There are clear signs of recovery in investment banking activity after 18 months of slow dealmaking as companies become more optimistic about economic recovery prospects, bank chiefs said last week – although they kept a wary tone and said it is still well off normal levels.

"On the investment banking side, you continue to see a stabilisation in the market … leading to some hope and expectation of a revival in activity, which we are seeing very early signs of. But it will take time to play out," Barclays chief executive CS Venkatakrishnan said at a financial conference in New York on Tuesday.

"I was asked if I see the green shoots, and I responded that I’m smelling them," he said.

Other bank executives said optimism had grown in recent weeks, helped by a positive reception for the initial public offering of Arm in the US, lifting confidence that other big IPOs could follow.

"There's no question that the environment for capital markets activity is improving. It's still way, way off what I'll call cycle averages, but definitely improving," said Goldman Sachs CEO David Solomon at the same Barclays conference.

"It's been quite a while since I could say to you we have a handful of very significant IPOs in the market. That's an improvement. I do believe that if these go well – and it feels at the moment like they're progressing nicely – it kind of creates a virtuous cycle of bringing more of the pent-up backlog to market," Solomon said on Tuesday, two days before Arm's debut on Nasdaq.

August can go two ways

Arm had a successful debut and bankers are hopeful that will clear the path for other big US listings from the likes of grocery delivery firm Instacart, marketing software firm Klaviyo and German shoemaker Birkenstock. The hope is if they are well received it will spur private equity firms to look to sell or list portfolio companies.

"In corporate finance it has been risk-off, but increasingly there is pent-up energy with a lot of dry powder needing to be deployed. We feel quite good about what we are seeing,” said Fabrizio Campelli, Deutsche Bank's corporate and investment banking chief.

The mood is not universally upbeat in private, however. One senior investment banker said the current handful of IPOs is not representative of the broader market and owners are likely to want to see more evidence they will get the valuations they want and may hold off until early 2024. Bankers also said while the US economy looks set for a soft landing, a recovery in Europe could take longer, and there are concerns about a slowdown in China.

Still, Daniel Simkowitz, head of investment management and co-head of strategy at Morgan Stanley, said he was more confident now than at any time this year for the 2024 outlook.

Simkowitz said August is often interesting for capital markets, especially in periods of uncertainty. "You could either go home and just hope that the fall or September was better, or you can start to move forward on some quality situations or M&A that had some more urgency. And it was pretty clear, [in] August we were highly engaged," he said at the conference, citing a pick-up in M&A and leveraged buyout announcements.

If it quacks

Venkatakrishnan said components are building for a sustained recovery, including growing confidence in economic stabilisation, availability of cash, attractive asset prices, and banks willing to lend for a lengthy period.

“What we’ve got to test in the next few months is whether that coming together produces some deals. We think there’s activity under the surface, the ducks are paddling furiously and we just need to see how much they move," he said.

Solomon said the pick-up in IPO activity was not surprising. "When you have a reset in capital markets like this, history tells you it takes about six quarters to get things to kind of re-sort and get things to reopen. What do you know? We're kind of [at] six quarters."

He said M&A activity typically takes slightly longer to pick up. "There's no question CEOs feel a lot better right now, much more leaning toward good prospects for soft landing.

"So it wouldn't surprise you [that] inside our shop is more strategic [M&A] dialogue going on with companies. And I do think you'll see an acceleration of that. It's just that will lag the capital markets pick-up for sure," he said.

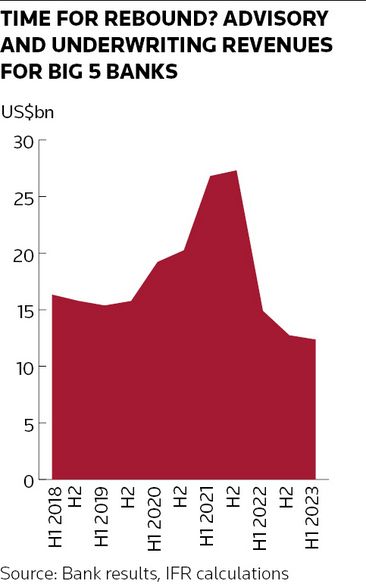

Bank chiefs said that lag between deal announcement and revenue realisation means the better tone won't show up much in third-quarter results, however, and advisory and underwriting revenues are likely to be similar to a weak year-earlier period.

“Obviously, wallets are still under pressure there, but juxtaposed against last year from a year-over-year basis, I'd expect to see us flat to up a bit year over year,” said Citigroup finance chief Mark Mason, citing good debt capital markets activity in the quarter.

But Bank of America said third-quarter investment banking should be around US$1bn, down about 15% compared to a year earlier. JP Morgan said revenue from trading could be down 1%–2% and sees a similar dip in investment banking.

Trading revenues should hold up better in the third quarter, bank chiefs said, continuing the trend of the last 18 months. Mason said trading revenue should be “up low single digits” percent from a year earlier and BofA said its trading revenue should be up “in the single digits”.