IFR: What is the outlook for peso financing this year and how will the government's new fixed-rate 30-year bond impact the local markets?

Alicia Núñez (Mexico's Ministry of Finance and Public Credit): We view the 30 year as the last natural step in the process of extending the yield curve. Our intentions were announced a long time ago. We said there would be a 30-year issuance in the fourth quarter and there would be two issues as opposed to three of the 20-year in the fourth quarter, but we will issue the same amount of the 20-year as we used to.

This is just the last milestone in the process of extending the yield curve. The market was expecting it and we conducted a survey for both local and international investors, which was very well received.

IFR: Were international investors' requests any different from locals?

Núñez: Their behaviour has typically been somewhat different. They have been more eager to welcome the long-dated instruments, which is good for us and hopefully it introduces an element of diversification to the commercialisation of our paper.

IFR: Do you expect to be able to pre-announce all the issues going forward?

Núñez: That is still in the works. We will be announcing the guidelines for the 2007 programme before the end of the year. And we will continue with the policy of announcing by the end of the quarter what will be issued in the next quarter.

IFR: How do you think the 30-year will be received and how do you see the market developing into next year?

Ricardo Cano (BBVA Bancomer): The 30-year bond is very positive for the market in terms of extending the yield curve and letting investors know that the market will continue to develop and that there will be more volume in the longer-tenor transactions. But the direct impact on corporate and structured issues is going to be very limited given the absence of foreign investors at the long-end of the corporate yield curve. And there are tax reasons that explain that.

But it still gives a very positive outlook to the yield curve for non-government paper, especially in the structured sector. We have seen a number of structured deals that have been coming out long-dated. A lot of that is denominated in UDIs (inflation-linked units), not so much in straight pesos, but it will continue to grow and the announcement of the long-dated transaction from the Hacienda will help that market grow.

IFR: When you bring corporates to market, are there liquid derivatives markets that allow for the hedging of these deals. Are there the same number of counterparties as banks that would lead deals?

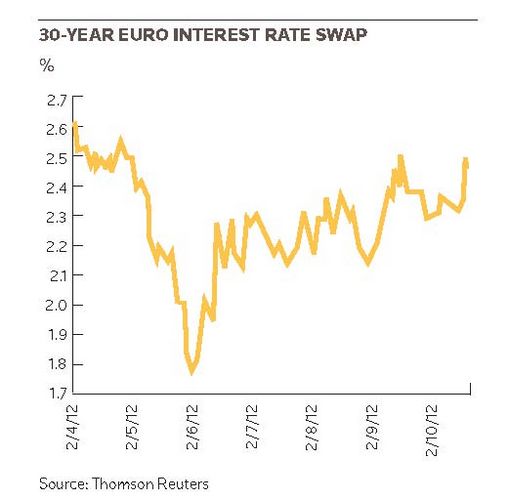

Humberto Cabral (Banamex): We have seen a lot of liquidity in terms of swaps up to 10 years. So if you want to execute a different swap beyond ten years, you have to prepare the treasury and a lot of stuff behind the transaction in order to be able to execute a swap like this. So it is very important when the Mexican government says it is going to launch a 30-year bond. The message is that there is stability in the market. We are not expecting to see a lot of transactions from corporates at this tenor, but it is important to see that at the end of the day, we have a new point in the yield curve.

IFR: Is there secondary trading liquidity in the derivatives market?

Octavio Calvo (Calyon): There is a fairly liquid market up to 10 years. If you want to trade a US$1bn worth of paper on a single day, that is not going to happen. My traders tell me between US$50m to US$100m of derivatives trading daily is quite achievable.

Arturo Arce (JPMorgan): The 30-year bond will also help develop the derivatives market because it will provide another hedging mechanism through the cash market via the 30-year bond, and it will definitely help the development of the 20 and 30-year interest rate swap market. In terms of liquidity up to 10 years in derivatives it is very strong. We are starting to see some liquidity up to 20 years, and we are starting to see some liquidity in the UDI peso markets, which is going to be key for further development of mortgage-backed security deals in the long-end of the curve.

Cano: It is amazing the pace at which this has grown. A couple of years ago you could have seen a liquid curve up to five years, and four or five years ago, probably up to a year, if that. A lot of that growth has been precisely because of the liquidity in the government securities market, given the efforts of the government in developing that market.

Raul Martínez-Ostos (Deutsche Bank): One point I want to address in terms of the issuance form the Mexican government, is that fact that they are approaching the market gradually. They are starting with small issues. We do anticipate great demand for the 30-year, but as we have seen with other sovereigns in the region if you start to tap the market with new issuance in very large volumes, you run the risk of killing that part of the curve. I think the gradual strategy on the part of the government is critical. They did this when they issued the three, the five, the ten, and the 20. I think that strategy will be valued significantly by markets.

Mauricio Alazraki (Pemex): For the corporate market, it is also key because this will extend the yield curve in pesos for corporates that could afterwards go and issue in longer tenors. So far for corporates, the Mexican market has been no longer than 10 years and this could open the possibility for corporates to go to 20- and 30-years.

IFR: How many corporates can you expect to be active at that part of the curve?

Alazraki: I think you can expect the high quality names, the Mexican triple As.

