The face of foreign exchange markets is set to change significantly in the coming years as new bank regulations encourage more activity to be funnelled through central clearinghouses and onto exchanges, senior finance executives told TradeTech’s annual FX conference in Paris on Wednesday.

The Basel Committee's standardised approach for counterparty credit risk, or SA-CCR, has already taken a chunk out of US banks’ capital ratios and caused some to lose ground in parts of their FX businesses over the past year after they implemented the new rules in full.

More institutions are expected to take steps to ease the significant capital burden now weighing on their FX desks in the years ahead, potentially transforming a market where most business is still transacted on a bilateral basis rather than on-exchange or with a clearinghouse acting as an intermediary between trades.

“We’re still at the front end [of SA-CCR] but it will have a very fundamental impact on FX market structure,” said Paul Houston, global head of FX at exchange operator CME Group, speaking at the conference.

SA-CCR is designed to calculate capital requirements for banks’ derivatives exposure that more accurately reflect their counterparty risks. It replaces a model that was introduced in 1988 as part of the first Basel Accords, which focused on how much banks stood to lose if trading counterparties defaulted. Longer-dated trades typically attracted higher capital charges, while shorter trades had an almost negligible capital footprint.

The new approach still focuses on banks’ trading exposures, but it is supposed to be more risk-sensitive by differentiating between transactions that are margined, which reduces counterparty risk, and those that aren’t. It also recognises the benefit of netting when banks have various positions that offset one another. That means banks with cleared and margined trades – and those holding many offsetting exposures – will face lower capital requirements under SA-CCR, while banks with lots of uncleared trades and large, one-way positions will face higher requirements.

Trading headaches

SA-CCR went live for UK and US banks at the start of 2022 following jurisdictions such as the European Union that had come online halfway through the previous year, and instantly became a major headache for those with large FX derivatives operations.

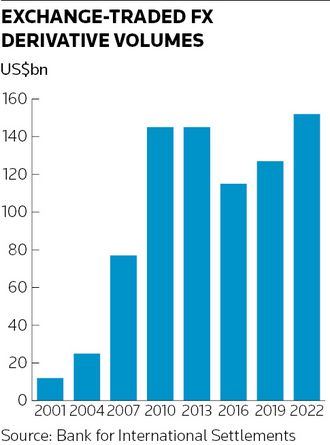

FX trades tend to be far shorter-dated than those in other asset classes, such as interest rates or credit, and so faced much lower capital requirements under the previous counterparty risk regime. And, unlike other derivatives markets, there was no enforced mass migration to central clearing or exchange trading for most FX derivatives in the years following the 2008 financial crisis. Only 4% of the US$108trn FX derivatives market was centrally cleared at the end of 2022, according to the Bank for International Settlements, compared with more than three-quarters of the interest rate swaps market.

US banks also have to contend with the so-called “Collins floor”, a piece of regulation that sets minimum capital requirements and makes SA-CCR even more punitive for them. Citigroup said in early 2022 that implementing SA-CCR had trimmed 49bp off its Common Equity Tier 1 ratio, while JP Morgan and Morgan Stanley have flagged increases in risk-weighted assets because of SA-CCR. The short-dated business of FX forwards trading is one area where some firms have had to cut back as a result.

“There are very large American banks who have been under [SA-CCR] for longer and who have almost halved their FX forwards book [with both other banks and clients] to such an extent that gross notional [derivatives exposure] wasn't a problem for them at the end of the last year,” Ben Tobin, head of Europe at market technology firm Capitolis, told the conference.

Easing the burden

Moving trades into central clearing is one way to mitigate the increased cost of SA-CCR. More than 80% of derivatives market participants expect FX derivatives clearing to increase in the coming months, according to a report published last month by data firm Coalition Greenwich, fuelled by a renewed focus on the efficient use of capital, balance sheet, credit, margin and collateral. Cleared over-the-counter FX volumes have increased 42% in LCH’s ForexClear in the past 24 months, while cleared notional is up 25%, according to Coalition Greenwich.

“The direction of travel [for the next five years] is for most of the interbank market to clear and for the buyside to join clearing as well to optimise their portfolio and get better market access,” said Loic Moreau, global head of risk and operations at ForexClear, speaking at the conference. “Because [doing that will save capital and margin, and] if the banks are saving capital and margin they will [also] realise that in their pricing.”

LCH is part of LSEG, which also owns IFR.

Prodding more trading activity towards FX futures could be another way for banks to lower capital requirements. Futures only represent about 2% of the US$7.5trn-per-day FX market, but are growing at a fast rate – with average daily turnover rising 42% year over year to US$199bn as of September 2022, according to the BIS.

“Futures are definitely part of the solution [and] are capital efficient,” Houston of CME Group said at the conference. He said the exchange was trying to make futures products more accessible to FX traders accustomed to the OTC world through steps such as offering contracts in more maturities.

“We’re really trying to leverage the benefits of clearing while retaining some of the features and flexibility [of] the OTC side,” Houston said.