Banks overhaul structured note desks for fixed-income revival

Structured notes, long the preserve of banks’ equity derivatives desks, are getting a fixed-income makeover.

Banks are investing heavily to overhaul their structured note operations to re-gear them more towards fixed-income products, as higher interest rates have led to surging client demand for bond-based investments. That represents a notable departure from the ultra-low rate environment of the previous decade, when equity-linked notes dominated this business.

Barclays, BNP Paribas, Societe Generale, Natixis CIB and Nomura are among the banks that have seen a steep rise in fixed-income structured note issuance over the past 18 months as the promise of higher returns has attracted clients ranging from insurance companies to retail investors to these products.

SG has tripled its fixed-income volumes over the past 12 to 18 months, while Nomura’s volumes have almost doubled. Natixis, meanwhile, is often seeing four to five times more activity in fixed-income products compared with equities in notional terms, according to co-head of rates and currencies markets Pascal Amiel.

“Given the rates environment, we’ve clearly seen a switch towards fixed-income products,” Amiel said. “We continue to think these structures will be profitable for the fixed-income market and so are continuing to invest and on-board new clients.”

Equity-linked products have long dominated banks’ structured note businesses. Rock-bottom interest rates and depressed market volatility dampened returns on fixed-income investments in the years following the 2008 financial crisis. That increased the appeal of products such as equity autocallables that promise investors – typically wealthy savers in Europe and Asia – juicy annual coupon payments so long as equity markets rise. David Sciolette, Natixis CIB’s head of interest rate sales, said up to 90% of its structured products business distributed to retail investors focused on equities between 2006 and 2022.

Packaging and selling these products became an incredibly lucrative business for banks’ equity derivatives desks. It was also a risky one – occasionally causing significant losses for some of the biggest players. But that wasn’t enough to deter them from building formidable structured products operations and piling resources into technology to process ever-larger volumes of tickets.

Evolving tastes

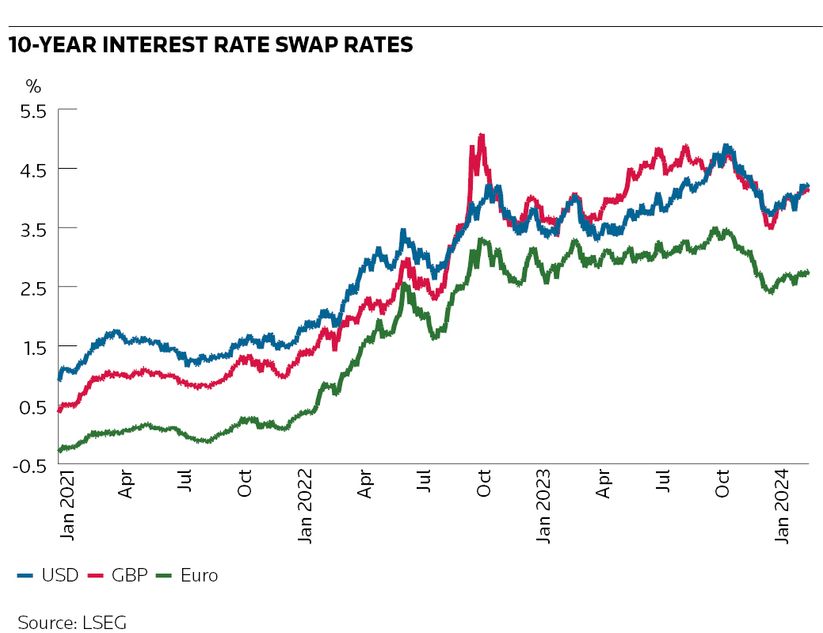

Client tastes have now evolved as the market backdrop has shifted over the past two years. The swift and sharp rise in central bank interest rates has made bonds an attractive proposition again, drawing in a whole new investor base for these products.

"There is now a whole new client segment engaging in the fixed-income side that wouldn't necessarily have felt comfortable doing so before rates went higher,” said Christian Treuer, co-head of EMEA equity derivatives distribution at Barclays, who said rates-linked products sometimes accounted for 75% of flows in certain jurisdictions.

Structured notes are designed to provide investors with a fixed return that is higher than they could achieve otherwise if they parked their money in a savings account or owned low-risk government bonds. That could be a callable note, which provides them with an above-market coupon to compensate for allowing the issuing bank to redeem the product prior to maturity if interest rates drop.

These products represent the “bulk” of the notional within Natixis’ fixed-income structured notes business as they’re “as simple as possible to understand” for mass retail clients, Sciolette said.

Other popular structures include “steepeners”, where payouts are dependent on long-term interest rates rising relative to short-term rates, and range-accrual notes, where coupons are conditional on rates staying within a pre-agreed band.

One major selling point for investors is that fixed-income products are often less risky than their equity counterparts. That’s because it’s much easier for banks to create notes that guarantee clients won’t lose money on their investment.

These capital-guaranteed products fell out of favour during the last decade when it was virtually impossible to manufacture decent returns without resorting to risky or highly engineered structures. But central banks lifting interest rates to multiyear highs changed all that.

“With higher interest rates, fixed-income flows become much more attractive because often they can give you the principal protection – which isn’t always possible in equities – or you can get a higher exposure to an asset or an underlying with more simple payoffs than you would have been able to achieve in the past,” said Natalia Cermeno, head of rates structuring and ESG structuring at Nomura, who pointed to an “exponential increase” in fixed-income pricing requests. “So, investors feel like they can have their cake and eat it too.”

Treuer at Barclays gave the example of the end retail clients of life insurers getting involved in this space. “These end clients are typically risk-averse and want to ensure their capital is protected, which simply wasn’t possible when rates were near zero as you had to take more risk to get any kind of yield,” he said.

Investing in the revival

The question is whether the fixed-income revival can be sustained now that interest rates look to have peaked and central banks are preparing to ease monetary policy. Still, the investments that banks are making in this space suggest they’re not expecting it to be a flash in the pan.

Natixis said it has increased its sales team head count across France, Italy, and Germany over the past 18 months while reorienting the team to market fixed-income structures more effectively to brokers, private banks and retail clients.

Firms such as SG and BNPP are leveraging the sprawling distribution networks they developed to sell equity-linked products to retail investors. And the likes of Barclays and Nomura are ploughing resources into technology and automation to be able to price and execute a wider range of fixed-income structures electronically.

“We’ve certainly invested a lot in technology,” said Frederic Despagne, European head of cross-asset solutions sales and EQD flow derivatives at SG. Those investments in automation have paid off as they allow the bank “to maintain a high quality of service while servicing growing volumes”, he said.