Prime brokerage: the multi-billion dollar cash cow redefining banks’ trading divisions

Prime brokerage accounted for more than half banks’ equities revenues in 2023, a record share that underlines how providing financing and market access to hedge funds is simultaneously anchoring and redefining banks’ trading divisions.

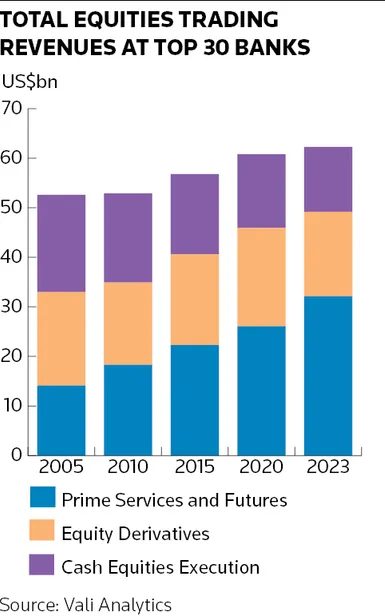

The top 30 banks made an unprecedented US$32bn in prime services and futures in 2023, according to Vali Analytics, up from US$26bn in 2020 when activities represented 43% of equity trading revenues. That fast-growing pie, fuelled by the breakneck expansion of multi-strategy hedge funds, is encouraging banks to compete ever more fiercely in a business that only three years ago triggered a death spiral at Credit Suisse.

The stakes are high and extend far beyond banks’ equities desks, as prime businesses have evolved in response to the most sought-after (and profitable) hedge fund clients fanning out across asset classes. The benefits of this boom have mostly accrued to the biggest firms. Goldman Sachs, JP Morgan and Morgan Stanley hold a market share of nearly 60% in prime, according to Amrit Shahani, partner at research firm BCG Expand, and are each closing in on US$1trn in client balances.

That hasn’t stopped the likes of Bank of America, Barclays, BNP Paribas and Citigroup from investing heavily to try to break that stranglehold. Executives expect prime brokerage to remain a key battleground as banks bet on financing activities playing an increasingly prominent role in their markets divisions.

“Prime started as an equity-centric product. Now, as clients have evolved to become more cross-asset, the breadth of a bank’s financing and clearing capabilities has become increasingly relevant to the broader markets franchise,” said Jon Cossey, head of global prime finance and global clearing at JP Morgan. “The financing component … is one of the finite resources that banks have to deploy.”

Banks’ prime brokerage businesses trace their origins to the heyday of long-short equity hedge funds, helping star managers use borrowed money to amplify wagers on company’s shares. Banks like Morgan Stanley invested heavily in their prime offerings to get closer to these heavyweight investors, reasoning they would be more likely to trade with firms that lent them money.

There were other benefits. Clients tended to stick around, providing brokers with a steady and predictable income stream. Banks also earned far higher returns lending money against funds’ investment portfolios than in their once mainstay business of trading stocks with them.

Significantly, the business has kept growing. Prime revenues at the top 30 banks more than doubled between 2005 and 2023, according to Vali Analytics, while cash equities revenues shrank by a third to US$13bn. That helped Goldman, JP Morgan and Morgan Stanley amass more than US$30.5bn of equities revenues between them in 2023 – almost as much as the next 27 banks combined.

“We still consider it our marquee business and one that is absolutely core to our equities franchise. When you’re a prime broker to a client, it promotes a very strong firm-to firm relationship,” said Alan Thomas, co-head of equities at Morgan Stanley. “It’s very hard to run an equities business that is full scale without having a full-scale prime brokerage business."

Archegos strikes

It can also harbour serious risks. Several banks, including Morgan Stanley, lost around US$10bn between them in 2021 from the collapse of Bill Hwang’s Archegos Capital Management after huge, concentrated bets turned sour on a handful of stocks. The US$5.5bn loss at Credit Suisse proved a watershed moment for the bank, which never fully regained its footing and was rescued in a forced UBS takeover two years later.

