Asian Bank of the Year: Kotak Investment Banking

At a time when deal activity in India was off the charts and competition was rife, one Mumbai-headquartered bank dominated equity capital markets while also deftly handling select bond market deals. For its unparalleled ability to channel domestic and foreign investor demand, Kotak Investment Banking is IFR Asia’s Asian Bank of the Year.

Indian markets had a year to remember, as equity and debt issuance boomed, attracting unprecedented international investor interest.

The country’s ECM market was the most active in Asia Pacific ex-Japan, accounting for 37.9% of deal volume. India was also home to the region’s two biggest IPOs of the year – for Hyundai Motor India and food delivery app Swiggy.

Leading both jumbo floats was Kotak Investment Banking, which was equally adept at bringing in domestic and international investors to its deals.

Kotak was the top IPO arranger in Asia in 2024 with US$2.1bn of league table credit from 18 deals, leaving international banks in the shade. It topped India’s ECM league table for 2024 with US$8bn of volume and an 11.1% market share.

It was also the highest earner in Indian investment banking, garnering US$93.2m according to LSEG data, more than double the previous year, after fees from IPOs jumped 238% year on year and earnings from follow-on offerings nearly doubled.

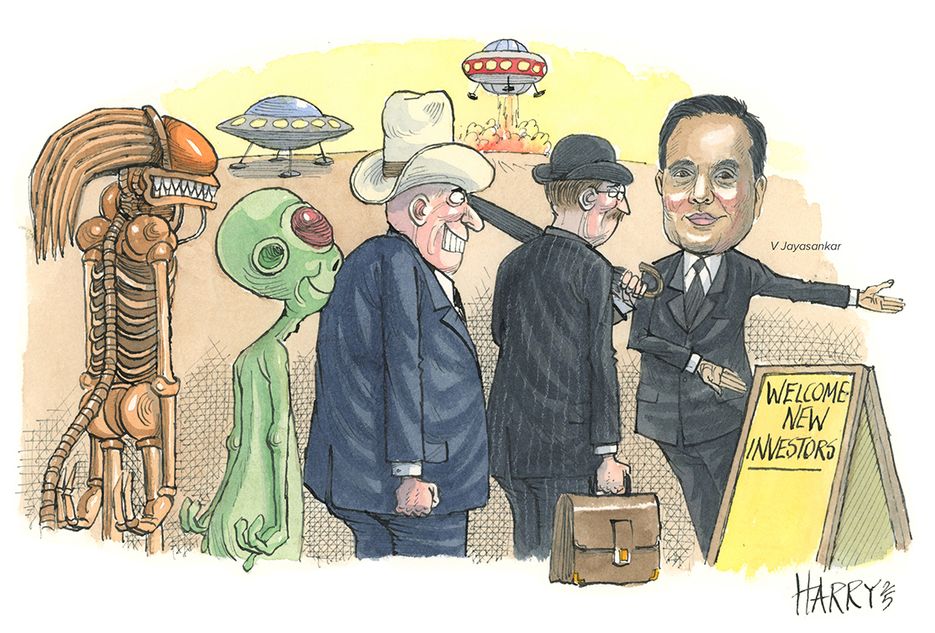

The performance “has been possible on the back of the confidence and trust our clients have with us and our distribution strength with foreign portfolio investors and domestic institutional investors. That is a benefit of Indian markets opening up consistently over the last 25 years,” said V Jayasankar, managing director and board member at Kotak Investment Banking.

While many Indian equity deals were driven by domestic accounts, Kotak was equally capable when it came to reaching high-quality international investors like sovereign wealth funds, enabling issuers to find the right mix of demand.

“We are considered to be the India specialist when it comes to global investors looking at India,” said Kaushal Shah, managing director and head of equity capital markets.

Kotak was on the most sought-after IPOs in Mumbai this year, including Swiggy, Brainbees, the owner of online baby product marketplace FirstCry, electric scooter maker Ola Electric Mobility, and Bajaj Housing Finance.

Kotak helped issuers navigate India’s complex regulations. For instance, the deals of Swiggy and budget retailer Vishal Mega Mart were notable for being the first confidential IPO filings after the Securities and Exchange Board of India introduced the mechanism in December 2022. Keeping the process confidential until nearer the launch date allowed the companies to focus on deal preparations without outside distractions.

“Clients choose us for our marketing capability in addition to our regulatory knowledge. Additionally, we don’t shy away from giving the right advice which may be a tough message, but clients recognise and remember us for the same,” said Shah.

The real feather in Kotak’s cap was Hyundai Motor India’s Rs278.7bn (US$3.2bn) IPO, the country’s largest ever. It was the only Indian bank picked for the deal, and demonstrated its understanding of Indian regulations and an ability to connect with overseas investors.

