Pro-crypto Trump administration accelerates institutional demand for crypto derivatives

US president Donald Trump’s support of cryptocurrencies is helping to turbocharge demand for derivatives pegged to digital assets like bitcoin among institutional clients, exchanges say, as greater regulatory certainty helps to usher in a crypto “renaissance”.

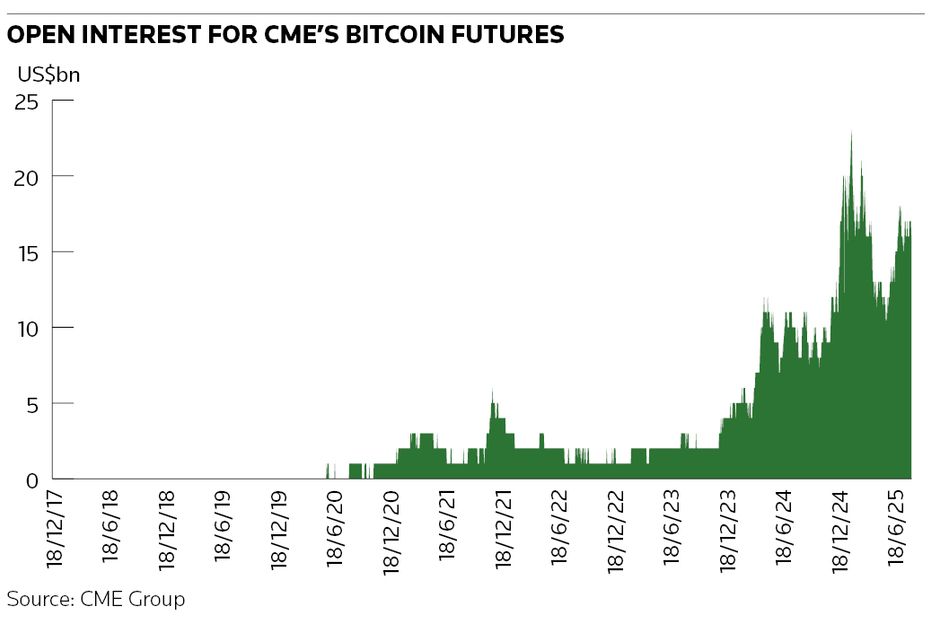

CME Group, one of the largest derivatives exchange operators in traditional financial markets, saw volumes in its crypto derivatives suite hit a record US$10.5bn traded per day in the first half of the year, spread across products such as bitcoin futures and options – more than double the volume in the first half of 2024.

Open interest for CME’s bitcoin futures had reached US$15.9bn by the end of June, almost double the US$8.7bn in open interest a year earlier.

“The crypto-friendly administration in the US has certainly helped to usher in a regulatory renaissance. It’s helping to provide greater clarity and establishing long-sought guardrails to allow this emerging asset class to flourish. In turn, that’s enabled institutions to further embrace crypto, especially bitcoin,” said Giovanni Vicioso, global head of cryptocurrency products at CME.

“This is an asset class that’s really here to stay and our products continue to help market participants either establish positions or hedge activity around their spot holdings,” he said.

The Trump administration has pushed for legislation to support crypto assets as part of the president's mission to turn the US into the “bitcoin superpower of the world”.

Such legislation includes the Guiding and Establishing National Innovation for US Stablecoins Act of 2025, known as the Genius Act, which enables private companies to issue cryptocurrencies pegged to assets like the US dollar, and Digital Asset Market Clarity Act of 2025, which aims to create a framework for the Securities and Exchange Commission and the Commodity Futures Trading Commission to regulate digital assets.

Trump’s efforts have helped the value of bitcoin increase by 75% since his reelection to the White House in mid-November – with the price of bitcoin rising above US$123,000 for the first time on July 14.

Growing demand

Trump’s enthusiasm has started trickling down to end-users, exchanges say. These includes institutional clients such as banks, hedge funds and asset managers that had previously been wary of dipping their toes into crypto waters due to the market’s chequered history – and their distrust of so-called crypto-native exchanges that operate in more lightly regulated jurisdictions.

Sam Bankman-Fried's FTX has come to embody the risks of trading on these venues after what was one of the largest crypto exchanges in the world imploded in 2022 amid revelations of massive fraud, causing bitcoin’s price to plummet to US$16,000.

Institutional clients have long been viewed as the key to further crypto market growth as they make up only 20% of overall crypto volumes, according to industry estimates.

Crypto-native exchanges, such as Deribit, have also benefited from growing enthusiasm for crypto derivatives among institutional clients. Deribit saw combined open interest for its non-perpetual bitcoin futures (the equivalent contract to CME's bitcoin futures) and options reach US$61bn in the first half of the year.

Roughly 85% of this flow stems from institutional clients, up from the 80% this time last year, according to Deribit CEO Luuk Strijers.

“Because of Trump, the doors are opening and the investment community is adjusting its position – which creates a huge opportunity for platforms such as ourselves. Even though they’re already at big levels, these volumes will only increase. This is still just the beginning of the growth story,” he said.

Recognising the huge growth potential of institutional clients more accustomed to trading on highly regulated venues, Strijers said Deribit will continue to become more regulated over time.

“To attract all of the clients we want to attract, we need to get licensed everywhere to ensure firms have to access to us across different countries. So, our regulatory push is only growing,” he said.

Basis trading

One particular trading strategy boosting institutional client activity across exchanges is a basis trade, which sees clients simultaneously purchase a bitcoin futures position relative to a bitcoin ETF or spot market position to profit from price discrepancies. Popular among relative value hedge funds, this strategy generates a return of around 10%, said CME’s Vicioso.

“Previously, many such hedge funds were unable to participate in basis trading because they lacked access to the crypto spot market but that changed with the introduction of bitcoin and ether spot ETFs,” he said.

Launched last January and regulated by the SEC, spot ETFs have become a popular way for market participants to gain exposure to bitcoin – having attracted more than US$35bn in cumulative flows by the end of 2024 and more than US$50bn by the end of June, according to analysis by Deutsche Bank.

“It’s typically institutional clients who engage in basis trading and we’ve certainly seen growing interest among them this year, which has helped to boost overall bitcoin derivative volumes,” said Strijers.