How Goldman Sachs turned financing into a US$9bn powerhouse

Goldman Sachs, long renowned for its prowess in trading and dealmaking, is riding a wave of growth in one of the oldest plays in finance: lending money to clients.

Goldman raked in a record US$2.66bn in fixed-income and equity financing revenues in the first quarter, underscoring how the Wall Street giant is seizing on soaring demand from hedge funds and private equity shops to juice returns using borrowed money.

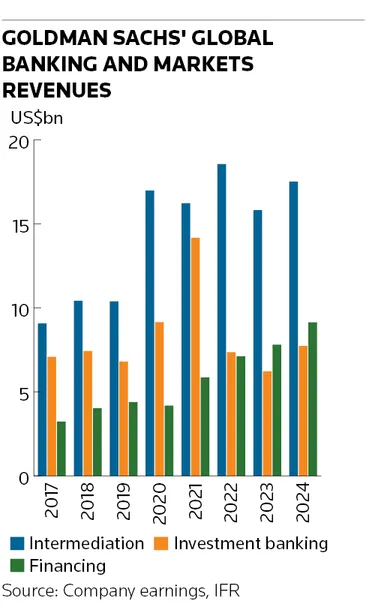

This breakneck expansion has transformed financing into a vital pillar in Goldman’s vast global banking and markets division. Last year’s US$9.13bn of financing revenue was more than double 2020’s total and comfortably surpassed the US$7.73bn Goldman earned from investment banking fees – making it the second consecutive year that financing has outpaced dealmaking.

Along the way, Goldman has become the standard bearer for the broader movement of banks using financing to buttress volatile trading divisions. This evolution enables the bank to benefit from the extraordinary rise of alternative asset managers and other trading firms that increasingly resemble competitors as much as clients in some corners of markets.

“This was an intentional pivot to do more financing,” Ashok Varadhan, Goldman’s co-head of global banking and markets, told IFR in an interview. “That has made us more relevant with our clients and helped us improve our ranking and market share.

“The empirical evidence shows that it’s not only increased our revenues, but made that higher level of revenues more durable,” he said.

Banks’ financing activities have gained prominence as equity and bond markets have swelled – along with parts of the investment management industry that use leverage to amplify returns.

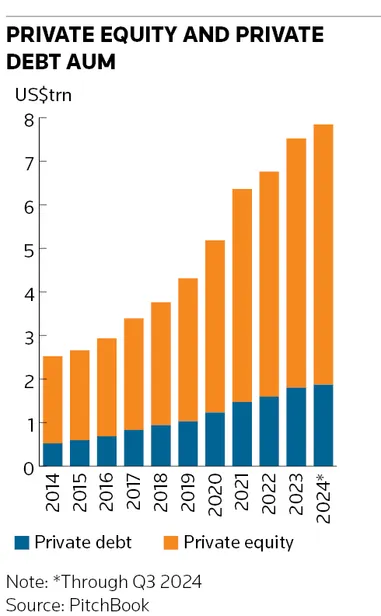

Hedge fund assets have increased by over a third to about US$5trn over the past five years, according to data provider Preqin, thanks in part to the success of multi-strategy funds like Citadel and Millennium Management. That has been a boon for prime brokerage units, which lend money to these funds and now account for more than half banks’ equity trading revenues. Private equity and credit funds have grown at an even faster rate, along with their appetite to borrow money against their holdings.

Steady and stable

The financing boom has provided banks’ trading divisions with a steady and predictable income stream that has only grown as markets have expanded and investors look to finance ever larger positions. The S&P 500 has doubled over the past five years, while US fixed-income markets have expanded 46% to US$47trn, mechanically inflating the size of financing deals.

“Financing correlates very highly with market cap – your financing book grows as the value of financial assets grows,” Varadhan said. “And the pace of that appreciation in market cap over the last five years has been exceptional.”

Financing represented over a third of Goldman’s markets revenue last year, up from 20% in 2020. That growth contrasts with a 15% decline in investment banking fees over the period following a drop-off in dealmaking. Goldman’s revenues from intermediation, in which it buys and sells securities on behalf of clients, jumped sharply following the outbreak of the pandemic in 2020, but growth has since slowed as market volatility has ebbed and flowed.

“The interesting thing about financing is that it truly benefits from a lack of volatility,” said Varadhan. “Not doing enough financing is why we lost market share in 2014 to 2016 when markets weren’t volatile. We were too reliant on market-making.”

The bank re-tranche

Goldman’s financing push reflects a broader transformation that some have dubbed the "re-tranching" of the banking system in the wake of the 2008 financial crisis. Regulators forced banks to hold more capital against risky activities, prompting much of this business to migrate to the so-called shadow banking system of private equity and hedge funds.

The rise of private debt funds is a case in point. These investors have seen their assets nearly quadruple over the past decade to about US$2trn, according to PitchBook, as they have taken over parts of the traditional bank business of lending money directly to companies. They also frequently require leverage to boost their returns – and banks are happy to oblige.

Crucially for banks, regulators treat this senior form of financing secured against a client's assets far more favourably than if banks were engaging in those activities themselves, whether that’s making risky mid-market loans, owning chunky private equity stakes or harbouring large trading exposures on their balance sheets.

“What’s happened is we’ve moved from the riskier part of the capital structure to the safer part of the capital structure,” said Varadhan. "In simple terms, we became less of an investor and more of a financier of people doing these activities because of the capital rules.”

Lurking risks

That is not to say financing is devoid of risk. The collapse of Bill Hwang’s Archegos Capital Management in 2021 inflicted roughly US$10bn of losses across the banking industry. That included a US$5.5bn hit on Credit Suisse that helped trigger a death spiral at the Swiss lender. Goldman, a prime broker to Archegos, emerged relatively unscathed – but the episode was a stark reminder of the dangers of the business.

More recently, analysts have raised concerns about private equity funds using complex loans to borrow against their already leveraged investments. These arrangements have become more commonplace as funds have looked to free up cash without selling holdings at what they consider below-market prices.

Varadhan said he is not concerned about certain parts of financing markets “running hot”. He did, however, underline the importance of maintaining strong credit underwriting standards, having robust legal documentation and high-quality systems to monitor risks.

“Not all secured lending is the same,” he said.

Client or competitor?

Bankers are fond of saying that financing solidifies client relationships, encouraging investors to funnel other business their way. However, the rise of private equity and hedge funds – as well as non-bank trading firms such as Jane Street – has posed a fresh dilemma for banks that face fierce competition from many of these firms in core businesses ranging from debt underwriting to stock and bond trading.

Varadhan said the lines have always been blurred between clients and competitors. “As you grow and become more relevant, there are going to be times when your clients will be your competitors and you just have to manage through that and have the maturity to realise that you're going to collaborate in some areas and compete in others,” he said.

Banks' financing revenues may struggle to keep up this relentless pace of expansion unless financial markets can maintain their own breakneck growth rate. Even so, the provision of leverage is an area where today's private equity and hedge fund behemoths still unequivocally need banks' services – making the financing business all the more valuable.

“Part of the reason we pivoted strategically into financing is that the barrier to entry to do that is really high. We have US$470bn of bank deposits – that’s something some of these competitors don’t have. Alts managers and hedge funds need us to finance them,” said Varadhan. “It is very clear that in the arena of leverage, they need it and we provide it. There’s no confusion there.”