IFR: Given that Pemex and America Movil are two of the major high quality borrowers, do Mr. Alazraki and Mr. Rivera feel a similar responsibility as the ministry of finance to foster the development of the local market?

Ricardo Rivera (America Movil): Well not so much a responsibility because we want exposure to those tenors, but we view it as a means to extend the average life of our liabilities as much as we can, and obviously in a currency that we have most exposure to in regards to our income and revenues. We know the market would be developed (if we issued certain securities), but we first have to take a look inwards and see if such a trade is worth it for us. Obviously if at that tenor the investor base is not very well developed in Mexico and pricing is more expensive than in other markets, then we would definitely consider going elsewhere.

Cano: One thing in the corporate segment of the long-dated transactions, volume is going to be limited, if we are going to see volume at all. We don't have foreign participation on the investor side in the corporate bond market. There is competition for the paper between foreign and local investors when you talk about government securities. But when you move to corporate paper, it is basically local investors. And it is hard to get foreign investors into the local market given those tax reasons. That is why we saw America Mobile explore the cross-border peso transactions, which was a good experiment. I think it went pretty well. That is where you can capture both sides of the investor equation.

Rivera: That point is very relevant. So far because of tax reasons in Mexico, you have to either gross up foreign investors for withholding tax that they would get here in Mexico. Otherwise they simply won't enter the market. What we saw last year during the first global peso for a corporate was that when you get the dynamics of international and domestic investors within the same transaction, there is significant price competition that helps equalize internal and external demand for the credit.

Obviously you have to consider curve conditions at the time of the transaction. At some point either the local or the dollar curves might be shifting, and the deal could turn sour. But if it is timed right, what we have seen is that external demand helps price the bond tighter or helps better find the credit's intrinsic value.

However, international investors have been opportunistic and sold the paper they purchased. A big issue for us was that last year our deal was supposedly more expensive for us because of the withholding tax. And a year later 90% of the entire deal is now in the hands of Mexican investors. As we go forward, it is our case and our commitment that whichever deal we do in the market, both if it is done locally through our shelf with the local regulators or outside through an SEC shelf, both will have the same language for international investors in the sense that we will do the gross up for whichever transaction we do. We are almost positive that the results will be exactly the same as we get both investor bases together within the same transaction.

Calvo: In Euro-peso are you grossing up for everybody?

Rivera: We are grossing up. For each coupon payment we know exactly how many holders there are in the Mexican markets through Indeval (the local securities depository), and how many investors get their payments through Euroclear. That is one of the things that regulation in Mexico has done very well to be able to have rules in place so for investors it is very clear how they are going to get paid. For instance for the last coupon payment, only 10% was paid through Euroclear. Going along the time of the issuance this might shift, but given the cost effectiveness that we get because of the correct pricing of the transaction we feel it is a limited risk that we are willing to take.

IFR: What was the original split between foreign and local investors?

Rivera: Seventy five percent was placed abroad and 25% was placed locally.

IFR: Is that dynamic well understood by other issuers?

Ricardo Fernández (Credit Suisse): After America Movil's global peso, which was the first global peso in that format, we saw Telmex and other issues. Then we have seen a lot of foreign issuers coming to the local market. I think they intended to do the same thing, issue in pesos, register abroad and then bring local and foreign investors together. What happened in the end is that we have really only seen mostly local investors participating. Why is that? Because they are taking advantage of an abitrage. Foreign investors say, why would I buy a peso-denominated bond, when I can buy a US dollar-denominated bond that pays me more.

Local investors are the opposite. It is a win-win situation for them and the issuer because local investors are buying a better credit with a better rating than the Mexican government. Let's say a Triple A bond that is paying a spread over MBonos. They are diversifying and getting a better spread than what they get with an MBono with a better rating. So it is a slam dunk.

I think the next trend is cross-border transactions from Mexican issuers, which I think is going to be the future of this market, trying to get foreign and local investors to compete against each other, to get a better rate for the issuer. But how do you do that? I think it is a question of format and documentation, of issuers really understanding that they have to go to the US or Europe, and comply with regulations. And that's the next step. And that is what we are going to start to see in the market.

Calvo: Going the other way, how do you make it easier for a foreign investor to invest in locally issued products, because right now it is a logistical nightmare. You have to open an account with a local bank. Settlement of that transaction is a must if you want to develop that market.

Fernández: One is the withholding tax issue, but more important for the foreign investor, so that they feel comfortable participating in locally registered transactions, is disclosure and documentation. They need to feel comfortable that you are disclosing 144A type documents. US and European investors won't buy a deal registered in Mexico unless they have that type of disclosure.

Rivera: To attract international investors to a locally registered transaction the way the deal is settled is critical. Right now all the pieces are in place so that for a local transaction you can make the local payment through Indeval and get international investors to settle with the accounts that Indeval has in Euroclear. They would not have to open an account here in Mexico.

Cano: The agencies are playing an important role in that process, in terms of coming up with a uniform criteria of credit risk and how to structure the deals and so forth.

Juan Claudio Fullaondo (HSBC): I don’t think we are far from that because the rating agencies run the models with the specialised people in New York. In essence it would be a question of taking the local rating into a global one. It should be fairly easy.