Those events have done little to dim most banks' appetite for this business. Many believe the appeal of financing has only increased over time, arguing these activities bring much-needed stability to banks' otherwise volatile trading divisions.

"Financing is attractive because of the size and consistency of the industry wallet. It’s increasingly becoming the means [by] which the largest [alternative asset] managers allocate their fee-paying wallet to providers," said Mike Webb, global head of liquid financing at Barclays. "The bigger reason is that the income stream from financing is stable, repeatable, client-centric and creates an incredibly accretive return profile."

Barclays last year generated 40% of its markets revenues from financing and said it plans to grow that business by £600m to about £3.5bn by 2026. Elsewhere, BofA has targeted prime in the first leg of a series of recent investments to bolster its equities unit. Fixed-income heavyweight Citigroup is also looking to grow. “Our strategy in equities is simple: grow prime,” said markets chief Andrew Morton, who has joined chief executive Jane Fraser in a campaign to woo clients to drum up more business.

BNPP has gone further in its investments after taking over Deutsche Bank’s prime brokerage in 2019. Ashley Wilson, global head of prime services, said the French bank has doubled its prime balances since the Deutsche integration and expects those balances to double again in the next two to three years.

“We are definitely in growth mode and we have a lot of capacity in terms of balance sheet and capital,” Wilson said.

Evolving business

This strategic push comes as the nature of prime brokerage is changing. The hedge fund industry may be nearing a plateau, but assets in multi-strategy funds, which make bets across markets, have increased by almost a quarter over the past four years to US$612bn, according to data provider Preqin, on the back of stellar performances from the likes of Citadel and Millennium Management.

Servicing multi-strats and quantitative funds has become one of the most lucrative business lines for banks’ markets divisions but building the required infrastructure involves serious investment. Quant funds, for instance, need banks to have cutting-edge technology to execute their systematic strategies directly in the market at high speed. The provision of clearing services, meanwhile, becomes more important when fixed-income trading plays a bigger role.

"To be a really credible prime provider in the era of multi-strats you need to be able to offer every product," said Mikhail Zlotnik, head of EMEA prime services at Goldman Sachs. "[That] require[s] investment, whether it’s an execution platform, or risk management capabilities to manage portfolios that are non-equity. You need a critical mass of revenue to afford that investment. But once you’ve made it, it’s easier to defend."

There are some tailwinds for firms looking to grow. Many fixed-income strategies such as the infamous "Treasury basis trade" use higher levels of leverage than traditional equity strategies, increasing the demand from banks to provide financing. And the high-profile exits of Deutsche and Credit Suisse from prime have thinned out the competition. Then there is the looming implementation of Basel III capital rules, which may constrain the largest prime brokers. Some say they are already forgoing less profitable client business in a bid to improve returns.

Smaller brokers also claim that the largest clients are getting warier of becoming over-reliant on a narrow group of banks and want to spread their business more. That comes as regulators have warned that the dominance of the top prime brokers could amplify financial market stress.

Managing risks

Many say they can entice clients with more attractive margin terms, helped by the migration to cross-asset investing creating opportunities to offset exposures across a wider range of products. The top prime brokers, for their part, say some smaller firms are guilty of lowballing margin requirements to win client business.

“Despite the vocal scrutiny from the regulators, we're surprised to still see some fairly aggressive behaviour from banks competing on margin terms that we wouldn’t agree to. We don’t think that’s prudent or sustainable in the long term,” said Zlotnik.

It's certainly true that the multi-strat era has changed the way banks manage risks in these businesses. Ashley at BNPP said quants and multi-strat funds trading direct market access are “firing orders into your systems every nanosecond of the day", which makes “capable operational systems” and “real time risk management” crucial.

JP Morgan’s Cossey said that traditional methods of just looking at concentration risk don’t necessarily hold true across all asset classes.

“And not all asset classes are as observable or as liquid as equities – some, like high-yield, only trade by appointment," Cossey said. "Increased conservatism is the most appropriate way to assess and manage risks."