M&A uptick to fuel rise in risky deal contingent derivatives

A brightening outlook for mergers and acquisitions is stoking expectations of an uptick in deal contingent trades, a risky type of derivative that banks sell to corporates and private equity firms looking to hedge financial market moves ahead of the completion of major acquisitions.

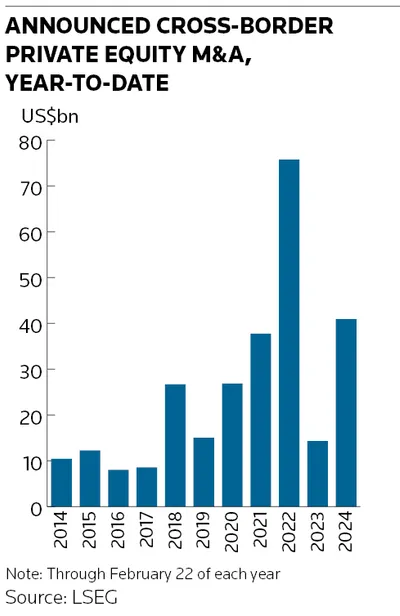

There have been US$111bn of cross-border M&A deals announced so far this year, according to LSEG data, a 19% rise from the same period in 2023. Announcements from private equity firms, meanwhile, are running at nearly three times their 2023 levels – with consultants reporting a healthy pipeline of deals to come.

More of this kind of activity would provide the much-needed fodder for banks selling deal contingent derivative hedges, which have become a mainstay among private equity firms over the past decade, while also growing in popularity with corporate treasurers.

“Deal contingent activity is directly correlated to the amount of M&A and general private equity activity,” said Jackie Bowie, head of EMEA at hedging advisory firm Chatham Financial. “If you see those deal volumes come back, you will see a large increase in deal contingent hedging, because it's so widely deployed as a risk management tool.”

Deal contingent options are often touted as the perfect hedge thanks to their ability to protect would-be acquirers against sharp moves in currencies or financing costs between the time they announce a deal and when it completes. The most valuable feature for buyers (and the riskiest part for the banks selling the derivatives) is that the acquirer can walk away without paying for the hedge if the deal falls through.

That dynamic can cause serious headaches for banks when deals fail and the market moves against them. Barclays suffered a US$125m hit on a deal contingent trade in late 2021 following Advent International’s abortive takeover of drugmaker Swedish Orphan Biovitrum. About 18% of cross-border M&A deals that were announced last year were ultimately withdrawn.

Such concerns haven’t stopped deal contingents from becoming an important growth area for many investment banks – although traders say they are always mindful of the risks involved.

Central banks raising interest rates to their highest levels in years has triggered a surge in demand for deal contingents among companies hedging future borrowing costs. Many FX desks have also looked to do more deal contingents as low market volatility has at times dampened other types of client activity.

“We continue to grow the deal contingent business as we have in the past five years and in accordance with our risk appetite,” said Frederic Han, deputy head of FX structuring for EMEA at BNP Paribas. “We expect 2024 to be a bit better in terms of volumes. Bigger transactions could happen in the market and we hope to be part of those and to help our clients hedging their risks.”

Bank of America is another bank that has been expanding in deal contingents. Carlos Fernandez-Aller, head of global FX and EM macro trading at the bank, said BofA takes a different approach to "most of the market” on these transactions.

“We do many more [deal contingent] trades, but we also spend more money on hedging the tail risks associated with them,” he said. “Limiting our downside in this way allows us to build a portfolio of trades and to be very active in this space."

Ultimately, the deal pipeline and general private equity activity will be the biggest drivers of deal contingent volumes. The industry revenue pool for banks in deal contingents hit a peak in 2021 amid a frenzy in dealmaking, according to estimates from analytics firm Coalition Greenwich, before falling sharply in 2022 as M&A slowed.

There were US$1.1trn in cross-border M&A deals announced in 2022, roughly half 2021’s total. Dealmaking remained lacklustre in 2023, but consultants and bankers see promising signs of a rebound. Private equity clients are telling Chatham that the pipeline of transactions that they’re looking at is high, according to Bowie, who predicted that private equity firms will be "very busy" if valuations reset.

"Last year was still a period of uncertainty for M&A, but that now seems to be changing,” said Xavier Gallant, head of corporate FX and local market sales for EMEA at BNPP. “Ten of the [French stock market index] CAC 40 companies announced they had ambitions of multi-billion acquisitions. So there are more constructive dynamics around larger size M&A this year.”

Additional reporting by Natasha Rega-Jones