Tariff turmoil fuels bumper payday for inflation traders

Banks’ inflation trading desks have enjoyed their strongest start to a year since 2022’s once-in-a-generation surge in consumer prices, as concerns over the impact of US tariffs have triggered a flurry of activity in this niche corner of financial markets.

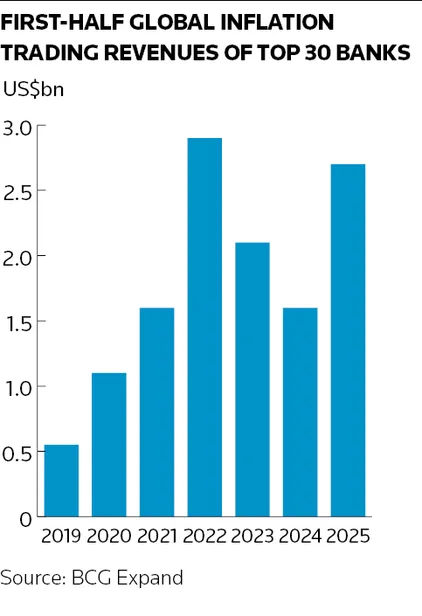

Global inflation trading revenues at the top 30 banks reached US$2.7bn in the first six months of 2025, according to data provider BCG Expand, a nearly 70% increase from the same period last year. That’s just shy of the record US$2.9bn haul banks generated in the first half of 2022 after inflation soared in the aftermath of the pandemic and Russia’s invasion of Ukraine.

Traders say the cloud of uncertainty surrounding US president Donald Trump’s stop-start tariff policies has encouraged more investors to insulate their portfolios against price shocks. That forms part of a broader uptick in inflation trading over the past few years, which contrasts markedly with the previous decade of tepid inflation and ultralow interest rates when investors could largely ignore these risks.

“Inflation trading has been consistently busy for the whole year across the globe. That’s part of a broader trend of structurally higher volumes in inflation markets in recent years,” said Bari Spielfogel, head of global inflation products at Citigroup.

“Tariffs have been in discussion since the start of the year and that’s drawn interest in inflation trading globally from both existing investors and new investors that are all of a sudden facing inflation risk they never thought of before in their portfolios."

Market revival

Governments have linked debt payments to inflation for decades, providing the foundations for a specialised market in which traders and investors can hedge and take views on the path of consumer prices in the years ahead. Inflation trading became a backwater after the 2008 financial crisis, as Western economies struggled with anaemic growth and inflation lay dormant.

But that changed abruptly in the early 2020s with the arrival of Covid-19. Huge government fiscal spending combined with supply-chain disruptions sowed the seeds for a massive shock to prices. Then, in February 2022, Russia’s invasion of Ukraine triggered a surge in commodity prices that sent inflation spiralling higher still.

In the US, annual rises in consumer prices peaked at just over 9% in June 2022, having spent most of the previous decade around – and often below – the Federal Reserve's 2% target. Banks’ inflation trading revenues increased more than fivefold in the first half of that year compared with 2019, when they made around US$550m over the same period, according to BCG Expand.

Volume surge

Inflation has since cooled considerably to 2.7% in July in the US but its path remains the subject of fierce debate. Dariush Mirfendereski, co-head of flow and structured rates for EMEA at MUFG, said there have been several inflation-inducing or reducing themes this year including tariffs, conflicts in the Middle East and a series of economic releases that have been critical for indicating when central banks might cut interest rates – and by how much.

“Those all have implications for inflation markets, particularly at the front end of the curve,” said Mirfendereski. “When you have volatile markets, you get these ructions in flows as counterparties rush to cover or add to their risk positions. So it leads to an environment where you see a lot more activity.”

Inflation swap volumes rose 58% to a record US$1.9trn in the first half of the year, according to ISDA. Sterling inflation-linked bond trading volumes increased 22% to a record £186.5bn, according to Tradeweb, while euro volumes were up 8% to €133.5bn.

The most intense period of activity came in the wake of April’s 'liberation day', when Trump announced sweeping tariffs against US trading partners. Investor expectations of inflation sank as stock markets plunged, with five-year US breakevens declining from 2.61% at the end of March to 2.25% three weeks later, according to Federal Reserve data. Breakevens are market expectations of average inflation over a given period as measured by the difference in yield between inflation-linked and nominal bonds.

“Inflation breakevens have a strong correlation with risk assets like stocks during times of stress. We saw a sharp drop in breakevens when the S&P 500 took a big hit after 'liberation day' and then they recovered as the stock market recovered,” said Mirfendereski. “That stress period caused big movements and flows in longer-term measures of inflation, but also in the front end.”

Developing market

Alongside the structural move higher in trading volumes there's also been “a big development” in the scope of inflation products available in the market, Spielfogel said. Citi has seen inflation options grow “pretty significantly” this year, she said, and the bank has also created and traded inflation swaptions for the first time.

Traders expect inflation to remain in the spotlight in the months ahead. Market consensus holds that recent economic data have cleared the way for the Fed to cut interest rates in September, even though many economists predict tariffs could yet push consumer prices higher. Trump’s efforts to bring an end to the Russia-Ukraine war could also have important implications for energy markets – and inflation.

“We continue to see increasing volatility around realised inflation, where prints are becoming less predictable," said Spielfogel. "Global trade policy is also changing the relationship between inflation in different countries. People see those as investment opportunities."