Bank traders ride record Hong Kong equities rebound

Hong Kong equities traders are enjoying their most profitable year on record as a remarkable rally in local stocks, renewed interest from international investors and booming equity capital markets have driven a surge in client activity.

The Hang Seng Index is up nearly 30% this year, more than twice the S&P 500’s gain, to put it on course for its best annual performance since 2017. That comes as China’s flourishing artificial intelligence sector is tempting international investors to return to these markets after a lengthy absence.

Buoyant stock prices have also unleashed a flurry of equity capital markets activity, with Hong Kong IPOs, follow-ons and convertible bond issuance tracking at their highest levels since the post-Covid 19 rebound in 2021.

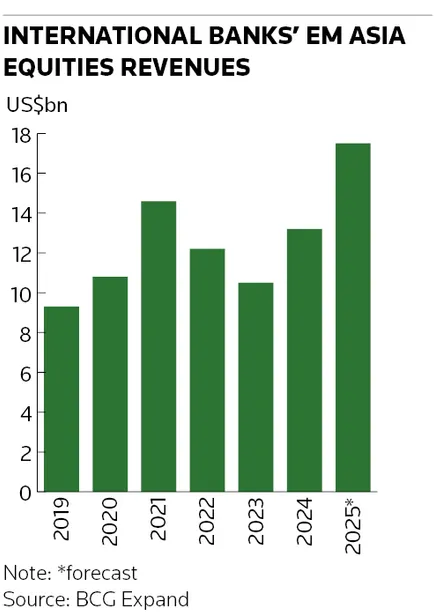

International banks’ trading divisions are reaping the benefits of this renaissance with their emerging market Asia equities revenues projected to rise by around a third this year to US$17.5bn, according to research and benchmarking firm BCG Expand. That will represent their largest ever haul, with Hong Kong expected to account for around 40% of the total.

“There’s been a huge pickup in trading activity in Asia with the market performance in Hong Kong and the amount of IPOs, blocks and secondary listings that are happening,” said Neil Hosie, global head of execution services at UBS.

“The trading volumes in the China A-share market are meaningfully higher and that's been great for clients. There's been a lot of activity on the quant side of the business, but equally we’re beginning to see global investors take more interest too.”

The revival follows years of lacklustre returns in Hong Kong and Chinese equity markets. The Hang Seng more than halved from its all-time high in January 2018 to a recent trough in early 2024 – a period that coincided with a slowing Chinese economy and Beijing tightening its grip on Hong Kong’s political machinery.

AI promise

Chinese equities have rebounded since then as investors have gradually warmed to the region once more. The launch of Chinese tech company DeepSeek's AI model in late February proved a pivotal moment for many – a sign that local technology companies could go toe to toe with US behemoths.

Investors have poured a net US$1.97bn into the China tech-focused KraneShares CSI China Internet exchange-traded fund this year, according to BNP Paribas, overcoming a brief reversal in the aftermath of the US’s “liberation day” tariff announcement in April. UBS hosted a China A-shares conference in Shenzhen in September with record attendance from non-Asian investors, Hosie said, in another sign of growing overseas interest in the region.

“The DeepSeek moment in the first quarter was a primary factor encouraging international investors to look at Hong Kong again,” said Jason Lui, head of APAC equity and derivatives strategy at BNP Paribas. “That interest faded following 'liberation day' but it has picked up again meaningfully over the past few months as AI spending has accelerated.”

Lui pointed to other factors that have contributed to the rally. Onshore Chinese institutional investors have provided steady demand for high-yielding dividend stocks, helping to stabilise the market during the rocky post-tariff announcement period. Southbound net buying from mainland Chinese investors hit US$150bn in the first nine months of the year, according to BNP Paribas, more than during 2023 and 2024 combined.

“International investors and mainland Chinese investors don’t necessarily trade together all of the time but when they do, you tend to see a very strong amplification of the price action,” Lui said.

Trading boom

That has translated into meaningful flows for international banks that act as a gateway to these markets. Citigroup’s Hong Kong equities client flows are up over 30% this year, a bank spokesperson said.

BCG Expand said it has been an "exceptionally strong year" for banks' Asia prime brokerage operations as global hedge funds have increased their allocations to China and Hong Kong and banks have capitalised on growing client flows in the region.

Cash equities and equity derivatives trading have also rebounded after a few weaker years, BCG Expand said. The firm highlighted a roughly 30% increase in structured products volumes in Hong Kong this year, as wealth management clients and retail investors have renewed their interest in local stocks.

Rising Chinese equity prices have also jump-started primary markets – creating more trading and hedging opportunities. Hong Kong-listed ECM activity had raised US$61bn as of October 13, according to LSEG data, almost as much as the three previous years combined.

The convertible bond market – and related derivatives activity – has been busy alongside IPOs and follow-on offerings. In one prominent example, NYSE and Hong Kong-listed Chinese e-commerce giant Alibaba Group issued a US$3.2bn convertible bond in September and entered capped call options to hedge against future equity dilution.

“There is no question that capital markets activity in the Asia-Pac region has increased this year and is firing on all cylinders, and that’s encouraging corporates and owners of equity to transact more actively,” said Mariano Gaut, managing director at Mizuho.

Upbeat outlook

There are still some reasons for caution on the outlook, however. Chinese growth remains lacklustre by historical standards. A recent flare-up in US-China relations over Beijing’s plans to restrict access to rare earth minerals – followed by Washington threatening retaliatory 100% tariffs – shows trade tensions are still simmering.

Bankers remain typically upbeat, though. Citigroup said its pipeline for IPOs and ECM in Hong Kong has “never been longer or stronger” and it expects the Hong Kong IPO market to be one of the most active globally over the next 12 months. The comparative cheapness of Chinese equities should provide another potential tailwind for the market when US tech stocks trade at rich valuations.

“I do believe AI stories can continue to attract both domestic and international investors. Earnings appear to be quite solid and valuations are much more appealing than international tech indices,” said Scarlett Liu, APAC equity and derivatives strategist at BNP Paribas.