Corporates pre-hedge debt sales ahead of potential US rate cuts

A growing number of corporate borrowers are taking advantage of widespread expectations of looming US interest rate cuts to lock in their borrowing costs on future debt sales ahead of time.

Anticipation has mounted that the US Federal Reserve will lower interest rates at its September 16–17 FOMC meeting following the release earlier this month of weaker-than-expected US job numbers. That has provided an opening for companies that price their debt off Treasuries to pre-hedge planned bond issues at lower costs following a sharp drop in market interest rates.

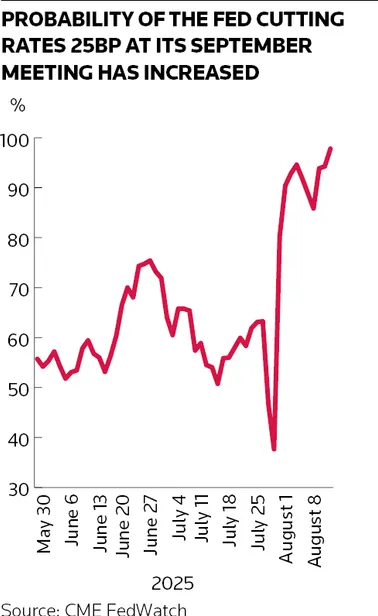

US five-year interest rate swaps fell more than 20bp following the release of the July jobs report to just above 3.6%, according to LSEG data, while the odds of the Fed cutting rates in September has surged to 97% in recent sessions, according to CME Group’s FedWatch gauge, despite lingering uncertainty over whether Fed chair Jerome Powell will throw his weight behind a cut.

Bankers say many companies with upcoming debt sales have grabbed this opportunity to secure lower financing costs instead of waiting to see how the Fed reacts next month.

“Because of the expectation that rates might come down, we’re especially seeing more pre-hedging being done on near-term [debt] issuances,” said John Chun, head of Citigroup's corporate solutions group. “A company that needs to issue in the next three months, believes that, over the long term, rates will fall but is concerned about short-term volatility. [That is] the typical scenario we’ve been seeing.”

Highly rated companies typically price debt sales off Treasury yields, making market interest rates a prominent driver of their all-in borrowing costs. Many have historically used forward-starting hedges to lock in lower funding costs resulting from anticipated changes to monetary policy.

The Fed lowered interest rates by 100bp between September and December last year but has kept rates on hold since amid caution over how president Donald Trump’s tariffs could impact consumer prices. However, many analysts believe July’s disappointing jobs report – and concerns over a weakening in the world's largest economy – should persuade the Fed to resume its cutting cycle.

The subsequent decline in Treasury yields and swap rates has reduced the financing costs on future bond sales for companies that are willing to put on hedges, covering the interest rate component of their debt issuance, in advance.

“At these levels, corporates that are going to issue debt are incentivised to put pre-hedges in place, especially as a lot of them have just announced their earnings for the first half of the year and so are coming out of their blackout period,” said Yasemin Artar, head of corporate sales, Europe, market and securities services at HSBC.

“Most of the activity we’ve seen has been swaps based, but some corporates are paying a premium to buy optionality – especially for shorter-dated tenors."

Conviction vs caution

Locking in borrowing costs in advance also provides companies with some protection in case the Fed disappoints markets in September. Jackie Bowie, head of EMEA at consultancy Chatham Financial, said this month’s Bank of England rate decision was a clear warning to anyone assuming US rate cuts are a done deal.

While the BoE lowered rates by 25bp on August 6, as expected, the decision was split five votes to four. Traders concluded that the close-run result meant the BoE could soon pause its cutting cycle and leave UK interest rates higher for longer. UK borrowing costs subsequently moved higher.

"If you hedged in advance of that rate decision, you’d have fixed in a lower rate which is obviously a good outcome. So in both the US and the UK, there’s certainly a benefit to look at hedging in advance and not always wait[ing] for the actual cut to come through,” Bowie said.

Some analysts caution that there is greater uncertainty over Fed policy than markets imply. Tuesday’s closely watched US consumer price data for July was a “mixed bag”, according to a Barclays' analysis, with headline inflation remaining steady at 2.7% while core inflation rose to 3.1%. Meanwhile, Thursday’s US PPI – which tracks producer prices – came in hotter than expected at 3.7%.

“While markets are treating a September cut as a near certainty, we think there is still a lot to play for,” said Seth Carpenter, chief global economist at Morgan Stanley, in a recent note.

Debt mix

Rate cut expectations are also fuelling a rethink of corporates' debt mix more broadly, bankers say. Many companies opted to fix as much as 90% of their debt in the previous decade of ultralow interest rates and have maintained a high fixed ratio even as rates have risen to ensure stable borrowing costs. Now that rate cuts are on the horizon, many are questioning whether a higher ratio of floating-rate debt would be more beneficial, bankers say.

“I wouldn’t be surprised to see more corporates moving from fixed into floating in the near future, especially for long-dated debt,” said Artar.

Chun said market volatility and uncertainty are making companies more hesitant to engage in this activity right now. “We expect to see greater fixed to floating activity once we’re closer to the end of the cutting cycle,” he said.