Stronger foundations

The Asian financial crisis showed how disastrous an over-reliance on foreign debt can be. What emerged in response Was a more domestically reliant local currency bond market in Asia, but the next stage of development will require a balancing act between improving liquidity and managing volatility.

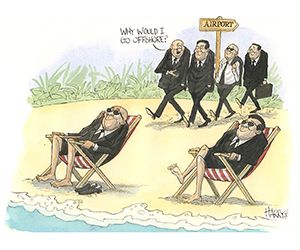

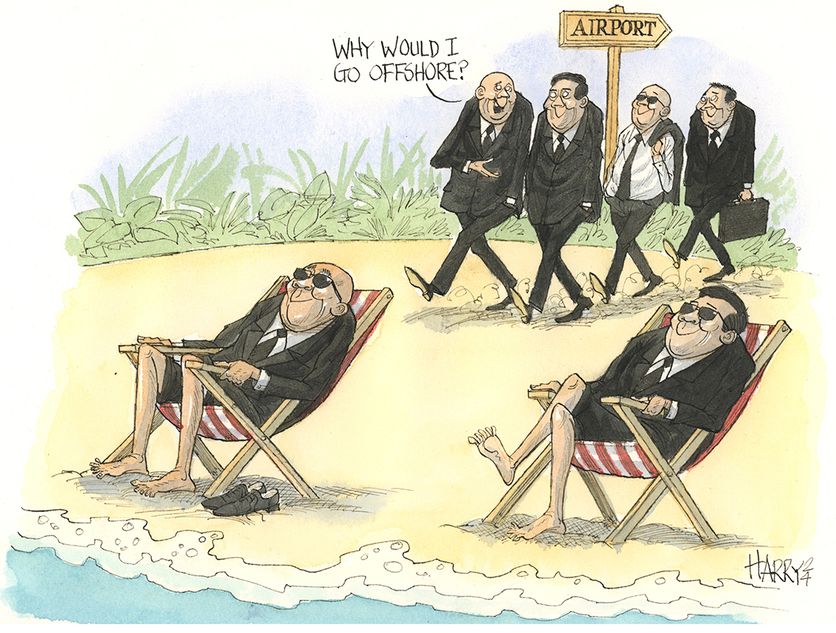

The Asian financial crisis dealt a nasty shock to corporates and sovereigns that had borrowed heavily offshore, as currency depreciation led to a wave of defaults, but that painful lesson has led to stronger domestic debt markets.

In almost every aspect, from diversity of issuers and investors to deal sizes, Asia’s local currency bond markets have deepened and developed since the crisis unfolded in 1997.

Asia’s robust economic growth over the past few decades has been the biggest catalyst driving the evolution of local currency bond markets. China is now the world’s second-largest economy with India coming in fifth, compared to eighth and fifteenth respectively in 1995.

Since 2006, the region’s total financial wealth – from bank deposits to securities – has nearly tripled to around US$140trn in 2022, according to the International Monetary Fund.

“As middle incomes have grown, the assets under management with asset managers and insurance companies have increased,” said Sean Henderson, co-head of Asia Pacific debt capital markets at HSBC. “High growth and high savings rates have made Asia a much bigger source of global liquidity.”

The growth in issuance of local currency bonds in the region since the Asian crisis has been staggering. In 1997, issuance in the local currency bond markets in Asia, excluding Australia and Japan, was just US$41.7bn, according to LSEG data. That had risen 85 times to US$3.6trn as of 2023.

G3 bond issuance has grown over that period, too, more than quadrupling to US$146bn from US$31.8bn, but has tended to slow during times of instability, while local currency bond issuance has proved resilient through interest rate hikes by central banks, geopolitical conflicts and economic concerns.

Asian G3 bond volumes fell 22.3% in 2023 compared to the previous year. This compared to a 5.9% uptick in Asian local bond issuance.

International issuances made up only about 12.4% of bond supply from Asia in 2022, compared to a world average of around 30% to 40%, according to a report by the International Capital Market Association. Domestically, corporates enjoy the benefit of “an increasingly straightforward and familiar issuance process,” reads the ICMA report.

Because the inflation dynamics of Asia are much contained and diverging from the likes of the US and Europe, several countries are arguably in a better position to start easing monetary policies. Not only that, fundamentals are also quite diverse within this region which provides investors a good diversification.

“In some parts of Asia, being food producers, there has been better control of food inflation hence central banks did not need to hike as aggressively,” says Jerome Tay, investment manager on the Asia Pacific fixed income team at fund manager Abrdn. “Furthermore, economic drivers in Asia have also evolved massively since the Asian financial crisis to shift towards domestic demand as one of the key economic pillars.”

Currently, local currency government bonds are providing very attractive real yields, said Tay. Of course, foreign investors have to assume currency risk, but hedging costs have come down quite substantially due to interest rate differentials. Some Asian FX forwards are giving additional carry when hedged back to USD due to the negative implied cost.

“Indonesian government bonds are yielding around 6% to 7% while inflation is expected to remain low at 2% to 3%, hence the real yield is one of the highest in the region,” says Tay.

