Shares are up but IB laggards still have work to do

“In global markets we did not capture opportunities to the same extent as some of our competitors did,” Barclays chief executive CS Venkatakrishnan said following its first-quarter results. It was both striking in its honesty and a statement of the obvious and, given his bank's results in recent quarters, was something he could have said before. Either way, shareholders don’t seem to have minded too much.

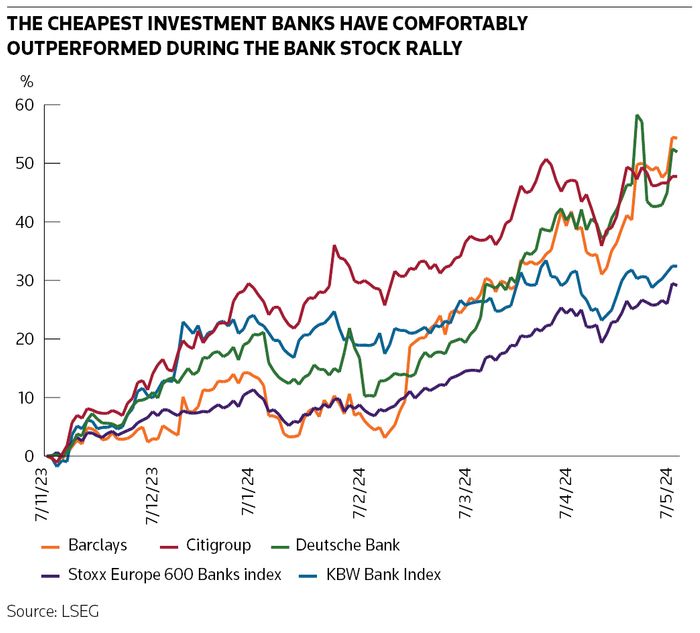

Following a decade or more of going nowhere fast, Barclays' share price has increased more than 57% over the past six months. Citigroup and Deutsche Bank, two other banks that have struggled with profitability and traded on extremely low multiples of book value in recent years, have also seen their share prices rise – by 50% and 53%, respectively – in the past six months, comfortably outpacing the rally in the broader banking sector.

Executives at these banks would doubtless argue the gains are long overdue. Maybe. But all three banks now need to demonstrate meaningful advances in revenues and profitability for momentum to continue. Otherwise, it could be nothing more than a dead cat bounce.

Despite being smaller than market leaders, it is the investment bank divisions that probably hold the key to success for Barclays, Citi and Deutsche. Barclays’ investment bank consumed 63% of the group’s allocated equity in 2023, but only made 43% of its revenues. At Citi, the investment bank represented around half of its allocated equity while generating just under 30% of revenues. At Deutsche, 45% of allocated equity accounted for 32% of revenues.

The first-quarter earnings season illustrated the magnitude of the job ahead. Top dogs JP Morgan and Goldman Sachs generated 18% returns on equity in their investment banks, while Bank of America and Morgan Stanley made 15%.

Deutsche’s investment bank saw its ROE jump by almost 500bp to 15% on the back of continued strength in credit trading and a strong recovery in FX trading and debt underwriting. But previous years have shown much more seasonality in Deutsche’s ROE profile than its US peers, so there is still a gap to be closed. For instance, the bank’s full-year ROE came in at only 4% in 2023.

Barclays’ latest investment bank results showed an ROE of 12%. This was in line with its conservative 2026 annual target, but the first quarter is seasonally strong. It also represented a decline of around 250bp from the same period a year earlier and around 500bp lower than the first quarter of 2022.

Barclays’ first-quarter fixed income revenues have declined about 15% since 2022, while equities revenues are down 16% (and even more if you exclude one-off items) – both a far bigger drop than its US peers. Strong growth in financing revenues, meanwhile, has shown signs of tapering off, especially relative to market leaders like Goldman.

Boosting returns

Both Deutsche and Barclays’ management have cited investment banking rather than the markets business as a drag on divisional returns recently. With European investment banking likely to remain structurally weaker than the US and the high degree of competition in areas like US M&A, cost control will be the name of the game.

But the markets business will still have a crucial role to play in their bid to improve returns. Barclays highlighted again the continued drag of its European rates business on the division’s profitability in the first quarter – and it is not the only one to struggle lately. BNP Paribas flagged its mix towards the quieter eurozone to explain a 20% year-on-year revenue decline in its fixed-income business, while Societe Generale also reported a 17% fall in fixed-income revenues – far greater than the slowdown at US peers.

Barclays and Deutsche said that market share gains are crucial to turning around profitability, but Citi should provide a cautionary tale. Its markets revenues remain a similar size to Morgan Stanley and Bank of America but its profitability lags materially. Citi’s markets business saw ROEs halve over 2021–23. Its first-quarter ROE of just over 10% represents a year-on-year decline of 370bp, contrasting with the improvements at its major US competitors.

Business mix has played some part in Citi’s underperformance. It has outsized dependence on macro trading (FX and rates), which was quieter than other products in the quarter. Although the 21% year-on-year revenue decline in Citi’s macro revenues was much worse than investment bank peers, its main transaction banking peer HSBC also saw a 19% year-on-year decline in FX revenues in the quarter. To be fair, if and when the hedge fund and prime brokerage boom ends, some of the gap to the other large US banks (which are bigger in this space than Citi) should naturally close. Encouragingly, the streamlining of Citi’s investment banking business has resulted in its ROE improving to 10%.

Even after the recent share price outperformance, Barclays, Deutsche and Citi still trade at below book value and at a considerable discount to US peers and Europeans with less exposure to investment banking.

Despite the lower multiple typically attributed to the more cyclical business model of investment banks, the high proportional exposure in terms of revenues and capital consumption means that outperformance in this business line will be crucial to delivering on their turnaround stories – and seeing further share price gains.

Rupak Ghose is a former financials research analyst