Jane Street is beating banks at their own game

Bank trading desks are from Mars and non-bank traders are from Venus, we are told. Different styles of trading. Different regulation. Different capital commitment.

But Jane Street Capital is challenging that stereotype and, in the process, changing the competitive landscape in credit trading.

Let’s start with capital. Most non-bank market-makers are high-frequency traders. They are thinly capitalised and rarely hold positions for long. Jane Street in its early years was also thinly capitalised with US$228m in 2007, just before the financial crisis, and even in 2016 this was only US$1bn. But in the last five years the firm has grown its capital base by US$18bn to more than US$20bn.

That has supported greater balance sheet exposures. From 2013 to the end of 2020 the value of long positions held by Jane Street rose from just under US$4bn to US$24bn.

The greatest share of that was from equities (likely to include not just equity but also fixed-income ETFs that are classified as equities), which increased from US$3.9bn to more than US$14bn.

Interestingly, corporate bond long positions that were only US$57m in 2013 increased to US$8.5bn by the end of 2020. There were offsetting short positions so net holdings were a fraction of that total, but it illustrates Jane Street's move beyond ETFs into bank flow credit trading.

Its growth exploded in the first half of 2020 when it was reported to have made US$8.4bn in trading revenue and Ebitda of US$6.3bn, the latter an eleven-fold increase on the year.

Activity normalised in the second half to give 2020 trading revenues of around US$11bn and Ebitda of US$8bn. Despite lower volatility, the company continued to benefit from being the market leader in the fast-growing bond ETF space, and the symbiotic surge in electronic and portfolio trading of corporate bonds. As a result, 2023 financial performance is expected to be less than 10% down on the record 2020.

That contrasts with its main non-bank ETF competitor, Dutch electronic market-maker Flow Traders, which is seeing 2023 revenues and Ebitda tracking around 70% and 85% below 2020 levels, respectively. If Jane Street is the Amazon of the industry, Flow Traders is looking more like Poundland, with revenues now only 3% of the size of Jane Street, a revenue-per-employee ratio that is only a 10th of Jane Street and a market capitalisation that is a mere €775m.

Jane Street’s market leadership underpinned a virtuous cycle of a flow monster, with the best technology and able to attract the best talent from big tech, big banks and big universities. Flow Traders' capital base is less than 4% of Jane Street’s, illustrating a different business model. Moreover, Jane Street has been skewed towards faster-growing bond ETFs rather than equity ETFs and has leveraged this to expand into corporate bond trading. Flow Traders' gross long positions in ETFs can be around a quarter of Jane Street’s exposure, while in corporate bonds it is less than 5% .

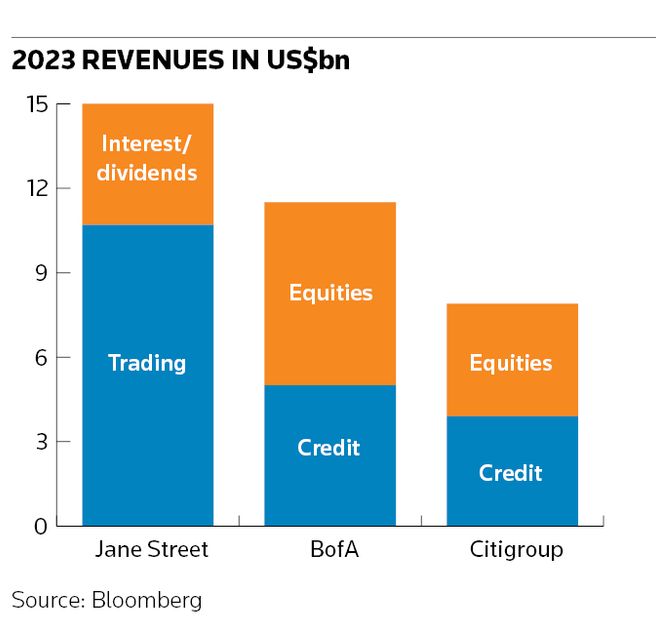

The chart illustrates Jane’s Street revenues relative to the overlapping businesses at Citigroup and Bank of America, two the largest markets trading franchises that break out their credit trading revenues from other fixed-income businesses.

Citi and BofA are also two of the only leading banks to break out capital allocated to their markets business. At US$46bn and US$53bn, respectively, this is much higher than Jane Street, but the banks cover a much wider range of business – across rates, foreign exchange and commodities. It is unlikely that any major bank is substantially better capitalised than Jane Street in their ETF’s and credit trading franchises.

Moreover, although in areas like private credit, non-bank providers are benefiting from regulatory arbitrage, Jane Street is not excessively leveraged.

According to Fitch, Jane Street’s balance sheet leverage ratio on March 31 2022, was 6.9 times – well below the benchmark for investment bank trading firms of 15 times. It estimated that had fallen to 6.2 times later that year and in late 2023 and early 2024 is below six times.

Banks tend to have lots of low-risk derivatives and government bonds on their balance sheet so gross leverage ratios are a crude comparison, but it can’t be said that Jane Street is driving growth through taking on more leverage.

Every major bank trading franchise is investing heavily in playing catch up in ETF trading but their ability to grow appears to have been more than countered by Jane’s Street’s ability to use its footprint as a Trojan horse to gain access to the bread-and-butter credit trading business of banks. The good news is very few non-banks are as sophisticated as Jane Street. The bad news is that one of the few other firms that has any balance sheet is Citadel Securities, which has expanded in rates trading after the Dodd-Frank rule changes and last year announced plans to get into credit trading.

It too is coming for the bank’s lunch.

Rupak Ghose is a former financials research analyst