Zero-day contracts become dominant force in S&P 500 options market

Volumes in equity options that expire on the same day they’re traded have reached all-time highs, as a surge in retail and institutional activity has made these ultra-short-dated derivatives the most popular S&P 500 options contracts in financial markets.

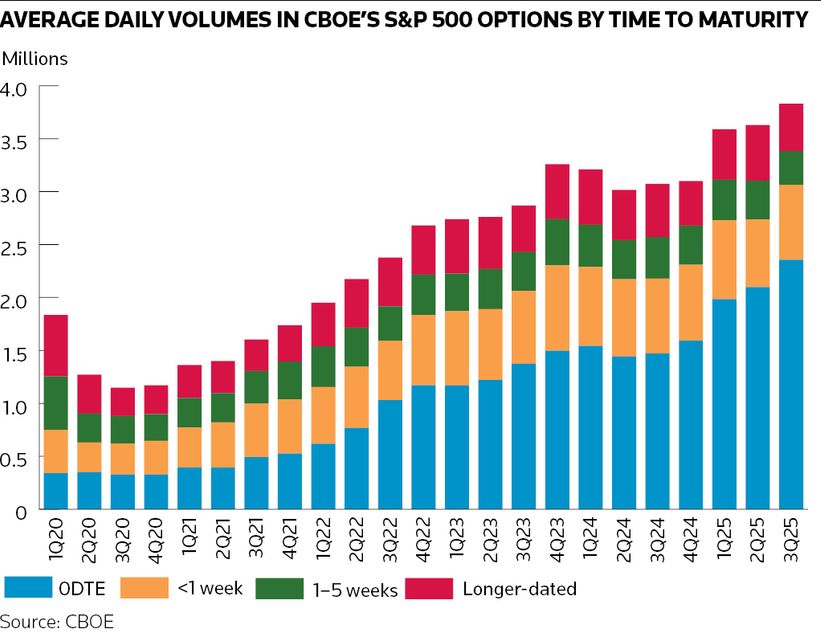

Average daily volumes in zero-day-to-expiry – or 0DTE – S&P 500 options jumped to a record 2.5m contracts in September, according to Cboe, with the derivatives now representing around 60% of all S&P 500 options volumes. This newfound dominance of flows comes on the back of a sharp uptick in trading from investors across the spectrum.

Financial institutions such as banks and hedge funds have upped their presence in the market as these derivatives have become an invaluable risk management tool to finetune trading exposures. The retail trading boom continues to drive activity too, as low or commission-free brokerages like Robinhood have brought these derivatives to the masses.

“The demand for practical and accessible investment opportunities from retail investors and the demand for scalable risk management from institutional investors has helped boost volumes in 0DTE options,” said Antoine Porcheret, head of institutional structuring for the UK and EMEA at Citigroup. “The 0DTE ecosystem is a well-oiled machine for both retail and institutional investors wanting to execute more precisely timed trading strategies.”

Cboe completed its 0DTE offering in 2022 when it added contracts expiring on Tuesdays and Thursdays to its weekly S&P 500 offering.

Investors have since flocked to the derivatives thanks to their ability to deploy risk management and investment strategies around major market events with exacting precision, whether that's economic data releases or central bank announcements. Volumes have subsequently soared, increasing almost fivefold since they were made more available over three years ago and driving a broader growth in S&P 500 options activity.

“There are all kinds of 0DTE trading strategies out there now so an ecosystem is really starting to develop around these products,” said Garrett DeSimone, head of quantitative research at data provider OptionMetrics.

“The short-dated nature of 0DTE options means these contracts come with a unique set of risks compared to weekly or monthly options, so we’re increasingly providing research and analysis to investors who wouldn’t otherwise be considering those risks.”

Retail boom

The zero-day options craze has been at the forefront of a wider trend in equities markets: the rise of the retail trader. Cboe says retail investors account for the majority of zero-day options activity – an estimated 50%–60% of volumes.

Part of that growth is down to access. Zero-day options are available on trading apps like Robinhood, which started offering Cboe’s S&P 500 options on its platform last October. There are also signs that retail investors are becoming savvier about how they use these risky derivatives.

“A lot of people assume retail traders use short-dated options as a cheap bet for leverage but that’s not really the case with 0DTE options,” said Mandy Xu, Cboe’s head of derivatives market intelligence. “When comparing institutional activity versus retail activity, the two camps are now almost identical in their use cases.”

Xu highlighted some of the tools that have been developed to help retail investors, including automated trading algorithms and other features that let them set specific parameters that are then systematically traded throughout the day on their behalf.

“These tools have historically been much used by institutional investors, which shows a clear trend in increased sophistication among retail investors. That’s certainly provided a key catalyst for volumes growth,” she said.

Risky business?

The acceleration in zero-day options growth – and the pivotal role played by retail – has inevitably fuelled concerns in some quarters that these derivatives could undermine market stability. The fact that zero-day options’ dominant position is still a recent phenomenon means that there haven’t been that many live stress tests to see how the market responds.

Many practitioners downplay those worries, pointing out that it remains a balanced market in terms of retail and institutional flow, as well as the ratio of puts to calls. It is also notable that institutional activity has grown faster than retail over the past year. Average daily volumes among institutional investors hit 1.1m contracts in the third quarter, Cboe estimates – a 70% rise from a year earlier, as hedge funds and banks rely more heavily on the contracts to manage their risks.

“0DTE flow is very systematic and balanced, we don’t only see one type of client or one type of trading strategy dominate,” said Xu.

Porcheret said there’s no reason to be concerned about zero-day options from looking at the historical data considering the market remained in balance even during stress periods like April’s tariff tantrum or the sharp plunge in stocks in August 2024.

“But let’s not forget that 0DTEs can, in theory, amplify a market move, so you can never disregard a one-way balance of risk on any given day for whatever reason,” he said. “0DTE options do introduce novel risks and can exacerbate adverse market conditions. Given the exceptionally high demand for these products, the potential for unforeseen market repercussions is equally significant.”