QIS: banks’ derivatives aces build trillion-dollar synthetic asset managers

Banks’ derivatives whizzes have a new favourite acronym: QIS.

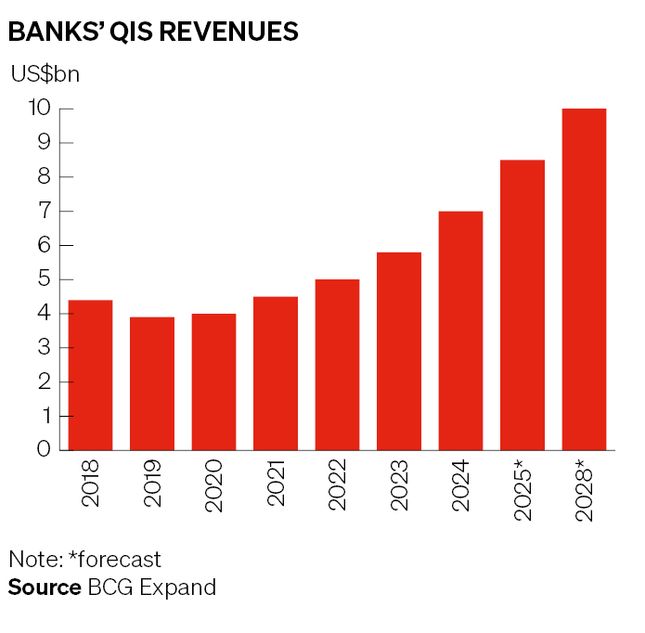

Global banks will generate about US$8.5bn of revenue this year from quantitative investment strategies, according to strategic benchmarking firm BCG Expand. That’s up from about US$4bn in 2019 as six years of revenue growth have turned QIS businesses into an important pillar in banks’ trading divisions.

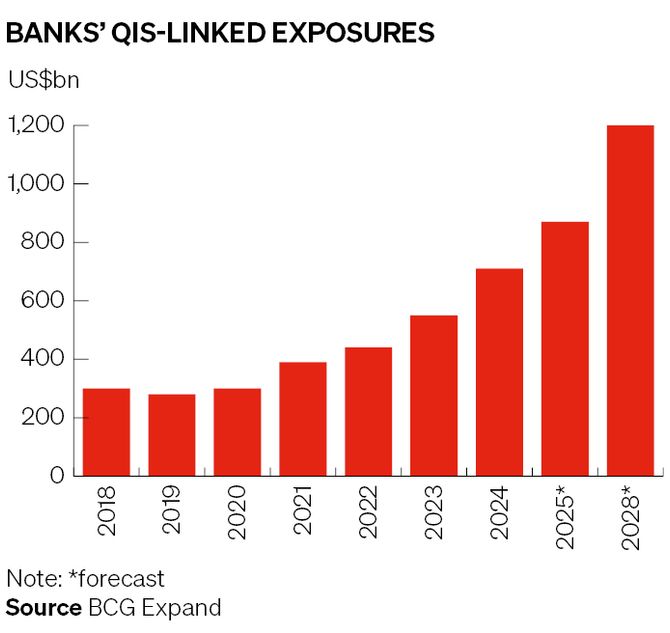

Banks’ QIS-linked exposures have roughly tripled over that time and are on track to push well past US$1trn by 2028, BCG Expand projects. That follows years of investment from firms like Goldman Sachs and JP Morgan in bringing these complex, hedge fund-like products to a wider audience.

The sheer scale of the QIS industry today has led some to dub it “synthetic asset management” – an allusion to banks’ use of derivatives wizardry to provide investors with exposure to quant-driven, systematic trading strategies in an affordable, off-the-shelf format. Like asset management, QIS tends to produce steady and predictable returns – a highly valued characteristic for banks determined to dampen the volatility of their markets units.

QIS also represents an arena in which banks believe they can retain an edge over would-be rivals while facing increasing competition in other parts of their trading operations. Those dynamics, along with fast-growing client demand, should ensure QIS remains a priority in the years ahead as more banks pile into this space.

“QIS is a jewel in banks’ structuring businesses,” said Arnaud Jobert, co-head of global strategic indices at JP Morgan, which has about US$110bn of QIS-linked exposures. “The beauty of QIS is it’s an accrual business with very sticky revenues, a high return on equity, low balance sheet consumption and very high barriers to entry – and that makes it extremely appealing.”

From quant to client

The modern QIS business – boasting its very own industry conferences and niche job postings – traces its origins to the early 2000s when banks’ quant researchers started publishing papers unpacking sophisticated trading strategies pioneered by prop shops and other arbitrage specialists.

Banks began industrialising their QIS initiatives in the 2010s as client interest picked up. The idea was simple: develop products that could offer hedge-fund like returns at a fraction of the cost, while also allowing clients to exit their positions each day for a reasonable price. The contrast couldn’t have been any clearer to the steep “two-and-twenty” fees and long lockup periods of the hedge fund industry.

Some invested heavily and established dedicated QIS units, complete with sales teams, trading systems and technology infrastructure. What had been a predominantly equity-focused world, leveraging quant research on topics such as the “factors” driving investor returns, branched out to recreate the secret sauce that hedge funds promised in other markets like fixed income.

