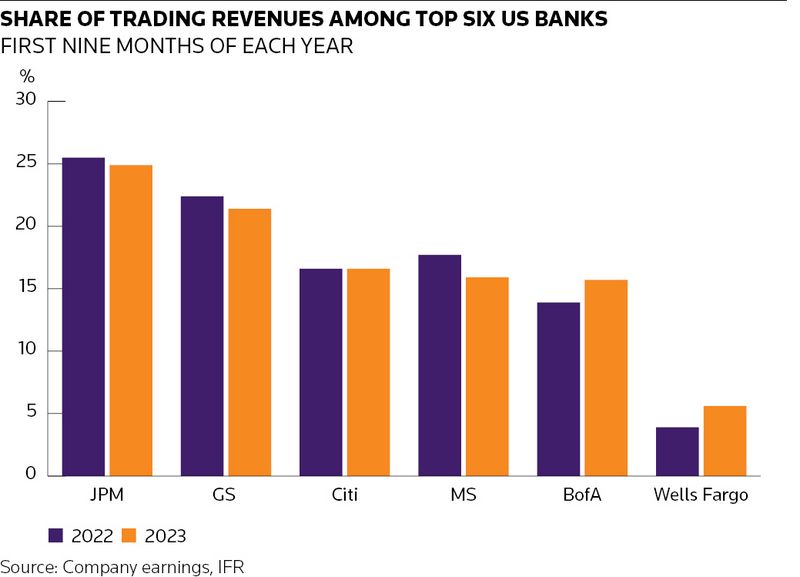

Wells Fargo’s trading division has gained ground in 2023, a year when most of its competitors have seen revenues fall, in the clearest sign yet that the lender’s push across corporate and investment banking is starting to bear fruit.

Wells has reported six straight quarters of annual revenue growth in sales and trading, contributing to a 38% rise in the first nine months of 2023 to nearly US$5bn. That has allowed it to leapfrog Societe Generale and put it within touching distance of UBS and HSBC in terms of market revenues this year, as the San Francisco-based bank forges ahead with plans to bolster its broader investment bank operations.

Wells is coming from a much lower base than the top five US banks, which dominate global markets and have all expanded in the higher volatility environment that emerged following the outbreak of the pandemic in 2020.

But executives say the investments Wells has made in its markets division – including ploughing resources into electronic trading and courting more institutional clients – has put it in good stead for the years ahead.

“Diversifying our business and broadening out our capabilities has paid off in spades,” said Mike Riley, co-head of markets at Wells Fargo. “We wouldn’t have been able to take advantage of this macro trading environment if we still had the same business that we had 10 years ago.

“We’re now a potential growth engine for the entire bank. It never used to feel that way,” Riley said.

Wells’ investment bank has regained its footing in recent years following a high-profile consumer-banking scandal in the previous decade that cast a shadow over the bank and prompted it to scale back risk in most areas. Charles Scharf, a former CEO at BNY Mellon and Visa, took over in 2019 and set about repairing Wells' reputation following a prolonged period of upheaval that resulted in hefty fines and the US Federal Reserve imposing a cap on its assets.

Finding CIB

Scharf organised Wells into five businesses, with a corporate and investment bank division, to give it a similar structure to its peers. He also looked to reinvigorate trading and dealmaking – two areas where Wells had historically punched below its weight considering it had been the world’s largest bank by market value at some points during the last decade.

“It was hard in the past to find Wells Fargo’s corporate investment banking division, even though we had been assembling pieces of the puzzle through the years to become more relevant as an institutional player,” said Dan Thomas, co-head of markets, pointing to Wells’ acquisitions of rival lenders First Union and Wachovia in the 2000s followed by the establishment of its prime brokerage and derivatives clearing operations in the 2010s.

“It was the clarity of vision and organisation from Charlie that really helped us to articulate a strategy around the markets business,” he said.

The numbers show those efforts are paying off. As well as growing trading revenues, Wells Fargo has earned more than US$1.9bn in global investment banking fees to date in 2023 to become the eighth-largest dealmaking bank, according to LSEG data, up from 10th two years ago. And Scharf has signalled there’s more to come. Last year, he said Wells could grab another US$1bn in fees from mid-sized corporate customers that it hadn’t previously targeted.

Competitors are already taking note. “Wells … is coming back,” Jamie Dimon, chief executive of JP Morgan and Scharf’s onetime boss, said on its October earnings call.

Institutional push

There are certainly aspects of the past 18 months that have played into Wells’ hands, given its close ties to corporate America. Finance chiefs hedging swings in interest rates, currencies and commodities has meant corporates have accounted for a larger proportion of the industry’s trading revenues lately, while events like the US regional banking crisis in March have further boosted activity levels in Wells’ home market.

Wells has engaged in some “pretty intense planning” over the past two years across CIB to identify its most important clients when allocating its financial and technology resources, said Thomas. “That’s been a big cultural shift which has been critical in driving a good chunk of our markets results.”

Part of that has been focusing more on institutional clients such as hedge funds, which represent comfortably the largest revenue pool for banks in sales and trading. The transformation of Wells' FX business – one of its main drivers of growth this year – is a case in point.

FX trading sat outside Wells’ global markets division until about six years ago, mainly providing payment services to the bank’s corporate clients, and didn’t have any institutional clients with which to recycle those flows. Since then, Wells has brought about 170 institutional firms on board.

“Hedge fund was a little bit of a dirty word when I first joined," said Riley, who arrived at Wells 10 years ago to co-head equities. “Now people have gotten over that and realise hedge funds are customers too. Corporates bring risk. Hedge funds take risk. We stand in the middle. I don’t think we really understood that for many years. Now we realise we’re part of the ecosystem and hedge funds have a significant part to play in it.”

Investing more heavily in technology to support electronic trading in FX and interest rate products has been an important part of that push – and one that has helped Wells handle more flows. “To deal with the institutional client base, you need the product capabilities and the technology to flip from being a liquidity user to a liquidity provider,” said Thomas.

Asset cap

It is no coincidence that much of Wells’ recent growth and investments have come in asset-light activities such as FX and electronic trading. The Fed limiting how much Wells Fargo’s balance sheet can grow inevitably acts as a constraint on the markets division, particularly in more asset-heavy businesses such as financing.

Wells’ trading assets have grown 11% over the past year to US$204bn, but they are roughly flat since 2019. Bank of America – the only other major US bank to grow trading revenues this year – has increased assets in its markets division by 27% since 2019 to US$864bn.

Riley and Thomas declined to comment on the asset cap. But Wells has also been building capabilities in businesses that consume more balance sheet, like secured financing in fixed income and equity prime brokerage – which are activities where rivals have been growing – with an eye on the future.

“It’s not lost on us where our competitors are making money, so we have been building the capabilities, but we’re also limited in how we can deploy that,” said Riley.

Thomas said the bank’s default position is to treat financial resources as if they are scarce, to keep costs down. Headcount in markets is roughly flat over the past few years despite a wave of hiring. Wells also remains conservative in terms of its risk appetite in trading.

“We’re treading carefully from a scarcity of financial resources perspective,” said Thomas. “We’ve been filling in some obvious holes in terms of product development. Overall, though, the plan is to sweat the balance sheet better.”

Areas that Wells has fleshed out include municipal bond trading and the equities franchise, as others have pulled back. Equities trading now represents over a quarter of Wells’ markets revenues after rising 62% to US$1.4bn so far this year. The bank is also investing heavily in equity research, which it believes will help it across markets and investment banking.

“We are setting up for a great trading environment for the next five to 10 years,” Riley said. “Interest rates are a thing again. Trading is back and it’s going to be that way for a while.”