Banks’ equities traders on track for record year

Banks’ stock-trading divisions are on track for a record revenue haul in 2025, as gains in derivatives trading and hedge fund financing activities look set to propel equities results higher for a second straight year.

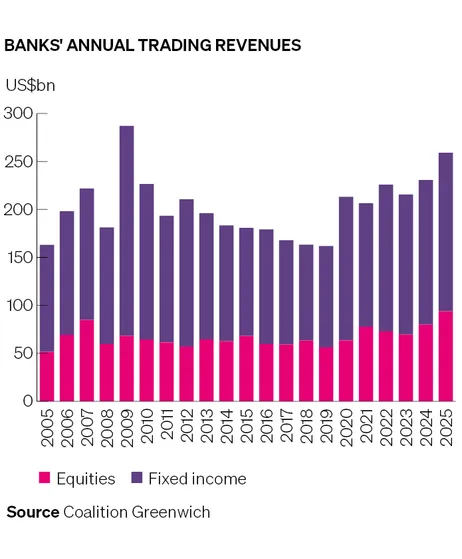

Banks are projected to generate about US$94bn of equities trading revenues this year, according to analytics firm Coalition Greenwich, a 17% increase from 2024’s already lofty total and surpassing the previous record of US$85bn set in 2007. Fixed income revenues are also projected to increase nearly 10% to about US$165bn, which would represent the second-highest amount on record.

The growth across banks’ markets divisions should push overall sales and trading revenues to their highest level since 2009, when a once-in-a-lifetime trading bonanza erupted as markets stabilised in the wake of the previous year’s financial crisis.

The impressive results are the latest confirmation that banks’ markets revenues have moved onto a structurally higher plain since the outbreak of the pandemic in 2020. Choppier markets and the return of inflation have unleashed a flurry of trading activity from banks’ corporate and institutional clients since that time, while rising asset prices and growing demand for leverage from hedge funds and other private investors has swelled the coffers of banks' financing units.

“We used to have conversations after the pandemic about whether trading revenues are going to normalise back down at some point,” said Mollie Devine, head of markets competitor analytics at Coalition Greenwich. “We’re not having those conversations anymore – everyone seems to think we’ve reached a new level of markets activity.”

The big get bigger

Much of the benefit of this pickup in trading has accrued to the largest global investment banks. In equities, for instance, Goldman Sachs, JP Morgan and Morgan Stanley together generated US$34.6bn in trading revenues in the first three quarters of this year – accounting for 47% of the total revenue pool that Coalition Greenwich tracks. That is up from US$21.9bn across the whole of 2019, representing 39% of the wider pool.

Morgan Stanley has had a standout run in equities lately, increasing its share of the revenue pool by about 170bp over the past 12 months. The bank clinched the top spot in equities trading in the third quarter from crosstown rival Goldman Sachs for the first time since late 2022, touting gains in prime brokerage – in which it provides leverage to hedge funds and other investors – as average client balances and financing revenues hit records.

Goldman Sachs, still the largest bank in equities across the first three quarters of the year, said in its latest earnings report that equities revenues were at record levels this year and that it generated its highest equities financing revenues in the third quarter.

“Everything worked in equities this year: there were substantial upticks in cash, in derivatives, in prime,” said Devine.

Overall, Coalition Greenwich projects banks’ prime brokerage revenues will reach a record US$32.7bn in 2025, an 18% increase over the previous year. Banks' equity derivatives businesses are also on track for a record year with revenues set to rise 19% to US$34.7bn.

“Derivatives was a very important driver for the growth of the overall equities pool. The single stock volatility we saw around technology names in particular facilitated a lot of client flow and has been a big catalyst for overall performance,” said Devine.

Rates hedging gains

In fixed income, gains in macro products linked to interest rates and currencies have been important drivers of banks' trading operations. Foreign exchange desks benefitted from increased uncertainty around the US dollar in the first half of the year, helping to push G-10 FX revenues 14% higher to an estimated US$22.1bn for 2025. G-10 rates trading has been the biggest growth area, with revenues projected to increase 17% to US$40.1bn.

“In the first half of the year, interest rate swaps did well as a lot of clients were playing the steepener trade,” said Devine. “In the third quarter, there was also a lot of outsized swap activity driving the growth of the rates business, including data centre financing hedges.”