Banks jettisoned the concept of all-weather products designed to thrive in any environment only to underwhelm in both good and bad times. Instead, strategies were classified either as “carry” (ie, looking to generate returns) or “defensive” (hedging portfolios from market downturns). Salespeople, meanwhile, began extolling the virtues of QIS to a wider range of investors.

Fast forward to the present day and that groundwork has paid off handsomely. The QIS business now serves all the client segments that Goldman Sachs interacts with across its global banking and markets division, said Piotr Zurawski, global head of systematic trading strategies at the firm.

That includes retail investors, pension funds, sovereign wealth funds, private banks, hedge funds and even corporates, across all geographies. The business is also more evenly split between equity and fixed income risks, as well as between carry and defensive strategies – a far cry from the equity-centric, retail-heavy world of a decade earlier.

“There’s been a transformation of the QIS industry over the past 10 years. It has matured by becoming much more balanced and diversified,” said Zurawski. “It’s becoming mainstream and has achieved scale across the whole ecosystem.”

Client or competitor?

The numbers certainly back that up. Banks’ QIS-linked exposures have rocketed from around US$300bn in 2019 to roughly US$870bn today, according to BCG Expand. That heady growth hasn’t gone unnoticed, prompting more banks to muscle into this space. Zurawski said Goldman sometimes competes with as many as 15 banks on certain trades.

“Competition is increasing with both new entrants and banks reentering QIS, and that’s impacting margins,” said Youssef Intabli, head of equities at BCG Expand. “But it’s still one of the healthiest businesses in terms of growth and profitability across global markets.”

That’s in part down to the breadth of activities QIS now encompasses. Strategies range from the elegantly simple to the fiendishly complex as demand continues to rise from investors across the financial spectrum.

In the US and Japan, retail investors have been hoovering up life insurance products linked to QIS indices that offer a twist on the returns of major stock benchmarks such as the S&P 500. At the other end of the scale, hedge funds – QIS’s erstwhile model and competitor – have converted to the cause in droves.

“Ten years ago, the QIS business developed as an alternative to hedge funds. Now, there’s been a structural change in the past two to three years where hedge funds are also allocating capital to QIS,” said Xavier Folleas, global head of structuring for QIS at BNP Paribas.

Derivatives have been pivotal to this expansion. Providing exposure to markets this way means clients don’t have to hand over the cash upfront covering the full value of their investments – an important distinction to traditional asset management. (Another notable difference is that banks have no fiduciary duty of care to their QIS clients.)

This “unfunded” format makes it easier to leverage exposures, which in turn can turbocharge growth. Derivatives also allow clients to access markets they might otherwise struggle to reach – or find it overly costly or fiddly to do so.

Threat no more

Those features make QIS particularly appealing for hedge funds. Many hedge fund managers now rely on defensive products to insulate portfolios against market downturns, bankers say, while others use QIS to outsource strategies where they lack the expertise – or the desire – to do it themselves.

A proliferation of "dispersion" products has been a case in point. The concept of betting on stocks heading in different directions has been around for years, but it can be painstaking to implement, sometimes requiring hundreds of individual options trades. Ready-made dispersion products that investors can tweak to their heart's content have proven hugely popular.

Other funds have taken to paying to use banks' advanced QIS trading infrastructure to execute their own strategies.

“Some hedge funds used to perceive QIS as a threat. That attitude has changed,” said Jobert. "Banks have won the battle around acknowledging that QIS can be a useful building block and part of the investment toolkit."

On the defensive

It hasn’t always been plain sailing for QIS desks. The industry stagnated during the “quant winter” of the late 2010s when some products fell out of favour after quant factors stopped behaving as expected.

The popularity of defensive strategies – while largely a boon for banks that offer them – has also brought its own challenges. That’s because investors tend to exit hedges and lock in their gains when markets tumble, leading to a decline in banks' QIS-linked exposures.

2020 was a prime example of this when markets swooned following the outbreak of the Covid-19 pandemic. Clients were “very satisfied” because their defensive strategies performed well and provided “strong protection”, said Guillaume Arnaud, global head of QIS at Societe Generale.

“[However] this can make managing the business challenging when clients decide to monetise, and assets drop significantly within a few months,” he said. “Rebuilding takes time. Over the long term, you must accept some volatility in AUM during periods of market stress, as we offer strategies with daily liquidity.”

A good advert

Even so, many believe volatile periods can be a good advertisement for the QIS business as long as the products do their job. April’s tariff turmoil provided another test for the market in that regard.

“Clients don’t expect every strategy to perform in every market," said Fatos Akbay, head of structuring for EMEA at BNP Paribas. "The key thing is, do you have a strategy that does what it says it’s going to do? The second thing is, do you show them liquidity on good days and bad?”

Overall, bankers are excited about the growth prospects for the industry. Zurawski noted that the amount of risk committed to QIS from clients such as hedge funds and pension funds is still "very low" in the context of the whole pool of assets they have at their disposal.

The most established QIS banks also seem relaxed about intensifying competition, pointing to the investments needed to build a top-tier platform. Aruna Tatavarty, head of QIS for EMEA at Citigroup, said some QIS products can take up to two and a half years to develop.

“The QIS business sounds simple, but it is very intensive in terms of people, technology, systems,” she said. “You also need to earn the trust of clients.”