Calvo: It will be a matter of demand. How much can the local market absorb. If it can't absorb as much paper, it will need the international side.

Fullaondo: For next year I am worried in the UDI for the format in 30-years. There are toll road transactions that are going to be coming out into the market, which accounts for almost US$15bn. Plus you have the RMBS market, which is maybe US$3bn. There is no way that in the local market you can fund those volumes. So for sure there is the need to tap into different kinds of markets.

Arce: If we go back in history, the Mexican government faced the same challenges three or four years ago, when it start selling their Mbonos to international clients. As far as I can see they have been successful, especially at the long end of the curve. Today foreign investors hold about 60% or so of the 10 to 20 year maturity in the peso yield curve. But three or four years ago that was a different story, first because we didn’t have a 20 year benchmark at the time. Hacienda was just starting to offer the 10 year to the market. And also we had this nightmare of settling and the withholding tax treatment for foreigners was not clear.

At the end of the day, Hacienda did a good job by creating a clear process for settling, which meant incorporating the peso as an eligible currency out of Euroclear and Clearstream. Second they clarified the withholding tax rule. Pretty much there is no withholding tax for foreigners for these securities. And third they road showed the peso offerings and started to capture the needs of international investors, and that is why they started to increase the tenor in the yield curve and increase the volume. Liquidity is also key for international investors. Following that experience, although there is still some work to do, there is an avenue that Hacienda has opened.

The two things that won't let this market really develop is the withholding tax because if the issuer has to pay the withholding tax, it will be more expensive than they can get locally. Second, there is the issue of volume. Corporates tend to issue small volumes. For instance, with MBS the typical average size is US$60m to US$70m. So there have been good changes in terms of reopening these mortgage backed security bonds because that will grow the volume. But it is a matter of withholding tax, liquidity and road showing these opportunities outside with international investors.

IFR: What are the hopes of any early change to the withholding tax issue?

Núñez: We are hopeful that with the new administration there is another chance to pass legislation with a different Congress, but that is as much as we know.

IFR: Regarding the issue of the bonds being held by foreigners and being liquid, is there a concern that they could be too liquid and volatile during times of global crisis?

Núñez: Contrary to the time around the Tequila Crisis, now participation of foreigners is welcomed. They have introduced a diversification element that we did not have before. Locals tend to move in a similar fashion when things get rough or when the market is good, and foreigners react to different incentives. So we very much welcome the participation of foreigners. We believe it will introduce good standards of market behaviour and if anything at least it introduces the diversification of risk.

Martínez-Ostos: One of the critical points is liquidity. That liquidity that has been created in the government securities market, but it is not taking place in the corporate spectrum. That is one of the things that foreign investors are willing to pay for. The America Mobil and Pemex experiences were positive. But if we want to take it to the next level we have to develop liquidity in the local markets. In the MBS market, it is artificially there, but you have the SHF (the government's mortgage lending arm) being a market marker and you have market makers being very active in MBS. The inflexion point will be when you have an environment where you have locals having one view and foreigners making the market and increasing the volume.

IFR: Even in the US and Europe there are not many corporates that are that liquid. How many do you think the market will support here?

Martínez-Ostos: It is hard to say. You need certain market makers to be active, and you need issuers to be there on the radar. It is hard to say how many will be there. America Mobil and Telmex and Pemex have done an excellent job in putting their names out there and people knowing them. Having a dollar curve in the US, these guys trade actively. What are foreigners looking for? There is a peso bet, and a rate bet and if to that you add a nice credit to the name, those are drivers. Issues about settlement and liquidity are keeping them from being more active.

Rivera: Also for issuers, the fact that a transaction is liquid creates a natural option for debt management, which is valuable for us. Just the fact that you have a transaction in which given certain conditions you can refinance by buying it back and the fact that it creates an opportunity for liability management is very important.

IFR: How closely can you monitor performance of market makers in the peso market?

Alazraki: In the peso market it has been fairly difficult and we have not seen banks making markets as they have done with the international issuances. At least for us, it is an issue because we have issued big sizes, bonds of probably over US$1bn in size, but we but we don't see much trading of those bonds. We don’t see those bonds being quoted on a daily basis. It would be very important to start having live quotes as we do have for bonds issued internationally.

IFR: Can you push banks to do that?

Alazraki: We are pushing the banks. But we still hear from local investors calling us and saying they are not giving liquidity on our paper. It has to be a process when banks would understand this is best for the market.

Cano: You also have a problem that local investors, which are the ones that buy the bonds, they are typically on the same side of the deal. So when one investor wants to sell paper, typically many investors want to sell the paper and the same thing when they want to buy it. So it is very hard to create a market that way.

In terms of the secondary market it is very limited. But certain Pemex deals are very liquid, depending on how they were structured in the primary, how well diversified they were, and how attractive they are in the current market conditions. What happens sometimes is that it eventually goes down to buy-and-hold investors, it gets into firm hands and it stays there. If there is a credit event or if there is a market move, then you may see investors go out and sell the paper, but they are all on the same side. In the international markets, you have people on both sides all the time. At certain times, there may be more liquidity for certain bonds in the Mexican market for those same names, but those are small windows. Over the long term it is more limited.

