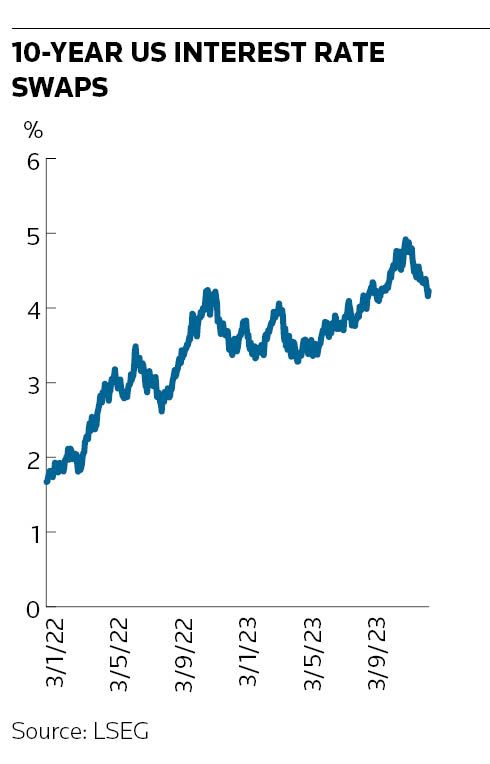

With interest rates resting at their highest levels in years, the dilemma facing corporate finance chiefs right now is how worried they should be about the future.

Bankers and consultants say the past year has brought about a revolution in the way corporate clients manage interest rate exposure arising from debt financing costs amid growing acceptance that rates are set to remain higher – and more volatile – for longer.

That marks a departure from much of the previous decade when the ultra-low interest rate environment caused many to shelve hedging programmes. Corporate treasurers have now significantly increased their hedging activities, bankers say, leading to a flurry of activity for banks servicing these clients.

"Corporate CFOs and treasurers are beginning to accept that interest rates will be higher for longer, which has ignited some interesting hedging activity," said Amol Dhargalkar, global head of corporates at advisory firm Chatham Financial.

He noted that many corporates were previously reluctant to hedge as they feared locking in the peak of the hiking cycle should rates dramatically decrease. “Today though, more people are accepting the idea that that’s not actually going to happen,” he said.

Managing interest rate exposure has moved towards the top of the agenda for many corporate treasurers over the past year as central banks have tightened monetary policy aggressively to cool inflation.

Higher interest rates have sparked fears over the wall of corporate debt coming due over the next few years, which will now be more expensive for companies to refinance. Strategists at BNP Paribas said in a recent report that they expect defaults in the US to slowly increase in 2024 as some high-yield issuers fail to refinance debt.

Market volatility is also fuelling hedging activity, bankers say. There have been 42 days this year when 10-year US Treasury yields have moved more than 10bp, according to LSEG data. That volatility means corporates, which price their debt off market interest rates, have had less certainty over their funding costs.

Pre-issuance hedging has gained more traction among investment-grade companies as a result, allowing companies to lock in the interest rate component on bonds they plan to issue in the coming months to replace maturing debt. To do that, companies can enter forward-starting derivatives contracts that will insulate them from any market swings around the time of their planned refinancing.

“It’s really tough for people to have any sense of projecting what their future [capital] structure and debt capital costs are going to look like [given rates volatility] and so pre-issuance hedging is allowing [corporates] a bit more certainty,” said Dhargalkar.

Hitting pause?

Not everyone is scrambling to hedge their rates exposure now that signs are emerging that central banks like the US Federal Reserve may be pausing their hiking cycles. Niall Coakley, managing director for corporate financing and risk management at Lloyds, said the fact that markets are now baking in interest rate cuts next year means some “clients seem more content to wait to see if rates do fall further before locking in".

Given the conflicting tensions, an increasing number of corporates are looking to hedge through interest rate options to retain some flexibility, said Neil Parker, FX market strategist at NatWest. Those hedging through more interest rate swaps, meanwhile, favour shorter tenors of “more than two years but less than five” to avoid locking in rates for too long, he said.

Alongside amending interest rate hedging programmes, some corporates have also been looking to protect themselves from foreign exchange risks, bankers say.

October saw the highest recorded volume of electronic FX volumes at Lloyds, exceeding the previous record by 10%, said the bank’s head of global corporate FX sales, Anders Nilsson – which he said pointed “to increases in client activity and hedging over the last quarter".

He said most of that activity came from clients using forwards and swaps to hedge risks, while vanilla options and other option structures were also seeing increased interest.

Brandt Portugal, head of Western Europe corporate FX and global head of corporate eFX distribution at Citigroup, has also seen increased demand for vanilla option strategies from corporate clients looking to hedge their cashflows from currency risk given "forecast uncertainty". He said the number of conversations the bank's risk management solutions team has had with corporate clients across the UK and Europe interested in hedging their FX exposures has increased by 25% compared with this time last year.