Late 2023 European bond rally was brutal for banks

Banks including BNP Paribas and Citigroup sustained heavy losses in European government bond trading in late 2023, underlining the risks that volatile interest rate markets pose to traders.

BNPP suffered a roughly US$80m loss in the fourth quarter, according to sources familiar with the matter, as positions in Irish and Greek government bonds and related derivatives soured. Citigroup also lost more than US$50m in European government bond trading around that time, sources said.

Traders said the size of the losses was not out of the ordinary for banks with a large presence in these markets, where they help governments issue debt and buy and sell securities on behalf of investors. Spokespeople for BNPP and Citi declined to comment.

A ferocious rally in European government bonds caught many traders unaware in late 2023, as expectations mounted that central banks would soon begin cutting interest rates from multi-year highs.

“It was a tough trading environment,” said one senior bank trader. “The strength of that rally took quite a few people by surprise.”

The losses in European government bonds came amid what has generally been a fruitful period for bank desks trading products linked to interest rates. Central banks tightening policy aggressively to lower inflation has encouraged clients to reshuffle their positions and led to increased volumes.

The top 12 banks generated US$24bn in G-10 rates trading revenues in 2023, according to analytics firm Coalition Greenwich, a slight decline from the previous year but still 40% above 2019. Citi, for instance, made nearly US$11bn in rates and currencies trading in 2023 – more revenue than the bank generated in credit trading, equities trading and investment banking combined.

But the new interest rate backdrop has, at times, proved to be treacherous with sudden, sharp moves in government bond yields frequently upending positions. Goldman Sachs, one of the largest firms in rates trading, sustained a roughly US$200m hit in the first quarter of last year when markets swooned during the US regional banking crisis. Some firms, like Bank of America, have been vocal about dialling back their risk as a result.

Many banks stumbled in European rates trading in particular. Barclays struggled to make money in European government bond trading in 2023, sources said, and sustained small losses in the fourth quarter. The UK bank recently identified European rates trading as one of a handful of businesses it is aiming to grow as it looks to increase its markets revenues by £500m over the next three years. A Barclays spokesperson declined to comment.

BNPP does not break out its rates trading revenues but the bank said a steep drop in activity in this business contributed to a 32% decline in fixed-income trading in the fourth quarter from a high base a year earlier.

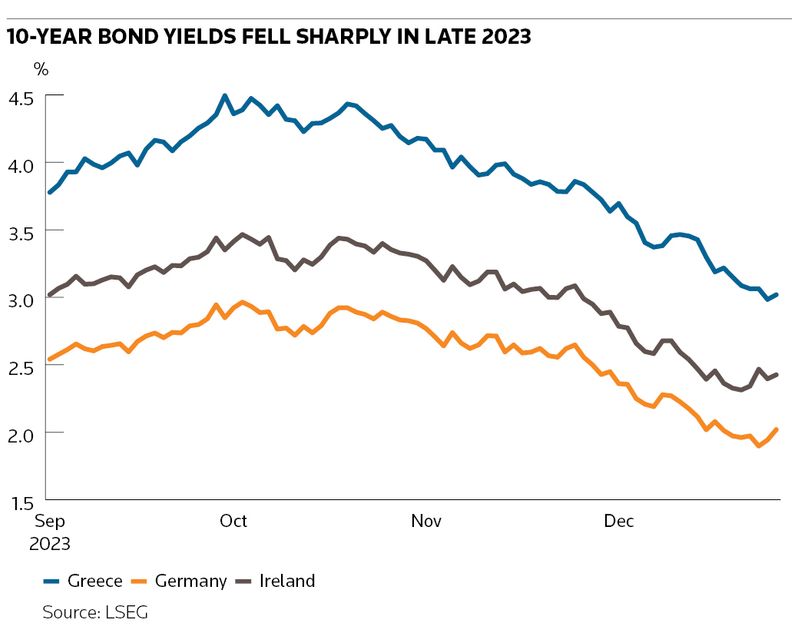

The late 2023 bond rally was particularly brutal. The yield on Greece’s 10-year government bonds plunged from 4.5% in early October to under 3% in late December, outpacing a yield drop of more than 100bp in ultra-safe German debt over that period.

Making matters worse

The timing of those moves made them all the more painful. Banks usually keep a tight rein on risk ahead of year-end reporting, encouraging traders to dump underwater positions quickly before they snowball into larger losses. That dynamic can exacerbate market moves.

To make matters worse, many banks were preparing for a seasonal uptick in government bond issuance at the start of 2024, traders say, putting them on the wrong side of the bond rally.

“Q4 was for sure a challenging one for the Street,” said another senior rates trader. “Providing liquidity involves significant risk transfer and risk warehousing. Of course, in a difficult market it can lead to volatility in P&L and drawdowns.”