Americas Structured Equity House: JP Morgan

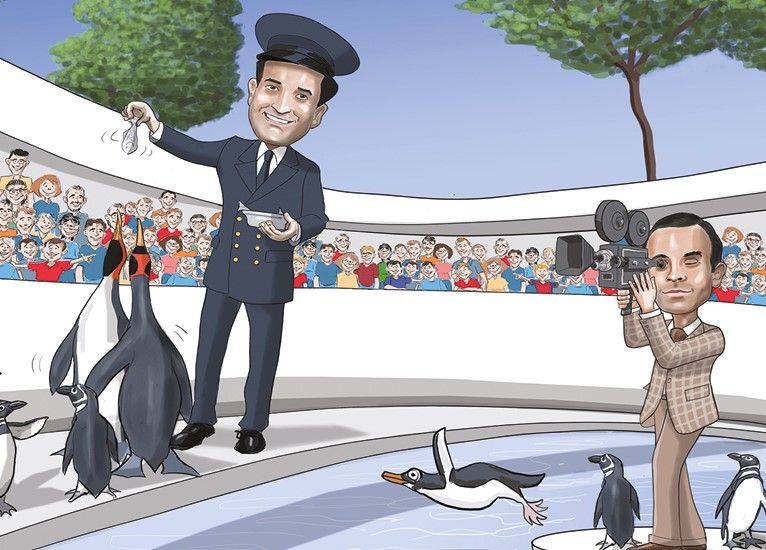

Pool party

Higher interest rates breathed new life into the convertible bond market in 2023, as highly rated companies looked to the asset class as an alternative to straight debt funding. JP Morgan stood at the forefront of that transition and is IFR’s Americas Structured Equity House of the Year.

Amid a surge in interest rates, companies looked to convertible bonds to lower borrowing costs, leading issuance to transition to rate-sensitive utilities, REITs and industrials from technology and healthcare companies.

PPL, a Baa1/A– rated US utility, was the first to take the plunge with US$1bn raised from the sale of a five-year CB priced at 2.875% coupon and 22.5% conversion premium, through the aggressive ends of price talk. The offering was the first plain vanilla CB by a US utility since 2001, highlighting hypersensitivity of utilities to dilution of issuing equity.

"It took time for issuers to get comfortable with the premise of refinancing straight debt with a convert," said Gaurav Maria, JP Morgan’s head of US equity-linked capital markets. "We had been educating IG corporate clients about the accounting changes for convertibles and the relative advantages of convertibles versus straight debt in a higher interest rate environment."

Implemented at the end of 2021, the accounting changes allowed CB issuers to account for interest expenses at the bond’s stated coupon, rather than a higher amount based on bifurcating a CB into debt and equity components.

PPL bought in following a meeting with JP Morgan in September 2022, executing the CB after reporting year-end financial results, PPL treasurer Tadd Henninger told IFR.

JP Morgan was one of four bookrunners on the PPL CB.

In the words of Maria, PPL was leading "penguins to a pool". Southern Co took the dive two days later with a US$1.725bn, 2.75-year priced at 3.875% coupon and 30% conversion premium. Alliant Energy, Duke Energy, CMS Energy and First Energy followed with CBs of their own issued in the first half of 2023. All with JP Morgan.

"Entering the year, we were optimistic that we would see a pick-up in convertible bond issuance in 2023," said Santosh Sreenivasan, JP Morgan’s head of equity-linked and private markets for the Americas.

"The level of activity we saw this year exceeded our expectations."

Overall US CB issuance in 2023 surged by 79.9% to US$48.5bn. JP Morgan earned league table credit of just over US$9bn for market share of 18.6% and had a hand in nearly half of all issuance at 37 out of 78 trades, according to LSEG data.

IG-rated companies raised US$14.4bn in the convertible bond market, playing into the strengths of JP Morgan as a universal bank, but it wasn't all low-vol, low-growth issuers.

DexCom, a medical device maker, turned to JP Morgan in May for an upsized US$1.25bn CB effectively to pre-fund the maturity of a CB that was deeply in the money. In a subtle twist, the glucose monitor maker opted to keep its existing US$850m 0.75% CB maturing in December 2023 in place, rather than buy it back alongside the new CB.

DexCom did spend US$188.7m of the proceeds from the new CB to simultaneously repurchase stock, providing built-in borrow for arbitrageurs, and another US$101.2m on an equity derivative to offset dilution to an 80% premium.

That limited the hit to DexCom shares to just 0.3% to US$118.12 over the one-day marketing of the CB. Opting not to buy back the 0.75s created scarcity value for the new CB.

Strong investor demand allowed JP Morgan to upsize the CB to US$1.1bn (US$1.25bn including greenshoe), from US$1bn, priced at a 0.375% coupon and 37.5% conversion premium, the lowest coupon in more than two years.

In a year light on financial innovation, JP Morgan pulled out the toolbox for Western Digital on a US$1.6bn CB in October. The hard disk drive maker had unsuccessfully shopped its flash-memory business, prompting it to pivot towards a spin-off of the consumer-focused flash business.

The twist here was a mechanism to compensate holders for any lost value on the spin of flash memory.

In the case of a spin-off – the most likely outcome – CB investors would be compensated for any lost value by an adjustment of the conversion price. If, for example, Western Digital shares were trading at the US$40.15 reference price on the CB and the flash-memory business was worth US$20 per share, the conversion price would be reset to US$20.15.

The spin-off investor protection is standard to CBs and the move to fund ahead of a spin-off is not unprecedented but had not been used on this scale.

For JP Morgan, the “penguin in a pool” year was one to remember.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email shahid.hamid@lseg.com in Asia Pacific & Middle East and leonie.welss@lseg.com for Europe & Americas.