Dutch pensions vote bolsters hedge fund bets

It came down to a single vote on Monday as the Dutch parliament rejected watered-down reforms for the country's €1.5trn pension fund industry – and in the process supported a popular hedge fund strategy of betting on a dramatic shift in the euro interest rate swap curve.

The defeated proposal would have opened the door to Dutch pension funds potentially opting out of a forthcoming overhaul of Europe's largest pension system. That has created a clearer path over the timing and extent of the Dutch pension fund transition, which has major implications for the €125trn euro swap market.

Dutch pension funds have long featured as one of the largest players at the long end of the euro swap curve because of their need to hedge future payouts to members. The new regime will reduce their need to hold long-dated hedges significantly – a development that traders believe should make the euro swaps curve steepen by around 30bp.

Positioning for a much steeper euro swaps curve has become a favourite hedge fund bet in recent months – and one that looked vulnerable amid the latest bout of political wrangling over the pension reforms. Now, with the opt-out amendment failing, hedge funds are doubling down on those wagers again, traders say.

“A lot of fast money is trying to game the transition and guess what the impact of it is going to be at the ultra-long end of the curve,” said Frederic Goulipian, head of euro swaps trading at Natixis. “A lot of hedge funds have been active on this theme, so it’s one of the most crowded positions at the moment."

The Dutch government's quest to revamp its vast pensions sector has far-reaching implications for the euro swaps market. The system encourages Dutch pension funds to engage in ultra-long dated interest rate hedging – typically between 30 and 50 years – to ensure they can honour payouts that have been promised to pension scheme members.

The new regime will encourage employees to take greater responsibility for building their own pension pots. It should also prompt pension funds to put on hedges that are smaller and shorter dated, upending these long-held dynamics in euro derivatives markets.

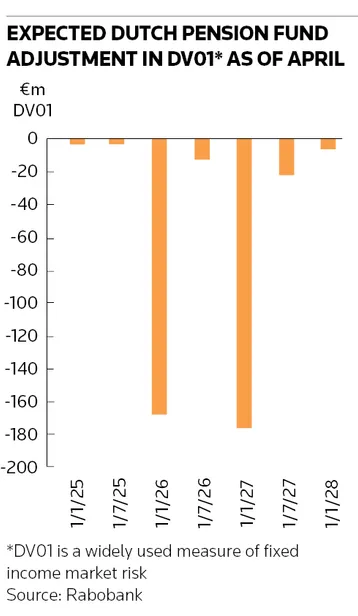

Pension funds should unwind roughly €200m–€250m in DV01 of these hedges in the coming years as a result of the reforms, according to Goulipian, referencing a widely used measure of fixed-income market risk that is the equivalent of more than €100bn of long-dated interest rate swap transactions.

Looking to profit from these shifts had become a favourite hedge fund bet until stiff resistance from some Dutch lawmakers threatened to derail these steepener strategies, which benefit from long-dated swap rates rising faster than shorter-dated rates.

The opt-out amendment would have given pension funds the ability not to transition at all if enough employees voted to do so. That left hedge funds in a precarious position in which the euro swap curve may not have steepened as much – or in the timeframe – as they anticipated.

Instead, the rejection of the amendment triggered a further steepening of the curve largely fuelled by hedge fund activity, according to Rabobank research. The 30-year swap rate moved 4bp higher versus the 10-year rate, while the 50-year rate moved 3bp higher versus the 30-year rate in the aftermath of the vote.

“At present, there appears to be little appetite to take the other side of that trade,” Rabobank said in a report on Wednesday.

“You do get the sense that the movements we’ve seen in the 30s and 50s are actually being driven by hedge fund flows but it’s very difficult to quantify," said a chief investment officer at an asset management firm. “A lot of hedge funds have positioned for curve steepening.”

Potential bumps ahead

While some Dutch pension funds won’t be transitioning to the new pension system until January 2027, roughly half the industry is expected to move on January 1, according to ING. Those dates are far from set in stone, though, analysts say.

Any surge in market volatility reminiscent of that seen in April may cause pension funds to postpone their transition to avoid a huge reduction in their “funding ratio” under the new system – the amount of money pension funds has to pay members.

Funding ratios are sensitive to movements in interest rates and equities, with any reduction to a pension fund’s ratio effectively meaning a cut in people’s pensions – a completely unthinkable scenario, said Michiel Tukker, senior European rates strategist at ING.

“If, on January 1 2026, one of the big pension funds has to take something like a 5% pension cut because [US president Donald] Trump caused a huge movement in rates and equities, it would be extremely controversial,” he said. “I've had debates with colleagues about whether people would take to the streets and protest in front of parliament."

According to Tukker, the average funding ratio among Dutch pension funds was 116% in April, with many facing a 7% reduction due to the plunge in equities and surge in bond yields following Trump’s tariffs announcements on April 2.

“If Dutch pension funds’ funding ratios fall below 95%, it’s likely they will pause their transition – for some, funding ratios falling to 105% would be enough to stop [the] transition,” he said.