Gold boom boosts demand for hybrid derivatives

A rush to bet on soaring gold prices has sent volumes in so-called hybrid derivatives surging, bankers say, as a growing number of clients have embraced these complex trades, betting on moves across different markets.

Hybrid derivatives volumes have roughly doubled at Citigroup this year as more investors have looked to pair bullish bets on gold with positions in other markets where they are typically more active such as foreign exchange.

The US bank said the number of clients using hybrid derivatives has increased by around two-and-a-half times this year – with about a quarter of these trades involving gold.

“We’ve certainly seen more activity in these derivatives this year than in others, partly because going long gold has been such a predominant theme in the investor community and clients have been looking for different ways to trade this view,” said Sam Hewson, Citi’s head of FX sales. “Hedge funds in particular are increasingly expressing their views within the hybrid space.”

Various flavours

Hybrid derivatives allow investors to take a view on movements across different financial markets in one structure. While hybrids can take various flavours, a typical trade might involve an investor entering a multi-legged options contract that will pay out if the price of an asset such as gold rises and another asset or currency – like the US dollar – also strengthens.

Trades can be tailored depending on the client’s preferences and whether they have a bullish or bearish view on anything from the S&P 500 to Treasury yields, the price of oil and Chinese renminbi. Some trades require each leg of the bet to move in the client’s favour to receive a payout, while some only require one leg to work, provided the others stay within an agreed range.

This dynamic of taking a view on how different markets will move in relation to each other – or what’s known in financial parlance as cross-asset correlation – can cheapen the cost of the option for the client compared to, for instance, taking an outright bet on higher gold prices. That is particularly true when investors are willing to wager on a breakdown in traditional relationships between different asset classes and currencies.

Hewson said hybrids were also popular ahead of last year’s US presidential elections. Many investors positioned for a Donald Trump win with hybrid trades such as betting on long-dated US interest rates alongside the dollar’s exchange rate against offshore renminbi. This year, it’s gold’s extraordinary rally that has fuelled significant interest in hybrid structures.

“We’ve done some very large trades with precious metals and currencies in the last year,” a senior trader at a large bank said.

Gold rush

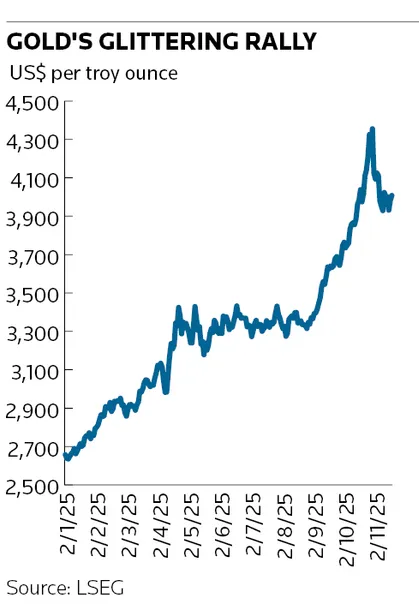

Concerns over government debt piles, inflation and the value of the US dollar have triggered a mad dash to buy gold this year as investors have sought protection in the safe-haven asset. The price of the precious metal is up more than 50% in 2025 despite a recent pullback after closing at an all-time high of US$4,355 per troy ounce on October 20.

“With the pickup in gold volatility there’s much more discussion around gold among clients – and precious metals trading among banks,” said Sagar Sambrani, senior FX options trader at Nomura.

Sambrani said correlation trades such as short sterling, long S&P 500 and long gold have been “extremely popular” among clients wanting to express core views while taking advantage of implied cross-asset correlations to minimise the amount of options premium they must pay to fund their bets.

Gold’s rally has also fuelled interest in currencies whose value is closely linked to gold, according to Erick Martinez, global macro strategist at Barclays. Chief among these is the Peruvian sol, which is up 11% this year against the US dollar.

About 9% of that appreciation is due to the improvement in Peru's terms of trades thanks to the increased value of its gold exports, according to Barclays estimates. Gold accounts for 36% of Peru’s exports and the precious metal’s rally has caused Peru’s terms of trade to improve by 22% year to date, the bank said.

“Because of Peru’s direct link to gold, we’ve seen growing interest from clients wanting to position themselves,” said Martinez. “For instance, [clients have been] buying Peruvian bonds without hedging the FX risk related to those bonds in order to take advantage of the stronger sol environment.”

Despite gold falling from record highs recently, Sambrani expects elevated levels of trading activity in precious metals heading into year-end.

“This year, hedge fund clients have all moved to focus much more on commodities – not just gold but silver, platinum and palladium as well,” he said. “We’re expecting more activity in the precious metals region as opposed to pure FX activity for the rest of the year as a fair amount of premium that would have been spent in FX has instead moved into precious metals trades.”