A listing by a South Korean parent could have been bogged down in regulatory approvals, but Kotak helped Hyundai Motor ensure the offering was executed smoothly and quickly, despite the cross-border angle. “They were inquisitive and always keen to understand issues and potential solutions,” said Jayasankar.

The IPO was widely seen as a test case for Indian markets, as more multinational companies consider spinning off their domestic units to benefit from high equity valuations and allow them to fund independently.

“A lot of global companies were looking out for [Hyundai],” Jayasankar said. “The success highlights the depth of the Indian equity market. The Indian domestic pool of money is larger than the foreign pool, driven in particular by the mutual fund players.”

The deal was followed by the Rs42.3bn IPO of the Indian unit of Blackstone-owned International Gemmological Institute in December. Other multinational companies also started work on listings for their Indian businesses once Hyundai Motor had shown domestic spin-offs could be successful.

Despite the supportive economic backdrop and flood of deals, there were still challenges. As valuations became richer during the year, there were some foreign institutional outflows as investors booked profits, and Kotak needed to manage issuers’ expectations in order to deliver successful performances in the aftermarket.

Kotak demonstrated the ability to pick the right pricing levels even in a tough global environment. Last August for instance, global stocks were particularly volatile amid fears of an impending US recession, while there was a sudden sell-off caused by unwinding carry trades after the Bank of Japan raised rates. Despite this, shares of Brainbees and Ola surged on their debuts that month.

FirstCry-owner Brainbees soared 46% on its first day of trading after its Rs42bn (US$501m) IPO, while Ola jumped 20% after raising Rs61.5bn.

The Swiggy float, too, was a tricky balancing act. Valuations were becoming frothy when the deal came to market in November, and some recent floats had traded poorly. There had also been few floats from the technology sector in previous months, making it hard to judge the appropriate pricing level.

By avoiding the temptation to be too aggressive in pricing, Swiggy’s Rs113.3bn deal was multiple times covered and its shares surged about 17% on their trading debut.

Kotak was also on Bajaj Housing Finance’s Rs65.6bn IPO in September. Those shares more than doubled on their trading debut.

Repeat business is hard to win in a competitive market like India when many banks bid for business by trying to undercut others on price, but Kotak’s impressive deal outcomes and reputation for skilful execution helped it become a mainstay for many issuers.

“We had significant amount of repeat business at about 50% reflecting the trust and confidence of our clients and investors,” Jayasankar said. Thanks to this, the bank’s ECM business during the year was split roughly 50–50 between IPOs and follow-ons.

After Kotak led Mankind Pharma’s IPO in 2023, the company hired it as one of only two banks to lead its Rs30bn qualified institutional placement in December.

Another repeat client was Five-Star Business Finance, a provider of small business and mortgage loans, whose IPO Kotak handled in 2022.

In September, Kotak was a bookrunner when a group of shareholders including TPG Asia, Peak XV Partners, and Sequoia Capital sold 56.2m Five-Star Business Finance shares. Kotak was also the bookrunner for an upsized block in Five-Star Business Finance in 2023. Kotak was the only bank that worked on Five-Star’s IPO and then participated in its blocks.

The growing depth of the Indian market meant that vendors were able to sell ever larger stakes in block trades, and Kotak was an astute judge of what the market could absorb.

“It has become common for private equity firms to exit completely through blocks. Doing large sell-downs of 15%–20% stakes has become pretty common in India. That just shows the degree of liquidity and encourages private equity firms to continue the momentum of increasing their India exposure,” Jayasankar said.

Transformative deals

On the debt capital markets front, Kotak did not aim to churn out volume, but was active on deals where there was value to add and a decent amount of fees involved, especially on structured deals. All the same, it recorded a respectable Rs234.4bn of league table volume in the rupee market and helped provide financing for transformative corporate deals.

Kotak helped Indian household products manufacturer Nirma raise Rs35bn in the bond market to acquire a 75% stake in Glenmark Life Sciences. The deal was split across three tenors and offered through India’s electronic bidding platform, maximising price tension and achieving a lower yield for the issuer.

The bank also helped Pipeline Infrastructure raise Rs64.52bn from a three-tranche bond offering to refinance rupee notes due in March.

Kotak structured a Rs20bn bond for Matrix Pharma, as part of the funding for the acquisition of the active pharmaceutical ingredient business of Mylan Laboratories.

The bank also helped Mercedes-Benz Financial Services India raise Rs3.5bn in the form of preference shares. The deal, which took more than 10 months to close, involved cross-border negotiations with multiple Mercedes-Benz teams to ensure compliance with Indian laws and German listing rules.

The standout year came even as the bank underwent a significant change of guard, with chief executive and founder Uday Kotak stepping down in September 2023, and Ashok Vaswani, formerly with Barclays and Citigroup, taking the helm shortly after.

Kotak’s stellar performance is a testament to a stable investment banking team, which it managed to retain even as global banks were snapping up dealmakers in Mumbai.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email shahid.hamid@lseg.com