Larry Ellison pledges 30% of his Oracle shares in loans

Larry Ellison has increased his use of margin loans over the past year, regulatory filings indicate, as Oracle's surging share price has furnished the tech magnate with more firepower when tapping his 41% stake in the cloud-computing giant as a source of cash for his business dealings.

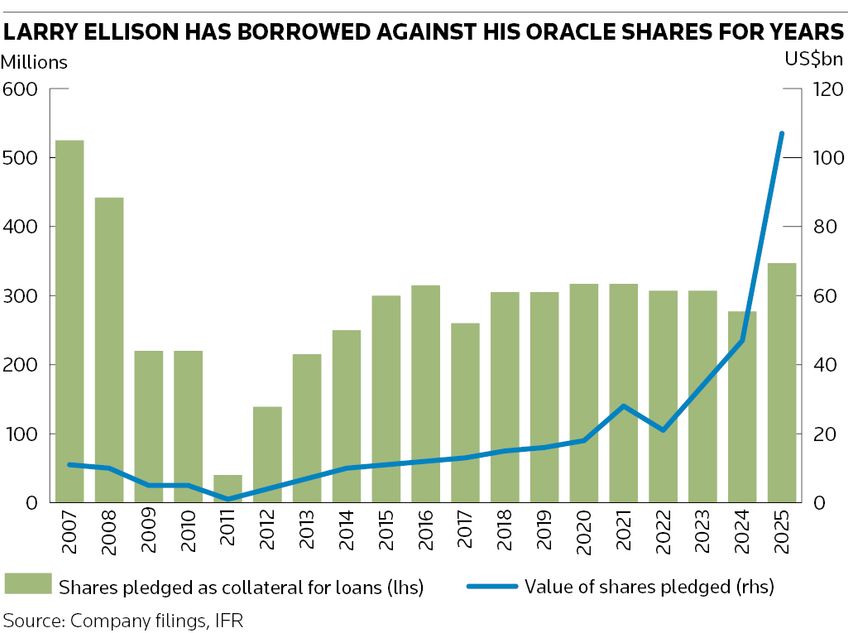

Ellison had pledged 346m of his Oracle shares as collateral “to secure certain personal indebtedness” as of September 19, according to regulatory filings, equivalent to 30% of his stake in the company. That’s up from 277m shares in September 2024 when 24% of his stake was pledged as security for loans.

It comes as the 81-year-old Ellison has become increasingly active in deploying his vast wealth to backstop corporate takeovers. Skydance Media, which is run by Ellison’s son David, acquired Paramount Global earlier this year in an US$8bn deal backed by the Ellison family's fortune and private equity firm RedBird Capital Partners.

The newly formed Paramount Skydance has since been preparing a majority cash bid for Warner Bros Discovery that will also be backed by the Ellison family, The Wall Street Journal reported last month. Separately, US president Donald Trump has said Ellison is among those involved in a proposed deal to take over Chinese social media app TikTok’s US operations.

Regulatory filings indicate Ellison has not sold any Oracle shares over the past year, even as he has made his fortune available to back high-profile corporate deals. Ellison held roughly 1.16bn Oracle shares as of September 19, filings show, a marginal increase from last year. Those shares were worth about US$334bn as of Thursday's market close.

Freeing up cash

Borrowing money from investment banks secured against equity holdings, known in the industry as margin loans, is a common way for wealthy individuals to free up cash without selling their stake in a company. Like Tesla owner Elon Musk, who Ellison briefly eclipsed as the world’s richest man last month, the Oracle owner has been a long-time user of margin loans, leveraging his vast stake as a piggybank to fund other activities.

Musk, who has pledged about a third of his Tesla shares as collateral in loans, became perhaps the most prominent example of this practice after securing a US$12.5bn margin loan to help finance his 2022 acquisition of social media platform Twitter, now known as X. That record margin loan was later shelved after Musk found other sources of funding, but that did not stop Tesla’s board from limiting its chief executive from borrowing more than US$3.5bn against his shares.

Oracle created a carveout especially for Ellison when it implemented a policy in 2018 banning all other Oracle directors, executive officers and their immediate family members from pledging shares as collateral for loans. The company did not state in its latest filing how much money Ellison had borrowed against his shares, but it has said its governance committee carefully monitors his pledging activities and any associated risks.

“The governance committee continues to believe that Mr Ellison’s pledging arrangements do not pose a material risk to stockholders or to Oracle,” the company stated in a September filing.

Oracle did not respond to a request for comment for this story.

Soaring shares

Oracle’s share price has risen steeply over the past year as the company has positioned itself as one of the main beneficiaries of the artificial intelligence boom. In theory, that appreciation in the stock should mechanically increase the amount of money Ellison can borrow in margin loan agreements.

It should also provide a greater cushion for banks that lent him money in the past that was secured on Oracle stock. Overall, that suggests Ellison’s motivation behind pledging more shares as collateral over the past year was most likely to increase his borrowing capacity with his bank lenders.

IFR reported in September 2024 that banks had extended a roughly US$1bn margin loan in connection with the Ellison-backed takeover of Paramount Global. It is not clear whether margin loans could form part of the financing package related to Paramount Skydance’s potential bid for Warner Bros Discovery.

Oracle first announced Ellison’s use of margin loans in a 2007 regulatory filing that stated he had pledged 525m shares – 41% of his Oracle stake at the time – as collateral for loans. Oracle’s share price was US$20 at the time, making the value of the pledged shares US$10.6bn.

The 346m of Oracle shares Ellison had pledged as of September 19 were worth about US$107bn on that date. That suggests Ellison could secure as much as US$21.4bn in debt against the shares, assuming a conservative loan-to-value ratio of 20% – the level banks were set to impose on Musk’s cancelled Twitter margin loan. In reality, though, such a sum would be far larger than any known margin lending agreement.