Calvo: The other side of the coin is that this gives dealers a huge margin to make profits. On the other hand you can't measure the true character of a market until volatility comes in to play. When there is a crisis, then we will see how mature the market is.

IFR: What is the typical bid offer spread on a deal?

Rivera: The Mexican market is still developing. There are a limited number of investors and a significant portion of the pool of funds being accumulated at first with the Afores (pension funds), and now Sociedades de Inversion (mutual funds) are beginning to grow. As the market develops you have a large number of participants and collusion is a lot harder. You don’t have all these investors that are buy and hold, but they are in the market to move around transactions. Eventually you will see bid offer spreads decline.

Arce: The other thing that will help the secondary market when we see institutional investors being more active in the derivatives markets, which just started about a year ago. Regulation has been in place for a long time, but we don't have many institutional investors really trading derivatives. Once we have more investors trading there is going to be good tradeoffs by selling the bond in the cash market and then taking a position in the IRS market or off loading a position in government securities and taking a position in corporates.

IFR: How many people are active in that market and what else is there to do on the regulatory front.?

Arce: In terms of derivatives all the regulation is already in place for Afores. But there is still no regulation for insurance companies and mutual funds. It is potentially coming next year. That is what we hear every year, but I think that this time it is really there. But even within the Afores we only have no more than five or six out of 20 something that are really active in the peso market.

Calvo: What I understand is that they have not been able to adjust the systems to the changing in regulation.

Juan Pablo Carriendo (CONSAR): It is an issue, but we have seen increasing professionalisation of the Afores. We expect to certify about five or six Afores in the use of derivatives and there are new systems that might be bought by Afores this year or next and that will increase liquidity in the markets. We expect Afores to increase their weighted average maturity. We have seen an increase of probably 25% in their maturity in the last three months or so. I think regulation has been accommodative of this. The risk measure that we use has moved. It is more ample and this gives room for new issues at longer tenors.

Arce: We are in the process of this new benchmarking system that Afores have come up with. It is going to be rolled out at some point.

Carriendo: It is in place. You can look on the web page at the benchmarks right now

Arce: At the moment they are only theoretical benchmarks or are they already following them?

Carriendo: They are going to change them in November and they will have the opportunity to change them like a trial. It is the first step but the benchmark you see right now are followed by the committees of the Afores.

Arce: This will result in the increase in duration of portfolios. That is probably one of the reasons they have increased that in the last three months.

Carriendo: Yes that is true and we saw there weren't many issues at longer tenors. Then you have two limits that are binding. The first one is that foreign investment limits. That is 20% and that must go through Congress to change, and most of this 20% is assigned to capital markets, not necessarily debt. That is one reason why Afores haven't bought more foreign securities. Then the second limit is the capital markets limit and that is 15%. We see great diversity there. We have some Afores that are close to the limit and Afores that are investing very little in capital market securities. I think at some point in time during the next administration those limits should be looked at. We are looking at those limits right now.

IFR: What was the increase in duration by Afores?

Carriendo: Since July or June, the Afores have increased the duration of portfolios around 25%, up from 1,500 days to about 1,900 days.

IFR: Coming back to the derivatives market, if or when they become more dynamic, which banks will be more active?

Martínez-Ostos: That depends a lot on the type of derivatives. For example, some issuers may issue in Cetes and then swap to dollars. The local banks will be more effective in carrying out those kinds of swaps. Whereas with swaps that are more actively used by foreign investors, the international banks can be more aggressive and will have some access that local banks don't have. It is a mix and it depends on the swaps. Some banks are more active in the longer tenors and have an advantage. It all depends on the swap and the market.

IFR: Is there liquid market in credit derivatives?

Arce: We are still waiting for regulation from the central bank, so there is no market. We expect that regulation to come on board by year-end. Probably we will see more of that market developing next year.

IFR: Do borrowers expect much to change in the financing options they have?

Alazraki: If you start having a development in the derivatives market locally, it will eventually make peso funding very similar to the one based in dollars. So far there has been an advantage to fund in pesos vis a vis in dollar or euros. I think eventually that trend will disappear with the development of the derivatives market. And if we start seeing a change in some of the limits and ceilings that Afores have on what they can invest, that will bring funding levels closer to international levels. What I think has been very important for issuers like Pemex is that with the development of the local market, we don't relay as much on the international markets and that has given us good leverage when we fund outside Mexico. The fact that we rely on the domestic market to give us very competitive funding, I think we have this good leverage to issue in dollars or euros.

Cano: We are talking about the tension in two different markets, inside and outside. Tension between investors is created by the scarcity value that a company like Pemex and others can bring to the market. They can say we have another market that will take our paper if you don't.

Núñez: When we road show investors ask us why we are diminishing external debt so much and which are the other credits we can buy from Mexico. The fact that we are issuing less and less opens space for issuance.

IFR: Will the government continue to do this?

Núñez: The market permitting, we will continue to rely more on the domestic market. We will keep liquid yield curves in dollars and hopefully in euros as well. We will maintain that access because we believe it is important. We also believe it is important to maintain benchmarks. But we will continue to rely more and more on the domestic markets.

IFR: Given that, how often do you think you will be coming to the international markets.