Seeking depth

The biggest competition to Asian local currency bonds comes from domestic lending. With banks being relatively well capitalised, loans are historically a less expensive option. In China, total loan financing accounts for more than four times bond financing for non-financial corporates, while in Europe corporate loans outstanding are about three times corporate bonds outstanding and in the US outstanding corporate bonds exceed corporate loans by 6%, according to ICMA.

“There is still a bit of a challenge in the depth of certain local currency bond markets, particularly as relates to appetite for corporate credit, but this is improving,” says HSBC’s Henderson.

There is also the limitation of size within local bond markets.

“Asian local currency markets are not deep enough today for us, so our core group funding strategy remains to be predominantly deposit funded across all key subsidiaries, coupled with prudent asset-liability management,” says Koh Chin Chin, head of group treasury and research at United Overseas Bank, which has been a frequent issuer of local bonds in Singapore, Indonesia, Malaysia, Thailand and China.

In 2023, UOB issued the first Thai baht Additional Tier 1 public bond after completing the acquisition of Citibank’s commercial banking portfolio in Thailand, Malaysia, Vietnam and Indonesia. Prior to that deal, Thai commercial banks had only raised AT1 capital in the offshore US dollar bond market, where there are more specialised investors familiar with bank capital writedown mechanisms.

“Unlike G3 markets where issuers usually seek out best relative value or achieve a larger issuance size cumulatively, we access Asian local markets to augment our onshore local currency business operations,” says UOB’s Koh.

Not truly fluid

To Cyn-Young Park, director of regional cooperation and trade at the Asian Development Bank, one of the stumbling blocks of local currency markets is the lack of a secondary bond market.

“The markets are not truly fluid in many ways,” she said. “If an institution wants to buy and sell a desired amount of bonds easily and quickly, it is going to be very difficult without affecting the prices. This is a serious problem as this lack of liquidity will make the markets vulnerable to sudden changes in investor sentiments driven by a large share of foreign investors.”

Although foreign investor participation in Asia’s local currency bonds has dropped to around 8%–9%, compared to over 10% before the pandemic, according to the ADB Institute, foreign participation looked to have begun increasing again last year.

Furthermore, with Indian government bonds winning inclusion in JP Morgan’s global emerging markets index last year and bonds from countries like South Korea expected to be added to other major indices, this could also spur more foreign fund flows into regional bonds.

This could be a double-edged sword, as research from the Journal of International Money and Finance indicated that local markets with larger exposure to foreign investors suffered larger yield spread widening during global negative shocks such as the global financial crisis and Covid.

In particular, economies with less developed local currency bond markets were more susceptible to capital flow volatility due to foreign investor participation.

While Asian local bond markets developed as a response to the Asian financial crisis, “does it shield Asian economies from volatile capital flows and foreign exchange volatility or sudden stops? I doubt that,” said the ADB’s Park.

Abrdn’s Tay, however, disagrees, pointing to the strength and diversification of many Asian central banks’ reserves, which are backed by a basket of assets and currencies.

“The reforms in Asia since the Asian financial crisis have allowed countries to build up national and local corporate savings. In addition, the development of institutionalised savings such as pension funds and insurance savings also create stronger demand for longer duration bonds,” Tay argues.

“This has built up onshore demand for domestic local currency bonds which allows Asian governments to finance borrowings onshore through their domestic currency instead of foreign currencies, leading to a much more stabilised market and better currency management compared to before,” he continues.

Uneven development

While Asia’s local currency bond markets have made great strides overall, development has not been even. Brunei Darussalam, Cambodia, the Lao PDR and Myanmar have only recently begun meeting the challenges of developing their own bond markets.

Even within more established markets, each has its own idiosyncrasies and niches. For example, Singapore has a particularly strong private banking market while China’s onshore market is dominated by bank treasuries.

How one judges the success of local markets also varies. Some market observers may rate size or duration as measures of success, such as Singapore’s S$2.4bn (US$1.7bn at the time) government bond sold in 2022, and tapped for S$2.8bn the following year, that chalked up a milestone by becoming the world’s first 50-year green bond sold by a sovereign.

Others see the ability to move down the credit curve as a more telling sign of maturity, such as the markets in Thailand and Malaysia where corporate issuers across a wider range of the credit spectrum can find demand for bonds, often with the help of structuring. Ultimately, it is a matter of stimulating and broadening the investor base.

“When you have a bond market that is driven by asset managers and insurers it can often be counter-cyclical to the bank market,” says HSBC’s Henderson. “For example as economies slow and interest rates are cut, companies can often tap institutional investors very successfully via bond markets just when bank loan appetite tends to fall — we saw this dynamic during Covid.”

The ADB’s Park says the second stage of Asian capital market development should be concentrated on “developing the money market segment; the foreign exchange market and also the secondary market, which will come from fostering a more diversified investor base and the development of auxiliary markets for derivative instruments such as futures, swaps, and options”.

As Asian central banks have started to trim their fiscal deficits that ballooned during the pandemic, this could lead to lower issuance of local currency bonds, which would generally be supportive of bond prices.

Asian local currency markets have helped regional economies keep funding flowing throughout global crises over the past two decades. Now they need to maintain stability as foreign investor interest grows.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email shahid.hamid@lseg.com