Asian investors think twice before ramping up FX hedges of dollar assets

Prohibitively expensive hedging is likely to deter Asian investors from rushing to shield themselves against a further weakening in the US dollar, analysts say, despite a recent slump in the greenback inflicting large losses on their vast holdings of US securities.

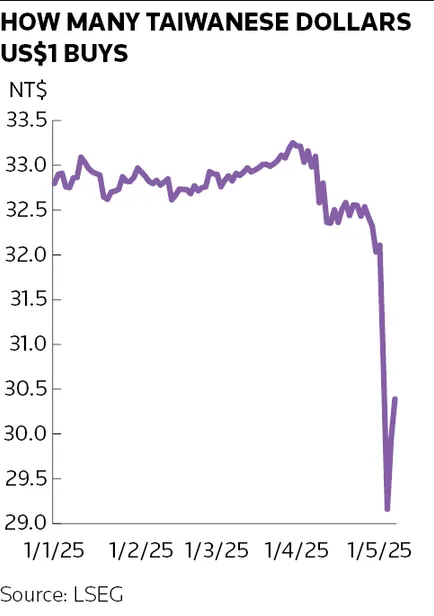

The Taiwanese dollar appreciated by 7.5% to reach NT$29.16 against the US dollar on May 5 in an unprecedented two-day rally fuelled by growing optimism about the emergence of trade talks between the US and China that buoyed Asian currencies more broadly.

The wild FX moves wreaked havoc on the US portfolios of Taiwanese life insurance companies, which are massive investors in US bond and stock markets and have been hedging progressively less of their currency risk in recent years.

Nevertheless, despite these troubles, analysts doubt that Taiwanese lifers and other investors will ramp up their FX programmes in the near future because of the eye-watering costs of hedging their exposures.

“Current interest rate differentials make it incredibly expensive for many Asian investors to hedge their US dollar assets, so the timing of hedging is incredibly important,” said Chris Turner, head of FX strategy at ING. “As the cost of hedging cheapens, hedging ratios will rise.”

That could come later in the year, Turner said, if the Federal Reserve starts to cut interest rates. While the Fed held interest rates steady at 4.25% at its latest two-day meeting that ended on Wednesday, many analysts believe the central bank will have to lower rates in the second half of the year as US president Donald Trump’s whipsawing tariff policy creates a drag on growth.

“That’s when we’ll likely see broader US dollar selling activity coming in from Asian market participants, as dollar hedging costs will cheapen," said Turner.

Under pressure

The US dollar has come under pressure this year as concerns mount over the impact of Washington's trade policies on the world's largest economy. The weakening greenback, combined with a dramatic plunge in US stocks after the April 2 announcement of sweeping tariffs, has heaped pain on overseas investors that for years have been content to leave large parts of their sizeable US asset holdings unhedged.

Recent swings in the Taiwanese dollar have shifted focus onto the plight of the country's vast life insurance industry. Taiwanese lifers held US$831bn of US portfolio assets as of February, according to Morgan Stanley, attracted by the lucrative returns they can make on US bond holdings thanks to the interest rate differentials between the two countries.

To maintain these returns, lifers have historically only partially hedged the FX risk stemming from their foreign assets, betting that the Taiwanese dollar won't strengthen significantly against its American counterpart.

But the growing interest rate differential between the two currencies has also made the cost of hedging FX risk more expensive. For instance, a six-month non-deliverable forward costs roughly 9% of the return that lifers could otherwise make from their US assets, according to Joey Chew, head of Asia FX research at HSBC. As such, the average FX hedge ratio fell for Taiwanese lifers from more than 75% in 2016 to 65% last year, according to analysis by Societe Generale.

That decline means the Taiwanese dollar's sharp appreciation against the greenback has been particularly painful for these institutions. Seven of the largest life insurance companies in Taiwan – representing more than 80% of the industry’s assets – are believed to have taken a 10% hit to their equity positions stemming from their unhedged US dollar exposure, Societe Generale analysts estimate.

That creates a dilemma for Taiwanese lifers, who face even higher hedging costs following the market moves.

“Taiwan lifers could thus increase their FX hedge ratios. That said, the increase in hedging may not happen immediately," said Gek Teng Khoo, an FX strategist at Morgan Stanley, in a recent report. "The cost of FX hedging for [Taiwanese]-based investors has risen meaningfully with the recent market moves. This may discourage [Taiwanese] investors from increasing FX hedge ratios meaningfully at this point of time."

The Taiwanese dollar isn’t the only Asian currency to have rallied amid the brightening outlook for a US-China trade agreement. The South Korean Won has also gained 2% against the US dollar since the start of the month and almost 6% since the start of the year.