Portfolio trading continues dizzying growth

Portfolio trading volumes in US corporate bonds jumped 54% in the first half of 2025 to a record US$823bn, according to Barclays, in the latest sign of how technology is fast reshaping credit markets by allowing investors to buy and sell large blocks of bonds in one go.

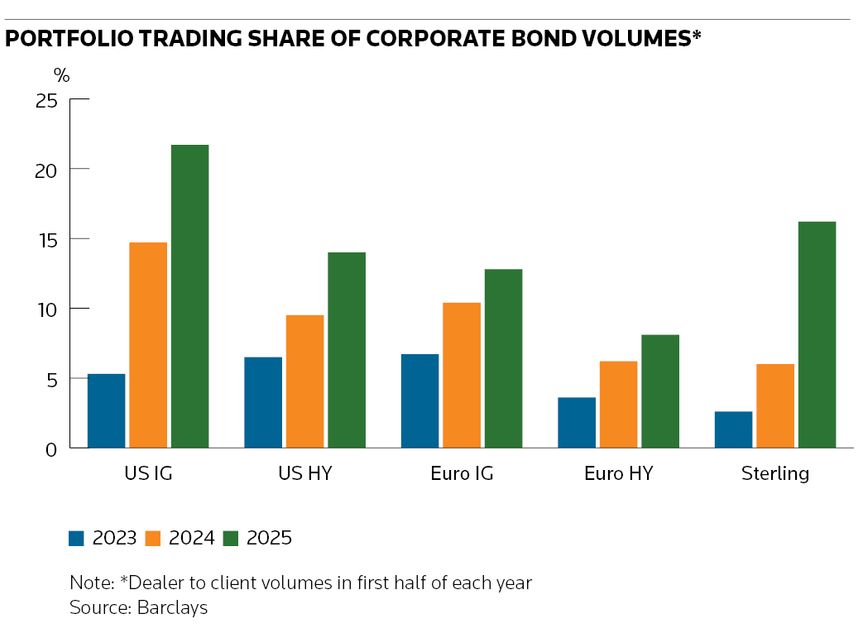

Portfolio trading accounted for 22% of dealer to client volumes in US investment-grade bonds in the first half, Barclays said, up from 15% during the same period a year earlier and 5% in 2023. That surge is part of a broader electronic revolution in credit markets that is helping trading desks process huge quantities of transactions.

The portfolio trading boom helped volumes in the wider US corporate bond market rise 14% to a record US$6.6trn in the first six months of the year, according to MarketAxess, with activity peaking in April when concerns over US tariff policies sent markets into a tailspin.

"Portfolio trading has grown considerably over the last few years as a proportion of the overall credit trading franchise. That's helped credit remain very resilient, particularly in volatile markets," said Rehan Latif, global head of credit trading at Morgan Stanley.

"Thematically, this is very similar to what happened in equities trading. The development of the technology around algorithmic trading is enabling larger portfolios to go through the system,” he said.

New paradigm

Portfolio trading has come to typify the shift towards more equity-like trading in corporate credit. Advanced technology is allowing banks to price hundreds of different securities worth billions of dollars in a short space of time, a feat that seemed impossible only a few years ago in these once human-dominated markets.

Barclays said there’s now a portfolio trade occurring every six minutes in the US corporate bond market, compared to one every 41 minutes in 2020, as the trading protocol has firmly entered the mainstream.

Many see the tariff-induced volatility in April as a coming-of-age moment for the market following several years of rapid growth. Portfolio trading volumes hit a monthly record of US$172bn that month, Barclays said, representing a fifth of all activity between dealers and clients.

That contrasts with earlier periods of stress such as around the UK’s ill-fated mini-budget in 2022, said Liane Fahey, head of European institutional credit at Tradeweb, when liquidity dried up and clients stepped back from portfolio trades.

“The system was battle tested in April and it came out with flying colours. It showed that portfolio trading isn’t just a flash in the pan, but a fundamental change in the market structure,” said Finbar Cooke, managing director in credit trading at Barclays. “Portfolio trading was the lowest cost way for [clients] to transact risk and so client volumes stayed really high.”

Track record

Ted Husveth, managing director for US credit at Tradeweb, said the track record that portfolio trading has established over the years – and the data now available for investors to analyse – have helped clients get more comfortable with the protocol.

"We’re seeing new clients using portfolio trading, but also existing clients using it more," he said.

That has led to a broad increase in activity across different parts of credit markets. Portfolio trading represented 14% of volumes in US high-yield bonds in the first half of the year – over twice as much as during the same period in 2023 – according to Barclays.

April proved to be a particularly busy period, with volumes touching a record 20% of total market activity in US high-yield on some days, according to Tradeweb. Barclays analysis showed steady growth this year in sterling and euro markets too.

Portfolio trades are also getting bigger – both in terms of absolute size and in the number of individual bonds involved. Tradeweb said it recently posted a new record of more than 4,000 line items in a portfolio trade.

“The bigger dealers have gotten so much better at recycling the risk that it's allowing them to take on those bigger sizes at competitive prices,” said Kevin McPartland, head of market structure and technology research at Coalition Greenwich. “That’s encouraging asset managers to take this approach rather than trying to trade in smaller chunks.”

Liquidity catalyst

The growing prevalence of algos and portfolio trading – along with the related activity of exchange-traded fund trading – has significantly increased liquidity in the wider corporate bond market. The share of US investment-grade bonds that don’t trade each month has fallen dramatically since 2015, according to Barclays, with portfolio trading helping investors offload illiquid positions.

Robert Douglass, director in credit trading at Barclays, said less liquid bonds are becoming “much more liquid” as a result. There’s also signs some of the seasonality in bond trading patterns is disappearing.

“Fridays are much busier, the summer months are busier, more trades print at the end of the day. Systematic strategies growing on both the sell side and buy side are driving this,” said Douglass.

Husveth said it’s no coincidence that overall market volumes have increased as portfolio trading has grown. “Portfolio trades are a positive catalyst for trading in the wider market as liquidity begets liquidity,” he said. "You see portfolio trades getting done, and then those same bonds trading in the market as dealers recycle those positions."