Jack Welch, in GE’s glory days, used to say: “If you don’t have a competitive advantage, don’t compete." Not everyone listened and there is a graveyard full of European banks with failed global investment banking ambitions as a result. But underwriting debt offerings is one area where they have retained a genuine edge.

European bank executives looking to build on the positive momentum of the past year – complete with improving returns on equity and higher share prices – would do well to leverage their prowess in debt capital markets as they start talking up their prospects in investment banking more broadly.

The big five US banks have now reported first-quarter results and, as expected, DCM has underpinned investment banking revenues, with more than 30% year-on-year increases. First-quarter earnings from the European banks will start emerging on Thursday and it's likely that the results will show broadly similar momentum for both leading US and European players.

The strongest of these European firms – Barclays – was number four in bond underwriting and number five in loan fees. Both Barclays and Deutsche Bank are benefiting from their presence in the recovering leveraged lending space, but BNP Paribas and HSBC were also high in the league tables.

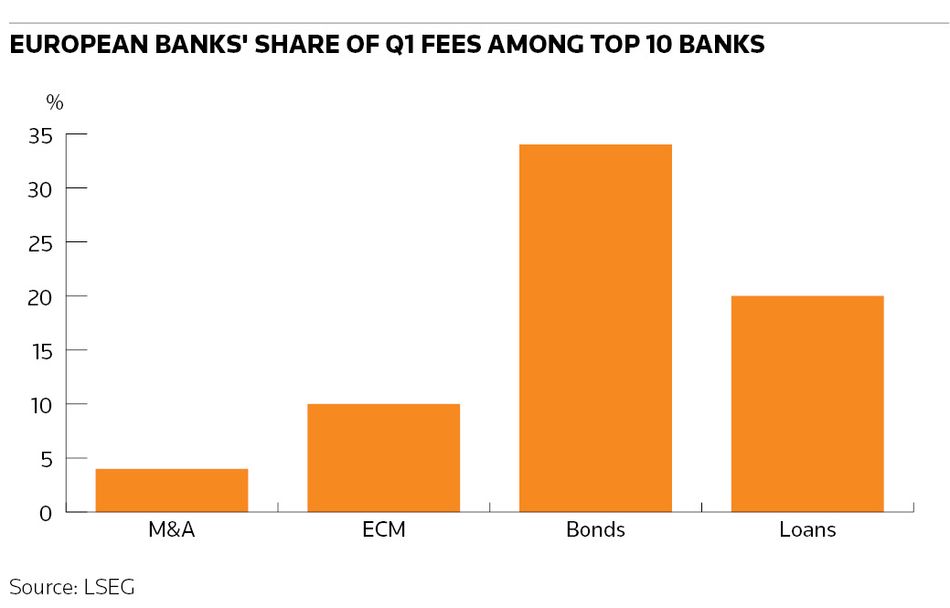

In equity capital markets and mergers and acquisitions, by contrast, European banks remain laggards so far in 2024. They continue to struggle in the larger and busier US market. As well as the big five US banks, boutiques such as Lazard, Centerview Partners, Evercore and Rothschild are all ahead of the European universal banks in terms of M&A advisory fees.

Some of this trend should reverse if European dealmaking activity picks up. But there’s still no mistaking the divergence in performance among European firms when looking at different parts of the investment banking world.

LSEG data for last year illustrate this trend well. Bond underwriting fees for top European banks were robust, with IFR’s Bond House of the Year, BNP Paribas, growing fees by 37% – well ahead of its peers. LSEG data showed BNPP leading 30% of all bond deals in the euro market in 2023. There were also strong showings from Barclays and HSBC. This contrasted with M&A and ECM, where there were no European banks in the top eight or top 10 firms respectively in 2023.

A recent report from consultancy BCG found that the big five US banks have increased market share in all areas of investment banking apart from DCM, where their share declined from 35% in 2018 to 31% last year. BCG said a group of 24 “Tier II universal banks” (including most major European banks) remained dominant in DCM, increasing their market share by 400bp over the same period to 68%. That came as those same 24 banks had seen their share in M&A decline by 500bp to 23%, while their share of ECM was down 300bp to 35%.

European banks have some natural home field advantages when it comes to DCM. True, US corporate bond markets are much bigger, especially in high-yield. But Europe has much more bond issuance from financial institutions. BCG estimates DCM fees from financial issuers were about US$13.8bn in 2023 – or 44% of all DCM fees. This creates a crucial beachhead for universal banks, particularly in Europe, given their strong ties with financial issuers. Sustainable financing provides another edge for the Europeans. Despite a recent slowdown, ESG-related deals are still nearly 10% of the market and heavily weighted towards EMEA.

Meanwhile, the traditional home field advantage that US banks usually enjoy matters less in DCM compared with leveraged lending, ECM or M&A. BCG estimates that 35% of the global DCM fee pool resided in the Americas in 2023, while 25% was in EMEA. Compare that with leveraged finance, where the Americas account for 2-1/2 times more in fees than Europe despite the latter's attempts to catch up. The M&A and ECM fee pools remain similarly skewed towards the US.

DCM has a natural umbilical cord to banks’ corporate lending and credit trading desks, which are core businesses for many European leaders such as Barclays and Deutsche. This unique relationship with corporate treasurers is of course more difficult to reproduce for pure play investment banks such as Goldman Sachs and Morgan Stanley, capping their market share. Moreover, it restricts the entry of boutiques, unlike in areas such as M&A advisory where they have grown markedly in recent years.

Rather than trying to emulate the US giants, European banks need to play to their strengths. If anything, Europeans should prioritise expanding in activities that are complementary to DCM, such as syndicated lending and private credit, instead of building costly waterfront coverage in highly competitive areas such as M&A. Underwriting bond deals may not sound as sexy as advising on blockbuster corporate mergers but it has been proven to bring home the bacon time and again.

Rupak Ghose is a former financials research analyst