UK remains top FX and derivatives trading hub

The UK has retained its crown as the top hub for trading foreign exchange and interest rate derivatives, according to a report from the Bank for International Settlements, underlining how London remains at the heart of financial markets five years on from the country’s exit from the European Union.

Half of all over-the-counter interest rate derivatives trading activity in April took place in the UK, according to the BIS’s triennial central bank survey, up from 43% in April 2022. London’s share of FX trading also held steady at 38%, the BIS said.

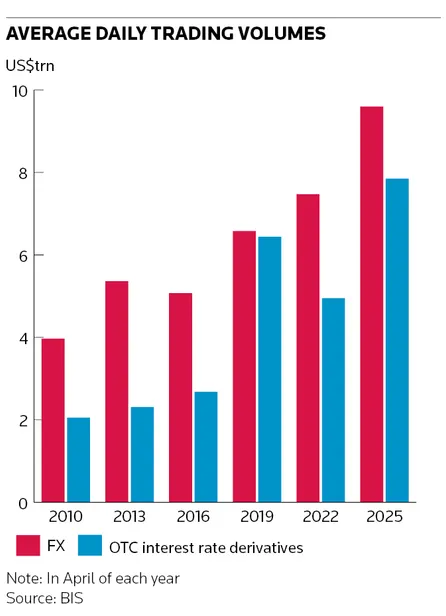

The UK’s dominance of FX and interest rate derivatives came amid a surge in activity in both markets. FX trading volumes hit a record US$9.6trn a day in April, a 28% rise from three years earlier, the BIS said. Interest rate derivatives trading activity increased 59% to an average US$7.9trn a day.

Dealers reported a sharp uptick in trading activity in April when the BIS survey was conducted following the chaotic announcement of US tariffs and a subsequent spike in market volatility.

In a somewhat ironic twist, the BIS noted a “surge” in euro derivatives trading helped drive the increase in the UK’s share of interest rate derivatives activity. Average daily turnover of euro-denominated interest rate derivatives nearly doubled to US$3trn in April from three years earlier, making euros comfortably the most popular currency for contracts in these markets.

Elsewhere, trading in sterling-denominated interest rate derivatives nearly tripled to US$939bn a day, while yen-denominated activity increased eightfold to US$411bn. Growth in US dollar contracts was more modest, rising 7% to US$2.4trn, the BIS said.

Frustrated EU

London’s dominant role in euro derivatives trading has long been a source of annoyance for the European Union. Brussels sought to grab a larger share of euro derivatives trading and clearing in the wake of Brexit, although it has so far struggled to engineer a mass migration of interest rate derivatives activity. Around 95% of euro swaps volumes were cleared through London's LCH in 2024, according to analytics firm ClarusFT.

LCH is part of LSEG, which also owns IFR.

Frankfurt-based Eurex operates the main EU-based interest rate derivatives clearinghouse. Germany’s share of daily interest rate derivatives turnover increased to 7.5% in April, up from 5% in 2022 and just 0.8% in 2019.

The BIS survey underscores the pivotal role the US dollar continues to play in global financial markets. The greenback was on one side of 89% of the US$9.6trn of transactions that on average changed hands in FX markets each day in April. The euro was the second most popular currency with a market share of 29%, followed by the yen on 17% and sterling on 10%.

FX swaps remained the most widely traded instrument across all currencies, with average daily turnover rising 5% to US$4trn. Options registered the fastest growth of any FX product, with daily turnover more than doubling to US$634bn. Spot FX volumes increased 42% to US$2.9trn while turnover in FX forwards rose 60% to US$1.8trn.