Financing Package: Copeland’s US$5.5bn LBO financing

Pushing the limits

Few deals have held a mirror up to the capital markets as clearly as the US$5.5bn debt financing backing Blackstone’s purchase of Emerson’s climate technology business, Copeland. For pushing the limits of the possible in the most difficult conditions, it is IFR’s Financing Package of the Year.

When US$5.5bn of widely syndicated loans and bonds for Blackstone’s purchase of a 55% stake in Emerson’s climate technology business priced in May 2023, weeks before the buyout closed, it all looked like a simple deal, even a little boring.

The renowned New York buyout shop was getting control of a heating, ventilation and air conditioning unit, renamed Copeland, of a publicly listed Fortune 500 company that was selling some assets as it tweaked its corporate strategy. Copeland was valued at US$14bn, or 12.7 times Ebitda. Investment banks were brought in to sell the loans and bonds to a typical group of investors. The LBO closed at the end of May, and the bonds and loans traded well in secondary.

That snapshot of the deal – though accurate – belies all the trouble the multiple parties went through to effect the final outcome. Rewind several months to when the deal was announced. It was Monday, October 31 2022 – Halloween in the US – and Blackstone revealed what was the stuff of nightmares for any leveraged finance banker who had ever been jilted on a deal. The US$1trn asset manager had stitched together a US$5.5bn debt commitment for Copeland, essentially without the aid of an investment banking intermediary.

Private credit

The initial financing package comprised a buy-and-hold US$2.9bn term loan A, a US$700m asset-based loan and, most importantly, a US$2.6bn commitment from the bete noire of leveraged finance bankers everywhere: private lenders. The buyout firm, which was also providing US$4.4bn of equity (and a US$2.25bn sellers note), notably signed on for a portion of the private credit, as well.

It called into question the traditional originate-to-distribute banking model, and illustrated how ever-growing private equity shops, which often house direct lenders, could do everything an investment bank could do, and more.

In hindsight, it’s obvious that the initial funding package had to take that shape at that time. In the summer and autumn of 2022, when Blackstone, Emerson and their advisers were hashing out deal terms, it was gradually becoming evident that the market for LBOs and the financing packages that typically back them was a wreck.

Several sizeable debt-financed buyouts that had been announced in the beginning of 2022, including those for Citrix, Tenneco, Nielsen and Twitter, were struggling in a big way to find traction in the syndicated bond and loan markets. And by the end of that year, all four of those multibillion dollar buyouts closed with all or part of their debt financings still “hung” on banks’ balance sheets. Most of the bonds and loans that were distributed by the banks were offloaded as steep, loss-making discounts. The traditional financing market was stuck.

'Twitter happened'

“Ultimately, the amount we collectively decided we needed to go get was US$5.5bn,” said Jonathan Kaufman, global head of Blackstone Capital Markets. “And we'd been in discussions with a number of banks leading into that. And then Citrix happened, and Tenneco happened – and Twitter happened.”

Indeed, the prevailing assumption among dealmakers in the summer of 2022, including those in Blackstone’s 345 Park Avenue headquarters, was that after Labor Day, on September 5, the leveraged markets would return to something close to normal and deals would start to get done.

“At the time, we thought for something of this size, historically, it had always been a syndicated capital structure and [we] had those conversations through late August, with the macro backdrop not fully functioning with all of the hung LBO paper,” said Susan Weiss, managing director at Blackstone. “But the one assumption – and it was a faulty assumption – of everyone across the Street, including ourselves, was that post-Labor Day all of that hung paper would just be blown out at any price.”

Weiss said the ultimate lack of demand for this kind of paper after Labor Day was reminiscent of the credit crisis in 2007. And as Blackstone sounded out banks on capital structure, “indicative terms widened out, pricing widened out, flex widened out to a point where it no longer made economic sense for us to accept that commitment”, she said.

Indeed, on the day Blackstone and Emerson announced the buyout, the average high-yield bond price had fallen to 85.69 from about 103 at the start of the year, according to ICE BofA data. The LPC 100, a cohort of the largest, most liquid loans, was at 91.79 on October 31 2022 – down from 98.5 at the start of the year.

Uneconomic

Kaufman explained: “Certain banks were outright closed for business at the time and had no ability to put on any new risks, given what they were saddled with and potentially marked at 20 cents, 30 cents below where they had put risk. Then there were other people who were open for business but were pricing that risk at levels that were uneconomic.”

Blackstone’s capital markets team sprung into action and did what banks could not do at the time.

“In October, we spoke to over 90 accounts, and that couldn't have been done with one person, even if you physically wanted to, it just took time, so we all split the list,” Weiss said. “We called on banks that were able to hold the ABL and term loan A and direct lenders, because we just weren't sure at that time how deep either of those markets were [and whether we could] place [the debt] all in one market.”

Tom Blouin, global co-head of leveraged finance at Barclays, an adviser on the buyout and eventually a lead on the syndicated financing, recognised that Blackstone had few options open to it at the end of 2022.

“I was having conversations with the team at Blackstone for months and months and months: when is the market healthy enough to support a US$5.5bn financing? The market's not there, the market's not there,” he said. “As happens in an M&A situation, there comes a time when a deal’s either signing up or it's going away.”

Green shoots

For several months Blackstone was ready to have the deal funded via TLA and private credit markets. Then in 2023 the market for syndicated debt – somewhat unexpectedly – started to appear, and dealmakers at the buyout shop were happy that the agreement they signed in 2022 with direct lenders included language that allowed them, for a fee, to get out of the commitment.

“Starting in 2023 we were progressing on the path to close,” Weiss said. “And we started to see green shoots, and we started to get inbounds that there was a much more constructive environment for financings in the syndicated markets. So even though we had a capital structure, and we knew we could fund, we decided it was in our best interest to explore what this looked like.”

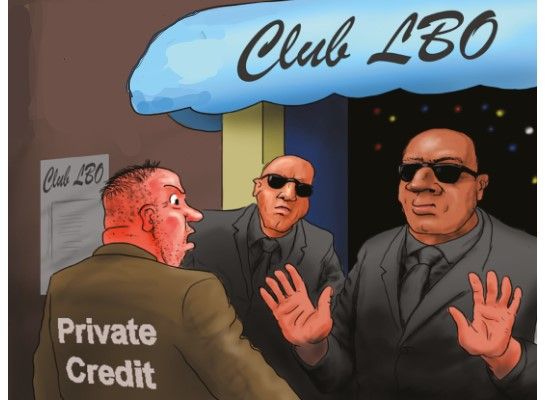

Soon, she said, it was obvious that they could achieve a less costly and more flexible capital structure if they tapped the syndicated markets and used banks for distribution. In a surprising about-face, private credit was out.

“We ripped up our commitment papers and pursued a best-efforts financing in the form of a syndicated term loan B and senior secured notes offering,” she said.

In the end, a group of banks led by Barclays and RBC syndicated a roughly US$2.775bn dual-currency bond offering and a US$2.275bn term loan B. The final package also includes a US$700m ABL and a US$450m TLA. All told, the revised capital structure reduced the debt cost of capital by about 375bp, according to one estimate.

Just as the initial financing terms, with all that the presence of private credit entailed, sent a stern message to leveraged syndicate desks, the final terms upset some in the private credit market.

“Those direct lenders were none too happy,” said Peter Toal, global head of fixed-income syndicate at Barclays. “People have asked us: ‘Is this what's likely to happen? Every time the markets rally, you're going to displace the private credit guys just like they've displaced you?’”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email shahid.hamid@lseg.com in Asia Pacific & Middle East and leonie.welss@lseg.com for Europe & Americas.