Investors sour on French stocks and bonds amid political turmoil

France’s uncertain political and fiscal outlook are set to weigh on local stocks and government bonds for the foreseeable future, investors and analysts say, following the resignation of France’s third prime minister in 15 months and mounting expectations of fresh elections.

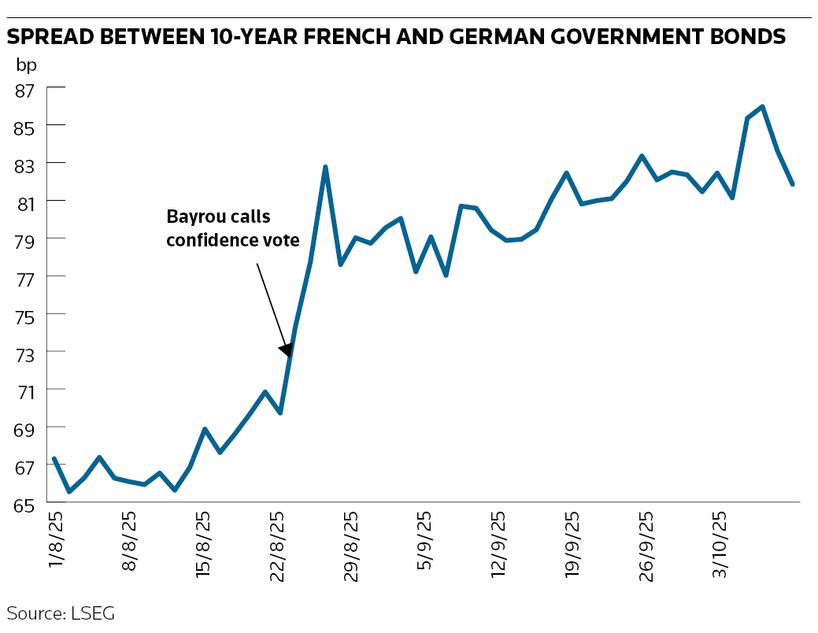

The spread between the yield on French 10-year debt and equivalent German bonds recently hit its widest level since the eurozone sovereign debt crisis more than a decade ago, as president Emmanuel Macron’s minority government has repeatedly failed to pass a budget through France’s parliament.

The latest episode in France’s political soap opera unfolded on Monday when prime minister Sebastien Lecornu resigned after just 26 days in office, making him the shortest-serving prime minister in modern French history. That came after his predecessor, Francois Bayrou, lost a confidence vote in September on a deficit-reducing budget.

Macron’s pledge to appoint a new prime minister by Friday evening has since brought some much-needed relief to battered French bonds. But international investors appear increasingly inclined to sit out the drama for the time being and steer clear of French markets altogether.

“Global investors should remain cautious on French assets,” Claudia Panseri, chief investment officer for France at UBS, said in a note on Wednesday. “Investors with global portfolios should consider reducing exposure to long-dated French government bonds and monitor developments closely, as political shocks in France can have spillover effects on broader European markets.”

Investors last month had already started to sour on French assets ahead of Bayrou’s doomed bid to push €44bn in budget cuts through parliament. Open interest in Eurex’s OAT futures hit an all-time high of more than 850,000 contracts on September 2, as a scramble to cover exposure to French bonds coincided with the futures rolling into a new contract.

Open interest remains elevated at 635,006 contracts as of October 9, according to LSEG data, up from the roughly 590,000 contracts before Bayrou called his confidence vote in August – suggesting many are keeping hedges in place. Others have decided to avoid French bonds completely.

“We own no French sovereign debt,” said David Roberts, head of fixed income at Nedgroup Investments. “This doesn’t look like a quick fix to us. And with plenty opportunities in the global market, we don’t need to risk our investors' money hoping Macron can turn things around [any] time soon.”

Downgrade

Many lawmakers remain staunchly opposed to cutting government spending despite France’s debt standing at 114% of GDP, costing an estimated €67bn a year to service. Fitch recently downgraded France’s credit rating to A+ last month from AA–, the country's lowest ever rating, due to concerns over strained finances and political instability.

Lecornu’s surprise resignation, which came after receiving widespread criticism over his cabinet appointments, has only compounded matters. Economists at Goldman Sachs responded by lowering their growth forecast for France for 2026 by 10bp to 0.8%.

Not all doom and gloom

Not everyone is downbeat on everything in France. Bank of America strategists said in a recent note that a growing number of French investment-grade credits – 6% as of September 19 – now yield less than French government bonds, suggesting corporate bond investors "are increasingly willing to look through the political risks".

French energy company Engie attracted final orders of more than €4.25bn for its €1bn dual-tranche hybrid green bond on Monday – the day Lecornu resigned – suggesting credit investors remain unperturbed.

France’s CAC 40 index is up 9% this year, but lags the wider Euro Stoxx 50 index’s 15% gain. "Simmering French politics" have also weighed on the euro against the US dollar, HSBC strategists said in a note on Wednesday.

Analysts warn that Macron calling fresh parliamentary elections to try and break the deadlock could further dent local assets. As well as causing French bond yields to widen versus Germany, snap elections could cause a roughly 3% derating for the CAC 40, Citigroup strategists estimate, and a 5% derating for French stocks with a particularly high domestic exposure.

“We are sceptical that new legislative elections would result in a meaningfully different composition of the Assemblee nationale due to current opinion polling,” Nomura analysts said in a note on Wednesday. “We believe that new elections would be more bearish for OATs than opting for a [prime minister] that would seek meaningfully less fiscal consolidation.”