Núñez: It is hard to predict, especially because transactions are now driven by liability management efforts. To the extent we can take bonds out of the market or we can gain some value by substituting certain debt with other instruments, we will tap the market. But we have the luxury of doing it when conditions are favorable, no?

IFR: Does that mean you will tend to increase the existing deals?

Núñez: Not necessarily. These are liability management driven transactions. So they really depend on whether it is a good time to take paper out of the market or if it is good time to make benchmarks more liquid to keep the shape and performance of the yield curve. So it will be, if anything, maybe more opportunistic as we go along.

Cabral: If we compare the Mexican market of the last three years, we have seen a decrease in spreads for corporates in Mexico. It is possible that you would see 15bp or something like that, depending on the issuer, tenor and structure. But if you check this year, we have seen issuers with decreases of up to 14bp from February to August/September. I think the reason for that is basically liquidity and the great appetite for new names or different issuers.

Cano: Regarding the decrease in spreads over the last say 12 to 18 months, a lot is a result of what is going on in the government debt market. But I think the reasoning is a little bit different in terms of the achieved efficiency and especially the spread decreasing in the last number of months. I think a lot of that has not so much to do with tension between foreign and local investors, but with the tension between the banks and bond market. With the bank market being so liquid, a lot of times it has caused the structures in the bank market to resemble what is going on in the bond market in terms of tenors, covenants and other credit structures. So you have issuers looking to see which is more efficient, the bond market or the bank market. Over the last 12 to 18 months and maybe 24 months, we have seen the bank market being much more efficient. I think it has taken a lot of the volume away from the bond market, at least locally.

IFR: What effect has that tension between the bond and bank market had on the local market and the power it gives borrowers?

Rivera: On the point of how we were able to decrease the spread. It was paramount the transactions we did with the Euro-peso. After that our local peso curve shifted probably about 20-25bp. So I would say it is not so much the complacency of local investors but the fact that they actually didn't need to compete in pesos for a long while and now that there is foreign interest in local issues, this created a critical mass of fresh funds that pushed down spreads. As markets continue to shift, basically what we saw was that liquidity with banks was much higher than what we had seen with investors.

Cano: I don’t know if liquidity is higher because local investors are very liquid. There might be a problem with benchmarks because the banks have a benchmark of trying to get their deals on their books and the income booked this year. Whereas investors typically are comparing themselves to each and may not have the same time pressures to invest. It is more of a budgeting issue.

Rivera: The other fact is that local investors and Afores they have a benchmark that they need to comply with. They have their customers and their promised returns. And obviously for them there is a limit on how much lower they can price the same credit, while I think that for banks it is a little bit of a case of a business proposition. In that sense, since there has been significant constraint during 2006 because almost every other corporate was already fully funded for 2006 catering for whatever political instability we could have had this year, that created the need in the banking industry to acquire assets even if it meant that the price of these assets was much lower that what it used to be.

IFR: How long will that situation last?

Rivera: It is a window of opportunity and that might be open for a certain amount of time and you should take advantage of it while it is there. I don't think it will remain.

Cano: A lot of it will depend on how the new benchmarking works and how pressured investors are buy paper and to differentiate themselves from the government paper. That pressure is going to be created by regulation and the new regulations have been forcing investors to diversify and also to create their own benchmarks and try to beat their benchmarks. The competition is going to be different between the Afores. It is going to create opportunities for them to need to buy paper.

Arce: For borrowers it is a great time. It has been a great time over the past two years. I know it is a window of opportunity, but that window is going to be big for a couple more years. The market in general is very liquid. Banks are very liquid and they are underexposed to Mexico. And second institutional investors are very liquid. The reduction of local issuers supplying paper to local investors has been complemented by this Euro-peso type of offering issued by not only Mexicans such as America Movil, but by a number of other international issuers. The Afores truly achieved their goal of diversification and reduced their exposure to Mexican government peso bonds from eighty something percent to now 75%. So international issuers coming to issue in pesos also helped, but going forward, institutional investors have no other room but to grow in asset size. The average age of the Mexican population is still about 25 years. So they will still have a lot of inflows in the Afores before you see significant outflows. The same is happening with insurance companies and mutual funds. The insurance industry in Mexico is booming. So I think liquidity will be here for a long time, and borrowers will benefit from that.

Rivera: From our point of view, clearly right now we have the additional advantage that we can also issue in different local countries in which we operate. We have issued in Colombia. We are trying to develop other local markets. It is related to how local curves are shifting vis a vis the US dollar curve. But right now for us it is very clear that the cheapest funding you can get in the Americas right now and where you can achieve a significant level of liquidity is the Mexican market.

Martínez-Ostos: One thing I think is important is that foreigners came because it is very cheap to fund in peso, but maybe tomorrow it will be cheaper to fund in Brazil, Colombia, Chile etc. So I think words of caution are neeeded. Mexico was and continues to be very attractive to fund, but foreigners are not looking at Mexico because it is nice and is near the US. It is in terms of cost, it was the most attractive market for a period of time.

Cano: I think it is going to be more expensive going forward as Afores have less need to diversify and going forward they are going to need higher pricing.

