Investment bank ROE collapse cannot be fixed by cyclical recovery alone

The 2023 earnings season for investment banks has seen mixed revenue trends, rising costs and low returns on equity. This is unsustainable and the only real solution is a brutal one: cutting costs.

Banking is as cyclical a business as there is. The 2023 results from large US banks illustrate a continuation of a recent cyclical trend. Bread-and-butter net interest margin banking businesses have been overearning as the cost of funding has taken time to catch up in a rising interest rate environment. Some of this will normalise now rates are falling. By contrast, investment banking has been cyclically weak and should recover at some point.

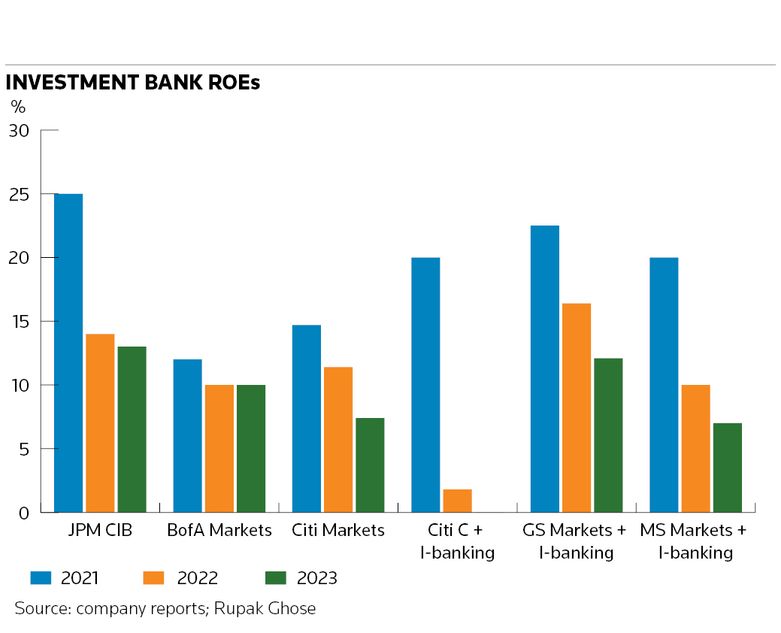

But here’s the thing. The gap in ROE between these businesses is now so large that without a massive dotcom or sub-prime-style boom it is hard to see investment banking divisions not continue to materially lag the returns of other business lines.

Citigroup’s new reporting structure allows us to get a closer peek at divisional profitability. Citi’s markets business has seen its ROE halve over the past two years to a mere 7.4%. Despite revenues declining by 3% since 2021, costs and allocated capital each grew by 15%–20% over the period.

Revenues for the division had some cyclical tailwinds as well. In 2023 net interest income was up 25% and generated 38% of Citi’s markets revenues, much higher than its peers reported. Macro trading, which has benefited from volatility in recent years, was also more than half Citi’s markets revenues.

Citi’s credit and equity trading business has underperformed. The collapse of the former was supposed to be a reflection of strategic actions to focus on more profitable desks and the latter has struggled partly owing to its weak hedge fund franchise.

Citi’s corporate lending and investment banking businesses have seen ROE fall even more dramatically – from 20% in 2021 to zero in 2023. Despite investment banking revenues more than halving over the period, costs for the overall division grew by over 10% and allocated capital by more than 5%. It’s hard to imagine a scenario where investment banking revenues more than double to return to 2021 levels.

Citi’s problems are well known but this is also an industry problem.

Bank of America’s trading business, which had dramatically underperformed large peers in 2017–21, has recouped a little market share recently. Despite higher revenues over the past two years, the divisional ROE declined from 12% in 2021 to 10% in 2023 due to an increase in allocated capital. The 2021–23 range of ROEs for the business is less than half what Bank of America’s retail banking and wealth management businesses generated in 2023.

Even JP Morgan – the LeBron James of banking – has seen a similar trend. Its monster franchises in areas like US retail banking have meant group profits have hit record highs. But the ROE of its corporate and investment bank collapsed to 13% in 2023 from 25% in 2021. Declining revenues owing to lower deal flow combined with low double-digit-percentage cost inflation resulted in profits declining by more than a quarter since 2021. Increased regulatory capital requirements and growth in capital intensive FICC meant a 30% increase in allocated capital to the division.

JP Morgan doesn’t break down return on equity between its business lines, but said at its investor day that its markets franchises were above its cost of capital. Given its position and likelihood that investment banking profitability in 2023 was very low, it wouldn’t be surprising if JP Morgan’s markets ROE is below the 13% for the overall division. Smaller corporate payments and securities services businesses are likely to be relatively high ROE.

Goldman Sachs and Morgan Stanley‘s markets and investment banking businesses have held steady market shares in recent years, with Goldman’s equities and financing business outperforming peers. Goldman has also seen better cost control that in its peers. Nevertheless, profits are down by a third over the past two years for Goldman’s markets and investment banking business and at Morgan Stanley they have more than halved. With capital also increasing in line with peers, this has resulted in very low ROEs.

Investment banks will benefit from improving deal flow in 2024 but a return to the record investment banking wallet of 2021 is unlikely. And markets businesses are many times larger and likely nearer a peak than a trough. To generate acceptable returns on equity, investment banks will have to be much more aggressive on cost cutting – which largely boils down to job losses – and capital usage.

Rupak Ghose is a former financials research analyst