Betting on the cost of leveraging US stocks has never been so popular

Trading activity is surging in a niche corner of financial markets focused on the cost of leveraging bets on US stocks.

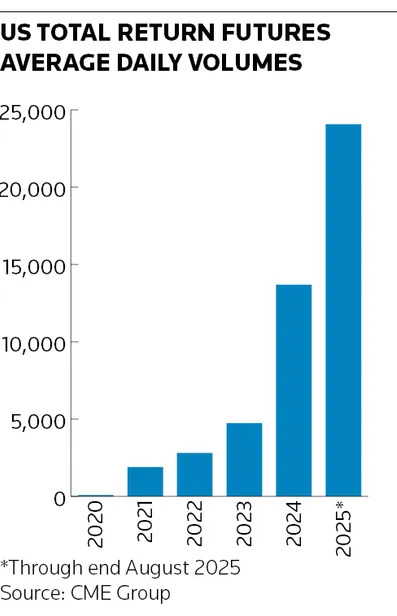

Average volumes in US total return futures have rocketed 76% this year to about 24,000 contracts a day, according to CME Group, further fuelling the growth of a market in which only five years ago fewer than 100 trades changed hands a day.

Total return futures allow investors to take views on the performance of major benchmark indices like the S&P 500 and Nasdaq Composite over a longer time horizon than regular futures contracts. These derivatives have also become a popular way for traders to hedge or bet on changes in the cost of financing equity positions. This gauge, also known as equity repo, measures how much investors must pay to leverage stock market exposures.

The trading boom comes in the wake of an unprecedented squeeze in equity financing costs in late 2024 that briefly pushed this little-known market into the spotlight. That episode highlighted how regulations limiting the leverage banks can provide to their clients can result in extreme moves when stock markets are high, raising the question of whether a repeat could be in store later this year.

“Equity repo has been a huge focus in the market as incoming regulations have made the cost of deploying balance sheet more challenging for banks. When people are bullish and there’s a lot of demand for assets, that creates a scarcity of resources among banks to provide investors with further leverage,” said Mark Smith, head of equities capital and financing structuring at Citigroup.

Smith likened the dynamics to a price squeeze in a sought-after commodity. “When there’s a lack of supply in a specific commodity, the price goes through the roof because people still need to buy and there is no one selling,” he said.

Recycling risks

Rising interest in equity repo is part of a wider increase in activity in derivatives linked to US equities. That comes as a rapid expansion in US structured product issuance has created more trading opportunities in other equity-linked markets.

Selling structured products saddles banks with exposures to parameters such as dividends and equity repo, encouraging them to use derivatives to hedge their positions. The growth of multi-strategy and other hedge funds in recent years has provided a further bump to activity as more investors have emerged that are willing to take the other side of these trades.

Some investors use total return futures to take longer-term views on equity market performance. However, a popular strategy known as a calendar spread – which involves selling a shorter-dated contract and buying a longer-dated one – also allows traders to bet on how the cost of financing equity positions will evolve over time.

“Banks have a need to trade equity repo to recycle the risks from other parts of their equities businesses. We’ve also seen more hedge funds adopting these products as delta one traders have landed at multi-strategy pods,” said Paul Woolman, global head of equity products at CME Group, referring to the bank traders that handle instruments closely linked to stock markets such as equity repo.

“Historically, trading equity repo was done through over-the-counter products, but more of that activity has moved on-exchange as clients have looked to get more capital efficient,” he said.

Limited leverage

Regulations limit the amount of leverage banks can provide, meaning there is a finite supply they can offer their clients. Demand for leverage, meanwhile, is heavily influenced by stock market performance; waning when markets are in a slump and surging when stocks are tearing higher.

That happened in late 2024 when a market rally following the reelection of US president Donald Trump coincided with the runup to the year-end reporting period, when banks typically reduce the amount of leverage on offer to clients. Financing costs surged to record highs as markets struggled to cope with the imbalance between supply and demand.

“Since balance sheet is a limited resource, financing naturally becomes more expensive when markets rally,” said Jeremy Rosen, head of delta one solutions for the Americas at BNP Paribas. “There was a historical dislocation in equity repo that accelerated in the last two months of 2024 and came to a head in December. The debate in the market right now is whether that’s going to happen again.”

Smith said there has been a lot of focus in the market on “optimising funding in the hope that the next squeeze will be better handled". However, equity financing costs are already elevated by historical standards as the S&P 500 hovers near all-time highs.

Many believe the decisive factor will be whether US stocks can shrug off concerns over a weakening economy and sticky inflation and march higher – dragging up demand for leverage with them.

“Ultimately, it is interlinked to the performance of the market," said Smith. "If [the Magnificent Seven tech] companies go down a lot, there will be less demand for financing. If there is a really bullish environment, financing may come under stress again."