Calvo: There are some dynamics that that the market has right now that puts pressure on the development the market. First, only select number of corporates can access the market. But to create a market you have to bring down the quality of the issuer. I would love to see a high yield market develop, where you give more products to institutional investors. If they are managing market risk, they are big and old enough to manage credit risk, and that way you will also see a surge of new companies coming to market. You have a more dynamic type of issuer coming to market. I would like to see that diversification. Right now very few corporates have access to this market.

Rivera: There is a cost associated with doing that. And you need to be in compliance with the rating agencies. You need to be able to disclose in different markets, not only in Mexican compliance but international compliance. There would be interest of Mexican corporates to do this, but I don't think that interest would be widespread enough to see a very liquid high-yield market in Mexico.

IFR: How many here expect to see a high-yield market any time soon?

Cano: There is a very limited high-yield market. We have seen single A, and even a couple of Triple B issuers, come to market. But it is very limited. You don't have a lot of companies that have the credit story to sell along with the transaction and that have the critical mass necessary and as Ricardo said are willing to make the disclosure commitments that are necessary. There is a lot of cost there. A lot of the companies that are not investment grade don't have the size or the critical mass. And the few that have the size a lot of them don't want to become public. Eventually it will happen.

But before we start seeing a high-yield market we are going to see other asset classes that will start to grow, for example the mortgage market, the toll road market. Certain type of structured finance MBS, ABS, future flow deals that will develop faster than the high yield market.

Why? Because they typically have the critical mass and they can get the investment rating. You are talking about double A, double A plus, and triple A transactions and then even sometimes they put on monoline insurance which brings you up to the triple A globally. So there are other assets that will be developed a little bit quicker, given the access to size and the ratings. My personal view is that it will take longer. It is going to be a few names that will go to the market and they are very limited. The investment rate in Mexico is equivalent to the rating scale outside of Mexico. When crossing from the double to the single A, the spread is huge.

Fullaondo: It is ironic, because if you are going to do a short term or commercial paper, you have a huge amount of companies which are willing to issue at ridiculous spreads in that market, and I think there is a broad market in Mexico in that regard.

Cabral: One way to help you tap these high-yield bonds could be to create the second tranche in MBS structures. To bring these tier II issuers is really hard.

Calvo: I would like to see it develop. I am not saying it is going to happen tomorrow. It happens in every developed market. In the US, penion funds and insurance companies are buyers of this paper and are sophisticated enough to analyse it and this sophistication has to drain through to this market eventually. I agree tranching deals with Triple B and equity type tranches paves the way for this development.

Alazraki: With this liquidity in the bank market, I think it is a more natural market for many of these companies to go before they go to the capital markets. They don't have to go through all this disclosure and documentation issues. For the banks, it is their natural client base.

IFR: How does Pemex treat this dynamic between the bank and bond market?

Alazraki: Until the recent past, in pesos syndicated loans have been more expensive than bond deals because they had to provision 40bp basis points for the IPAB, though we recently have seen loans at very low prices. We still can achieve better pricing in the capital markets, even if the end buyer would be the bank. If we document this as a capital market transaction as opposed to a loan, we can get tighter pricing. That is why Pemex hasn't been that active in the syndicated loans in peso as we have been in US dollars, where clearly you see an advantage of using this market vis a vis the capital market.

IFR: Are you talking about a private placement?

Alazraki: No. In a lot of our issues, the banks have been an important component of the demand, so they prefer to have Pemex exposure through the capital markets than direct or syndicated loans because it is probably cheaper for them, and we can achieve better pricing if we document it as a bond as opposed to a loan.

Cano: What Mauricio is saying in terms of the peso loan market, that is true. The burden of the IPAB cost is always a problem in the peso market. The loan market has been very active this year, and we have seen a number of transactions closed this year. We didn't see the market close over the electoral period like we saw in the bond market. We saw constant volume there. It was a pretty good market. The bond market is more volatile. In the bank market you are depending a little bit more on bankers having to fulfill their year's budget, so the deals have to go through and they are willing to be efficient on the pricing to get the deal done.

IFR: Do you agree that you have at least two years of blue sky borrowing ahead of you?

Alazraki: I don't know. I think there is a lot of liquidity. I don't see specific reasons for this to change in Mexico nor in the international markets. We have enjoyed a very liquid bank market for one or one and half years and I still think we will have this market for next year.

Cano: On the syndicate loan market, we have seen a little bit more concentration with the bigger banks. The very small retail banks that aren't that connected with Mexico but have in the past liked the asset and the profitability have participated less. The big banks in Mexico, whether they are local or foreign, are little more active than in the past.

Calvo: They have taken huge chunks of dollar debt. It is amazing. We have been lucky enough to lead several of these deals and basically the participation of the local banks here though their New York branches has been tremendous. .

Fernández: Why do you think the retail banks have been less active?

Cano: I am not talking about smaller banks in Mexico. I am talking about say an Asian bank that would come in with US$10m in the deal. Very small retail banks. I think a lot of that has to do with pricing.

Alazraki: It has to do with pricing and with additional business. Big banks want to be in the big tickets. No one wants to be in the small tickets because when they go in on the big ticks they can have better opportunity for additional business. That's what the big banks are looking for when they go and commit a big ticket.

