Buyside sources involved in discussions with UBS executives have suggested an Additional Tier 1 deal from the Swiss bank is not imminent after reports emerged of its potential return to the market, and while a potential adoption of an equity conversion structure to better suit investors after the wipe-out of Credit Suisse's AT1s was discussed, bankers are unclear on how such a switch could be achieved.

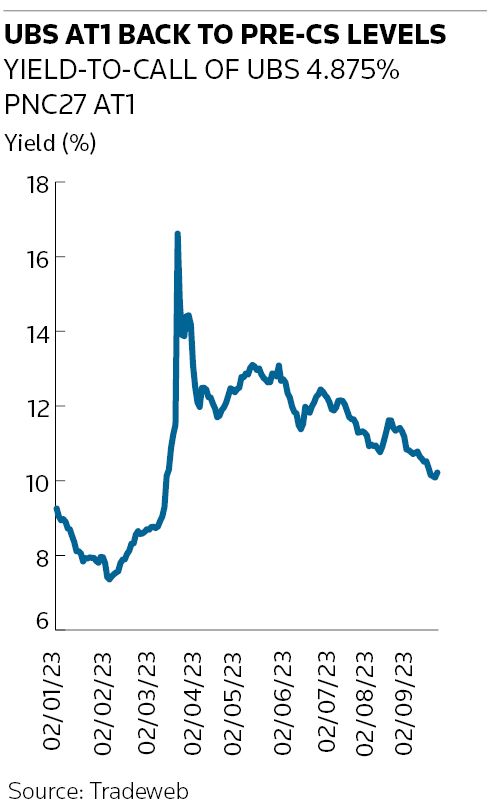

The question of when UBS will make its comeback to the AT1 market has intensified in recent weeks. Its next issuance will be a big moment for the sector after holders of Credit Suisse's AT1s saw their investment controversially written down to zero following its rescue by UBS in March, while equity holders were given shares in UBS. The saga shut the AT1 market for months, sparking multiple lawsuits and prompting regulators to renew questions over whether AT1s are fit for purpose as going-concern capital.

The Financial Times reported on Monday that UBS executives had sounded out investors over a potential AT1 deal during a roadshow. The report also said they discussed changes to the terms of future transactions to make them more palatable, including issuing equity conversion bonds instead of securities with a writedown structure. Credit Suisse's AT1s were structured with permanent writedown language, as is UBS's outstanding stack.

Investors who participated in the calls told IFR it had been more of a general update ahead of a holdco senior transaction – which UBS launched on Monday, raising US$4.5bn across three tranches – during which the bank's capital plans were discussed.

The investors said their impression was that an AT1 issuance is not coming soon and that UBS had not yet taken a decision on any change in structure. A UBS spokesperson declined to comment.

Speaking at the Bank of America Financials CEO Conference on Tuesday, UBS chief executive Sergio Ermotti said the bank is not under pressure to issue and is "assessing all options around the AT1".

“Of course, we will do what makes sense for us, but also what makes sense for investors," he said.

Lower price

Some market participants said a switch to equity conversion would be well received by investors and could allow UBS to issue at a lower price.

"It would help put the CS malaise behind them, at least psychologically, and the issue of subversion of the capital structure, with equity not being zeroed," said an investor at an asset management firm.

However, even bank capital specialists are uncertain about how such a switch would work in practice. Some said it would be a long process if UBS had to secure shareholder consent – given equity conversion AT1s are potentially dilutive.

Many cited the example of BNP Paribas, which earlier this year switched from a writedown structure to an equity conversion structure for its US dollar AT1 issuance. The process took many months, with work beginning in 2022 in order to have a proposal in front of shareholders at its AGM in May. After shareholders voted in favour, BNP Paribas sold its first transaction in August.

That would have obvious implications for the timing of any UBS deal. The bank's next AGM is scheduled for April – though bankers noted that the bank could call an EGM.

UBS is expected to return to the market to replace a S$700m (US$518m) 5.875% AT1 issue redeemable on November 28 and a US$2.5bn 7% note offering redeemable in January, although the bank has sufficient capital to call the bonds without immediately replacing them.

Some bankers said the timeline could be shorter if UBS already has sufficient authorised but unissued shares to sell an equity conversion AT1 without having to hold a shareholder vote. One suggested the bank would have enough to issue about US$3.5bn of equity conversion AT1s.

Adding to the uncertainty, some bankers questioned if the pricing benefit to UBS would be worth the effort.

Indeed, a second investor said he would be agnostic on the choice between a writedown structure or equity conversion.

Market participants have suggested that UBS will have to pay a premium to tap the AT1 market to compensate for perceived jurisdictional risk.

However, the second investor questioned if a large concession would be required, suggesting that many investors had been convinced by UBS's story post-acquisition. "To a large extent, UBS has recovered quite well after the bail-in," he said.