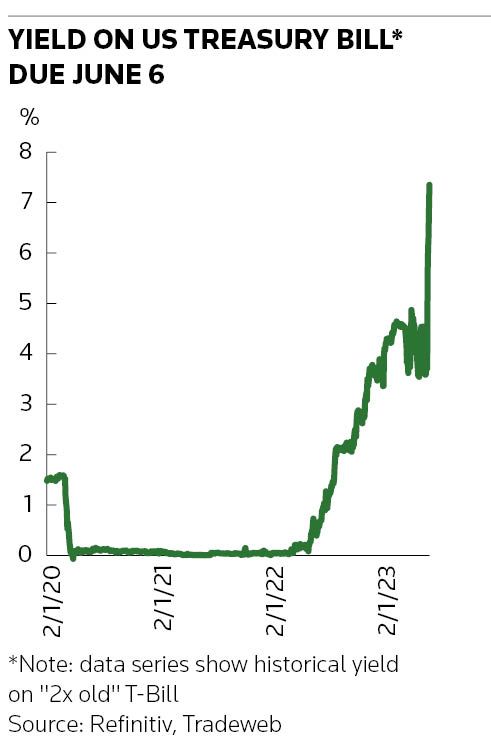

Treasury secretary Janet Yellen has said the US will run out of funds in early June. Yields on T-bills due to mature on June 6 have roughly doubled over the past 10 days to more than 7%, easing slightly to 6.60% on Friday following reports the two sides are nearing a deal.

By contrast, T-bills maturing just a few days earlier on May 30 yielded about 3.20%. The cost of insuring against a US default has also rocketed. Six-month US sovereign CDS spreads were trading at 200bp on Friday, according to Refinitiv, from below 20bp at the start of the year.

Other possible signs of unease are apparent if you look hard enough. US debt issuers have favoured raising more funds in euros lately, for instance, while secondary credit market trading volumes have also declined after a busy start to the year, indicating investors may be happier sitting on the sidelines for the time being.

But zoom out to wider bond markets and there are precious few signs of jitters – a surprising situation considering the pivotal role Treasuries play in valuing so many financial assets.

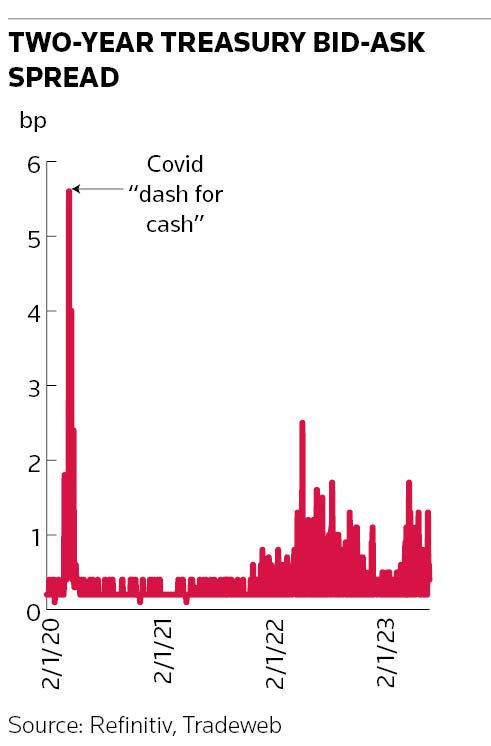

The bid-ask spread on two-year Treasuries, one measure of stress in these markets, has edged up to an average of about half a basis point in May, according to Refinitiv. That compares to just over a quarter of a basis point earlier this year.

Those levels are still below what was seen during the height of the US regional banking crisis in March. They're also a world away from the 5.6bp spread level reached during the so-called dash for cash at the start of the pandemic in 2020.

“I’m a bit surprised by the absence of signs of stress,” said one senior trader at a US bank. “T-bills is where all the action has been. If you look at risky assets, like equities or credit, you wouldn’t know that there’s something big brewing.”

Other popular gauges of bond market health are also showing a startling lack of concern. There isn't an abnormal amount of trading in shorter-dated bonds compared with other maturities – something you might expect if people were worried about the debt ceiling, Paranandi said. The balance between the number of buy and sell orders is also unremarkable, with no sign of a one-way market that might be associated with investors rushing for the exits.

“There’s nothing we're seeing in the numbers that looks like panic in the market or that liquidity has completely disappeared,” Paranandi said.