Citadel Securities keeps winning after Roaring Kitty

Anyone heard from Roaring Kitty lately? The former US financial analyst and investor, and king of the meme stock retail army, has kept a low profile since his early 2021 antics with GameStop. But Citadel Securities – another beneficiary of those heady days – has certainly not faded away.

The height of the meme stock craze was a very profitable time for Citadel Securities, with the retail boom helping the firm’s share of equities trading ramp up significantly. It appears the market making firm, majority owned by hedge fund billionaire Ken Griffin, has only gone from strength to strength since then.

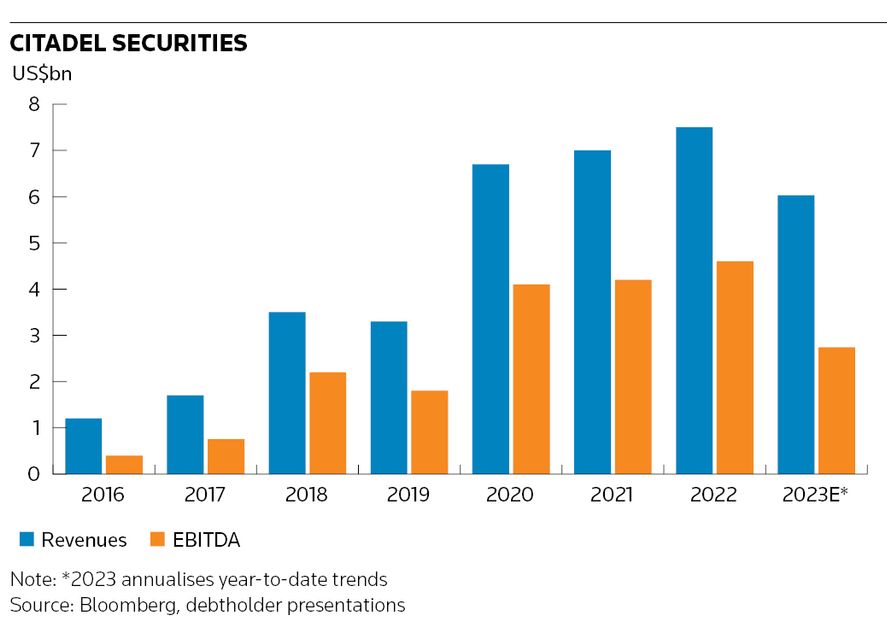

Citadel Securities, like its non-bank trading rival Jane Street, isn’t a listed company and doesn’t have to regularly divulge its earnings. But reports from Bloomberg News on disclosures that the firms have made to debtholders give an idea of their rapid growth. These show that Citadel Securities’ revenues roughly doubled in 2020 following the outbreak of the pandemic, and it has managed to maintain those high levels in recent years.

True, 2023 wasn’t quite so rosy for the Miami-based firm, with net trading revenues down 23% in the first nine months to US$4.5bn. That provides a stark contrast to Jane Street, which has signalled it expects to make nearly as much in 2023 as the US$10.7bn it made a year earlier.

But there are reasons to believe Citadel Securities is still one of the big winners in the non-bank market making space – and that much of the recent underperformance versus Jane Street is down to its business mix.

Its core US equities and options business makes up the bulk of Citadel Securities’ revenues. The firm said it is still the number one destination for US retail order flow in cash equities and equity options. And its 23% market share in cash equities – and 40% in the retail market – are in line with historic levels.

Significantly, it has been particularly strong in the ultra-fashionable area of zero-day options contracts with retail investors, where volumes have exploded. Citadel Securities has also leveraged its dominance in retail options to expand quickly in the institutional equity options market.

Citadel Securities now appears to be winning in a head-to-head comparison with Virtu, another non-bank market maker that has historically been a strong competitor in retail cash equities. Virtu claims to be maintaining market share but its market making revenues declined by 20% in 2023 to US$847m and are down 52% from its 2020 peak, while Citadel Securities’ revenue last year was on track to fall about 20% from their 2022 peak. Virtu’s net trading revenues for its market making business (which excludes its agency broker) as a proportion of Citadel Securities’ net trading revenues were 27% in 2020, 20% in 2021 and have fallen to 14% since.

Equity options being busier than cash equities has been key to outperformance. But so too has Citadel Securities’ rapid expansion in fixed income. It said it has taken the top spot in Treasuries trading on Bloomberg and is also active in US dollar interest rate swaps. It is now targeting European rates and credit trading in what are seen as natural next moves.

Then there’s its FX business. While not as well known in this space, Citadel Securities said it is a top three liquidity provider on FX futures and spot platforms, although it appears to lag significantly behind XTX Markets, the main new non-bank FX market-maker of the last decade. Citadel Securities has also seen material growth in its European equities business, although XTX has been the biggest winner lately.

This all shows Citadel Securities' ambitions to build a diversified portfolio of trading businesses, which should stand it in good stead in the years ahead. In the more immediate term, its reliance on equities relative to Jane Street cost it in 2023 and explains a lot of the divergence. Citadel Securities also has a large gap to close in terms of net revenues to Jane Street but, in the longer term, its push into fixed income should help.

Focusing on asset class and geographical expansion has been one of the main ingredients to Citadel Securities’ success relative to traditional high-frequency trading peers. Its ability to develop direct client relationships has been another, rather than depending solely on anonymous central limit order books, whether it’s capturing the flow of retail aggregators off-exchange in the US (the so-called payment for order flow model) or expanding on multi-dealer disclosed platforms like Bloomberg. Crucially, it has also shown a willingness to price in greater size and hold risk for longer than many competitors.

Like Jane Street, Citadel Securities' strategy has been underpinned by a virtuous cycle of talent and technology – all at scale. Its headcount has grown to about 1,600 from around 300 in 2013, which puts it behind only Jane Street in terms of revenues and headcount among non-bank market makers.

It’s also notable how these firms have developed reputations for high productivity – as well as high compensation. Citadel Securities’ revenue per head of US$3.8m is just below Jane Street’s US$4.2m, while remaining around twice the level of options market maker Optiver and three times higher than Virtu.

In banking, the big have a habit of getting bigger as high barriers to entry keep competitors at bay. It’s still early days for non-bank market makers but you wouldn’t want to bet against Griffin’s shop on current form.

Rupak Ghose is a former financials research analyst