Nonbanks’ trading growth stalls in US$7.5trn FX market

Nonbank trading firms have made giant strides in recent years, taking share from traditional investment banks' core business of trading stocks and bonds, but there's one area where they’re struggling to gain further ground: the US$7.5trn-a-day foreign exchange market.

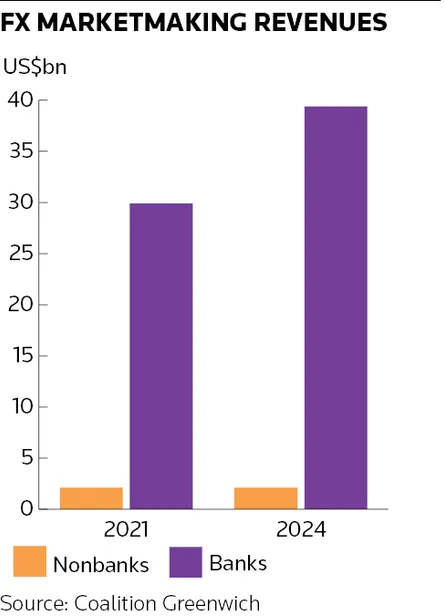

Nonbank trading firms generated US$2.1bn in FX marketmaking revenues in 2024, Coalition Greenwich estimates, roughly the same amount they made in each of the previous three years. Traditional investment banks, by comparison, increased FX revenues 32% over the same period to US$39.4bn, the data provider said.

The resulting decline in FX market share for nonbanks, to 5% from 7%, contrasts sharply with their relentless advance in other asset classes such as corporate credit and equities, where firms like Jane Street and Citadel Securities have made considerable inroads.

This failure to keep pace in a market once considered ripe for disruption raises questions about whether nonbanks have hit a ceiling in FX marketmaking – and whether their experience could signal challenges ahead in other markets they are targeting.

“It’s a space where there’s been dramatic evolution but there are pockets where they [nonbanks] have been more successful than others,” said Paolo Croce, head of global markets for EMEA at UBS. “In equities, for example, alternative liquidity providers have seen a massive increase, but in FX they’ve stalled in terms of market share.”

Hitting a plateau in FX marketmaking represents a rare slowdown for an industry whose encroachment on traditional bank strongholds has yielded spectacular results in recent years.

Jane Street’s dominance in exchange-traded funds has catapulted it into the top tier of firms trading stocks and corporate bonds globally, helping it generate more trading revenue than JP Morgan and Goldman Sachs in the second quarter of 2025. Citadel Securities, which says it handles nearly a quarter of all US equities trading volume, raked in a record US$9.7bn of trading revenue last year. XTX Markets, which started life as an FX specialist, minted a record £1.3bn in profits in 2024 – a near tenfold increase from 2019.

Prime target

Highly automated and extremely liquid, FX markets have long looked like a prime target for the nonbank trading community. More than 80% of FX spot transactions are electronic, Coalition Greenwich estimates, with much of the trading taking place on open, exchange-like platforms where tech-savvy firms can easily compete.

XTX Markets showed the disruptive threat nonbanks pose when it quickly established itself as one of the largest liquidity providers in FX spot markets following its founding in 2015. Others also have a significant presence. Citadel Securities says in the second quarter it was top three by volume on CME Group in FX futures and on the exchange’s EBS platform for spot FX.

Yet despite these achievements, analysts say revenue growth has proved harder to come by for nonbanks in recent years as the fastest-growing (and more lucrative) parts of the FX trading pie – corporate flow and more bespoke derivatives trades – remain largely out of reach. In what some say is a sign of the times, XTX Markets now makes the bulk of its revenues trading equities, according to sources familiar with the matter, as its rapidly expanding business in this area has overtaken its FX operations.

Spokespeople for XTX Markets and Jane Street declined to comment. A spokesperson for Citadel Securities said the firm has a strong presence in FX markets and continues to expand its client list and launch related products.

“Electronification has been a significant tailwind for nonbanks, but there are also structural headwinds that lead us to conclude that their upside in the FX market may be limited,” said Stephen Bruel, head of derivatives and FX research on the market structure and technology team at Coalition Greenwich and author of a forthcoming paper on nonbanks’ presence in FX markets.

“Their strengths play to a subset of the market that is highly electronified, which limits profit margins and their ability to further grow their market share,” he said.

Barriers to entry

Bruel highlighted barriers discouraging nonbanks from entering higher margin parts of the FX market in which banks hold sway. Most nonbank trading firms aren’t registered as swap dealers with the US Commodity Futures Trading Commission – Citadel Securities being a rare exception – limiting the amount of over-the-counter derivatives they can trade.

“A lot of nonbanks don’t want to become swaps dealers and become more heavily regulated," Bruel said.

They also don’t tend to have trading relationships with one of the largest (and most profitable) client segments: corporates. Multinational companies often require bundled services such as lending facilities, cash management, transaction banking and trade finance – and regularly reward their banks with FX flow.

“These nonbank players don't have the same client base that we have, particularly when it comes to corporate clients,” said Flavio Figueiredo, global head of FX at Citigroup. “Corporates ... look for different types of solutions other than just flow execution, which requires the use of balance sheet and access to local markets. That’s something we can provide – and the nonbanks can’t.”

Corporate treasurers also tend to be less focused on securing the best possible FX rate compared to, for instance, hedge funds – and are willing to pay extra for the additional services bank provide. A second head of markets at another major bank put it more bluntly. "Most of the money in foreign exchange is really made from client flows where the clients’ primary business is not trading FX," he said.

That could be providing workflow solutions for an emerging markets fund manager so they can focus on their day job of picking stocks or helping a European company selling goods in China to get money in and out of the country.

“The FX market has been 'open architecture' for 10 years now – everyone can compete on exchanges. So your edge really comes from giving your clients great service,” the second head of markets said.

More luck elsewhere

It is perhaps no coincidence that nonbanks have made larger inroads in parts of financial markets in which corporate clients figure less prominently. Their share of marketmaking revenues in credit trading, for instance, has increased to 13% from 9% over the past three years, according to Coalition Greenwich, as a greater proportion of corporate bond transactions is processed electronically. Nonbanks also account for about a third of industry revenues in cash equities.

Raman Kalra, head of nonbank liquidity provider competitor analytics at Coalition Greenwich, said interest rates trading is another notable asset class in which nonbanks have struggled to take business from banks lately.

Similar to FX, rates trading involves large amounts of activity from corporates and other institutions that need more bespoke hedging and financing arrangements, often bundled together. This business usually takes place away from exchanges and frequently involves banks putting their balance sheet to work and extending credit to clients.

“Rates and FX are highly electronic and liquid, but a lot of the margin is made from corporate and institutional clients that need access to balance sheet and trade over the counter with their bank counterparties,” said Kalra. “Bid-offer spreads are much tighter in the highly liquid and electronic parts of the market where nonbanks are more active.”

Not stepping back

That doesn’t mean nonbanks will retreat from the US$2.1bn bridgehead they’ve established in FX. Bruel said nonbanks have found a niche within “this hugely complicated FX ecosystem” where they can make money without using a lot of capital, taking advantage of their strength in technology and pricing.

“They’ve cemented their place in the FX market and it’s a feature, not a bug of their model that they’re avoiding other parts of the market where banks are active,” he said.

Figueiredo agreed there is room “for everyone in the market”. Still, he said: “I don’t think they can take away the business that we now have.”