Rivera: It is also a matter of how you structure it. In our case, we did a successful transaction in April. I am not sure it was the largest for a corporate so far in Mexico, but certainly one of the largest, a US$2bn facility. In our case, there was a scenario in which we hadn't been in the bond market for quite a while, specifically because of market conditions both in Mexico and the US had been very good for placing of bonds. And we hadn't done anything with banks for a period of two or three years. In our experience we had a significant bank participation. We had about 24 banks at different levels. But as Mauricio says, it has a lot to do what else a financial institution can do with the client.

IFR: But you can't reward all 24 banks with further business. Have you changed the way you allot the business?

Rivera: For us, the syndicated loan was a business proposition. We know market conditions are what they are right now and almost every other bank is liquid. Going forward it is a borrowers' market and now as a borrower you have a significant power to push down the price, especially if you have not been in the bank market for a while and most of the banks have no exposure to you. And then you can package it as a business proposition in which going forward this will probably be the transaction that will settle our relationship with the banking industry for the next five years, which was the tenor of the loan.

Alazraki: Even though for the small banks it might not be that good of a return, the market is so liquid, that as Ricardo mentioned, we did see them participate in the last syndication. We had over 40 banks and probably you do business with 20. But you still see them participate.

Martínez-Ostos: A lot of the new syndicated facilities are refinancing of previous facilities which reflects a lot of the appetite. And the refinancing has been at lower rates and longer tenors. We are seeing syndicated facilities beyond five years, seven years and that is a structural change that we have witnessed in the syndicated loan market. We may expect that trend to continue going forward. When there are some important M&A transactions taking place, the syndicated market will become more active related to those transactions.

IFR: M&A has been a key driver of international loan markets. Do you expect that to percolate down into Mexico?

Cano: We have started to see a lot of activity in the M&A market, especially over the last 18 and 24 months. A lot of the corporates have been doing liability management and pushing their tenors out and really repricing. There hasn't been much new financing to finance capex. A lot of companies are also cash rich and generated a lot of internal cash flow. Let's say the capex and the investment activity has generally been down through the M&A. When you see these jumbo deals a lot of they are because of the M&A activity. That will continue because the blue chips in Mexico don't have much room to grow in Mexico and so they need not only to invest in new capacity but buy market share in another market and diversify their income.

In terms of bringing that down to the middle market, we also see certain industries where will continue to see consolidation and we will a little bit of M&A activity there. But I think that a lot of that type of activity, the middle market company probably doesn't have the critical mass to go out to a syndicated loan and we have seen some club deals and a couple of deals with three or four banks and a lot has been done on a bilateral basis.

Rivera: As rates have come down over the past three or four years in Mexico, the funding of Banco de Mexico and the expectations that they will go even lower, given that inflation stays at the right level, I think that you should start seeing smaller companies willing to finance themselves, to have to other deals of M&A, here locally in Mexico. As an integrator of the region, I think it is positive what is happening in Latin America and in the past four or five years. And very good opportunities have presented themselves, and I think that going forward there is significant room for more expansion of companies like us, or some of the global companies that Mexico now has. For example in all the countries in which we operate, if you would ask us which country do you worry most about? We would probably say the US. Five, six, seven years ago it was the opposite. This reflects the good development that the financial sector has had across the region, both in market dynamics and on the regulatory side.

IFR: Is the market impervious to minor political upsets? It doesn't seem to upset markets much at all these days?

Rivera: I think it is the openess that the market has right now. If it were for locals, in Mexico we would have seen much more volatility, but now Mexico has exposure to international investors who care less about certain events, which we have seen in Brazil and Colombia. Not impervious, because some events could significantly disrupt the market as in any other market. But the soundness and the depth of the market have helped to lower volatility.

Calvo: The locals tend to be more negative. That is a problem not only in Mexico but also in Latin America or even Eastern Europe. You see the big international players taking positions when the locals are selling.

Carriendo: Institutional investors have also played their role and as Octavio said they have grown up and they didn't make strong movements given the political times we just went through. They had a long-term view that has prevailed over local politics.

Cabral: The Mexican market is mainly a floater market. So we have seen that no matter what the volatility is and no matter the international facts we are seeing in other countries, and also the electoral effects internally, what happened in our market is basically that we reduced the tenor or the size of the transaction or changed the structure. But at the end of the day, no matter what the volatility is the market has been there.

Alazraki: I agree. It is very important for the local markets, that no matter how volatile or how difficult the situation is, we have always been able to price competitive deals. We might have to change the format for tenor and rate, but the market has been open.

IFR: For those who report to managers abroad, are there any changes in what they are asking?

Calvo: Five or 10 years ago, the bulk of the business was done internationally, so all the capital markets business was done offshore. That has changed and the debt capital markets, New York-based person is becoming an animal in extinction. Today the motor has to be based in Latin America. There may be a couple of guys up there to cross-fertilise the sales effort, but at least in Mexico, 95 percent of the business is going to be local.

Martínez-Ostos: I agree. The local presence has been increased. To become a player in a wide array of products is critical. Banks are also more focused on technology and it is critical to bring some type of value added beyond plain vanilla products and make the best of platforms and bring it down to the local offices. I think the interaction with our people in New York and London is important. A few of competitors offshore are really putting more efforts in the local offices because it has been important to have that presence.

