The prospect that duration will return to the euro covered bond primary market is on participants’ lips as they contemplate what 2024 may hold in store for the asset class, which has not seen any issuer venture beyond the six-year mark since August.

“It’s hard to ignore the persistent rumours that there’s going to be more duration returning," a syndicate banker said. "Quite a few people do believe that now."

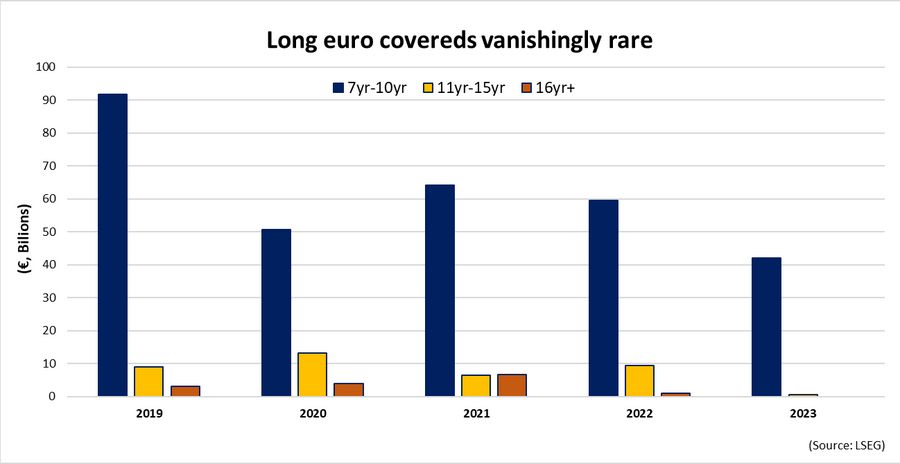

Longer dated covered bonds have been scarce through the course of 2023, a repercussion of an inversion of the yield curve that has kept duration buyers at bay, with the lack of liquidity at the long-end exacerbated by the European Central Bank's exit from the market earlier this year.

"In the last couple of months it wasn't a question of pricing, but a question of whether [long-dated covereds] worked at all irrespective of pricing, because investors were spooked by anything longer dated," said a DCM banker.

The volume of euro covered bonds with tenors longer than seven years amounted to just €23.5bn in 2023, versus €42.8bn in 2022 and €56.25bn in 2021, according to IFR data.

However, with market consensus currently being that the Federal Reserve, European Central Bank and Bank of England will cut rates through the course of 2024, most participants believe the year ahead will offer favourable windows for duration to be extended - an obviously welcome development for issuers.

“There are clearly a number of issuers that have been directed to the shorter part of the curve with most of their activity this year, so there is a desire to fund longer now that the rate outlook is a little bit clearer,” said a second syndicate banker. “Things could move quite quickly. There’s a lot of short-dated funding that needs to be refinanced over the next 12 to 18 months, so there would be a lot of issuers that look to turn those short dates and refinance them into longer dates.”

Market participants acknowledged, however, that such predictions could turn out to be built on fragile ground, should near-term rate cuts fail to materialise or if central bankers undermine the narrative.

"As we look ahead, the ECB this Thursday will be important in terms of duration appetite," a second DCM banker said. "If the ECB does not quash the market's rate cut expectations for next year with what it says on Thursday, the market will respond with more risk appetite and we will see a bit more duration appetite in January, if people truly believe it’s the end of the rate hike cycle and the time is right to extend.”

Other bankers also pointed to structural constraints in the market, stressing that central banks’ policies are not the sole factor that would support sustained revival of long-dated supply. Some said a significant rebuilding of the so-called real money investor base is likely to be required and that only attractive spreads will lure asset managers back to the market. In the ECB's absence from the market, bank treasuries - which prefer short-dated bonds for their portfolios - have become the dominant investor.

First movers

The first duration tests are expected to come as early as January, with market participants confident that seven to 10-year supply will pick up. The first DCM banker said that although there haven't been many long-dated reference points from other markets for covered bond issuers to look at, SSA borrowers typically launch 10-year euro deals early in January, which should provide some key markers for new issue premiums and demand dynamics.

However, the jury is still out whether euro covered bonds with maturities beyond 10 years will emerge at the beginning of the year.

“I wouldn’t rule it out," a third syndicate banker said. "You need to be the right name, you need to have the right timing, and you need to have the right approach. So don’t aim for €2bn in one go, and be flexible in terms of spread, which is going to be quite costly because the spread curve is steep. On the other hand, I think it’ll be easy to have a chance once we’ve reopened the lower end of the market, then maybe we might see the spread curve flattening a little bit.”

“I think, at the end of the day, 15 years is probably going to be easier than 12. We have some insurance companies that are looking for duration, and 15 or 17 would work for them; 12-year would be too short for them."

In terms of the type of issuer likely to reopen duration, bankers said national champions from jurisdictions such as France, the Netherlands or the Nordic region would be the most plausible candidates.

“I wouldn't necessarily see the first mover coming from Germany, simply because German issuers had a lot of headwinds in 2023, and I don't think that will change in the near term, as they are still perceived to be the tightest," added the first DCM banker.

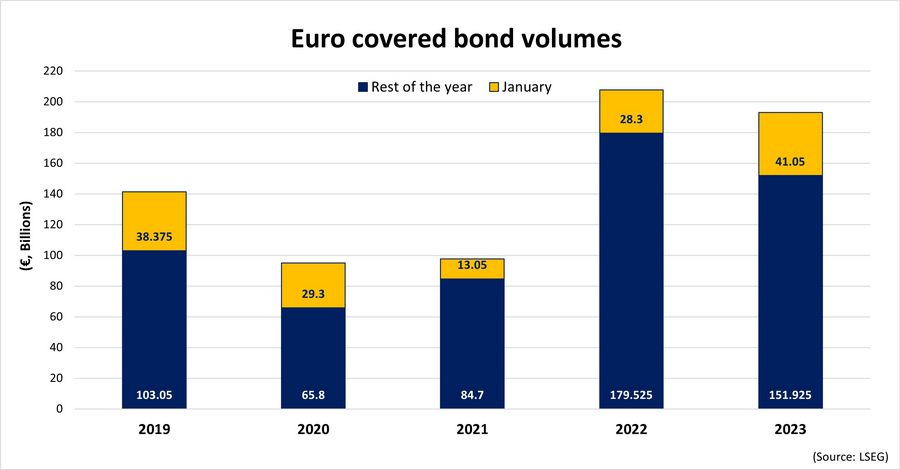

Market participants anticipate euro covered bond volumes next year will be similar to 2023’s tally, which stands at €192.975bn, with issuers expected to make a typically fast start next month.

“We’re coming from a relatively quiet period and many expect pressure on spreads next year, so there will be an incentive for issuers to move sooner rather than later,” a fourth syndicate banker said.