Arce: The commitment to the region is there. Each bank has it own strategy. Either you have big banks, which have bought big local banks, and are in all in the businesses, including retail and consumer. And you have the other types of banks, which don't have a retail presence in the country, so the strategy to have the local presence, but to get critical mass and justify the business you look at it in a regional way. So if you want to develop the mortgage backed securities market, if you only try to be a competitor only in Mexico, it is probably not going to be sufficient business to justify a presence. The way to look at it is to create a regional platform and try to have your business develop in three or four or five Latin American countries.

IFR: Do you mean serving five countries from here in Mexico?

Arce: No what I mean is you pretty much have the know-how out of New York or London. You create a small team fully dedicated to Latin America and you complement that with the local expertise by having one or two bankers in country, in the market you really want to approach. Although each country is different in its own way, the platform and the know-how and the expertise is pretty much the same. There are different stages of development. By having a regional platform combined with local expertise that is way to leverage the resources of the bank.

Fernández: The easiest part has been bringing our business down to Mexico. The hardest part has been educating investors and sometimes the issuers about the international standards we require for those structures, which is key for the development of the market going forward. Now we are talking about being cross border, we have to be up to international standards. Otherwise no one is going to buy it.

Calvo: There are other imperfections. We see all these Triple A structured deals coming at huge spreads. If you compare a Triple A corporate versus a Triple A asset backed deal, there is like a 100 basis points difference in spread.

Fullaondo: In Mexico, it has always been that way. I mean we have to change I agree, but so far it always been that way.

Fernández: There is always a premium to structured trade, but not such a large premium. But if you see MBS deals done in 2003 versus the ones done today, you see 40 or 45 basis point tightening on those issues. I think it is the educational process that both investors and issuers are going through with those type of structures.

IFR: Are investors comfortable with taking different parts of the capital structure on structured deals?

Fernández: We have seen maybe four or five deals with these senior subordinated structures. The subordinate tranche has been fairly small so one single investor can actually buy that tranche. I think going cross border and coming up to the standards of international investors is going to be key for the markets. I think securitisations are going to be the future of this market as well. You'll see the recurrent issuers like Pemex and America Movil that have the luxury of having SEC shelves and going that route. But maybe you will see smaller issuers coming to the market, but I think securitisation going cross border. It has been a small securitisation market so far. So there is huge growth and banks haven't been securitising for obvious reasons. They are liquid and fund themselves. But going forward you will even see banks tapping this market.

IFR: Do you have any estimates on how big the securitisation market might get?

Fernández: I saw some S&P estimates the other day and they were saying in 2010 the residential mortgage backed market in Mexico will be about US$10bn and we are US$1.5bn today over the last three years.

Cano: To get that type of volume, you need commercial banks to start securitising their assets. You are still a little bit away from that. I am not speaking for Bancomer, but more as a market participant. I don't work in that part of the bank, but I imagine that we are a few years away from seeing a lot of volume coming out of the banks in regards to mortgage securities. The banks are still very liquid. They still have a lot of capital, and they don't need to securitise their assets, and in fact they are asset hungry. Eventually we will get there and when that happens the market will become huge.

Arce: Regulation has to move in that direction because you are seeing the few local investors that are active are starting to get some limits in terms of that industry. Regulation has to move in hand with the development of the market.

IFR: What order do you expect the local to incorporate the other structured finance markets, and are there any other impediments.

Fullaondo: There are no impediments at all. Thanks to Basle II, I think you are going to start getting pressure from banks to securitise their assets. I think the first transactions from the banks are going to be MBS, CMOs and CLOs.

Fernández: In the asset securitisation world, there are other things like auto loans in which we have seen private transactions. We have not seen public transactions for auto loans. That is something that investors are really keen in buying. There have been problems regarding historical information on the loan portfolios that don't permit you to really go out and do public transactions. That is one sector we will see growing. It targets a deep investors base in Mexico, which is the short-term floating rate investors. You are starting to see more and more not just residential mortgages, but construction loans, coming to market.

Cabral: Mexican investors are looking for new asset classes. So if we have the ability to bring more RMBS , with a better level of rating, and toll roads, auto loan securitisation, CLOs and CMOs, it is going to be a way to take the market to the next step.

Carriendo: The demand will be there. The Afores grow more rapidly than the issuance of corporate bonds and MBS. And they are reaching their limits on equities and foreign securities, so unless there is more corporate issuance, they will start building up government assets as they did before and that will decrease their diversification, and that is not something we would like to see.

Arce: The change in regulation allowing investment in equities and foreign securities was very timely. Otherwise, this year Afores will have really suffered by not getting enough supply of paper. So they were able to reach the diversification objective, but that was because of that change and now they are reaching the limits.

IFR: Does the bank have any particular targets on the securitisation business, given that there is downward pressure on fees on regular deals?

Arce We don’t have a specific plan. For us, the driving force are the institutional clients, more than the borrowers.

The challenge is to bring more products to institutional clients. If that product is in the local market, ie MBS, we will try to bring it. If there are new limits on foreign securities, we will try to bring foreign securities. We see the market growing and it is just a matter of working around the regulation.