A contentious saga over the treatment of credit default swaps on Ireland’s Ardagh Packaging Finance has exposed longstanding flaws in these controversial derivatives contracts, legal experts say, prompting some to call for reforms to the US$11trn CDS market.

A trio of investment managers locked horns in recent days over which bonds should be used in an auction to calculate CDS payouts on Ardagh following the company's debt restructuring last year. That dispute ended on Friday when the Credit Derivatives Determinations Committee, a panel of banks and investors that adjudicate on CDS market matters, ruled that Ardagh's senior unsecured bonds could be delivered into the auction.

That decision should boost the payout that CDS protection holders receive. Arini Capital Management, which was a major creditor to Ardagh and was involved in its debt restructuring, had previously argued that Ardagh’s unsecured bonds should be excluded from the auction, a scenario that would have probably resulted in lower CDS payouts.

Despite the positive news for protection holders, the protracted debate over Ardagh CDS has laid bare shortcomings that have plagued these derivatives for years – and which may still need addressing in the future. The CDS committee has had to meet 29 times to discuss Ardagh CDS since it was first asked to rule on the matter in early October amid widespread confusion over the fate of the contracts.

“Ardagh is a manifestation of an old problem with the CDS product – specifically for a restructuring event – where there can be confusion over what the possible outcome is going to be,” said John Williams, a partner at Milbank, which filed a recent submission on behalf of Laurion Capital Management countering Arini's arguments.

"We [as a market] tried to build in legal provisions [to CDS] so that we’d get the right result, but the uncertainty can tempt people to try and invest to achieve extreme outcomes," said Williams, who also helped create much of the modern CDS market architecture.

Many CDS committee rulings and auctions are straightforward. The few cases that aren’t, however, tend to draw intense scrutiny of a product that regulators have eyed warily since the 2008 financial crisis. Usually, the root cause behind these problems lies in the sheer complexity inherent to credit markets – and the difficulty in designing an insurance contract that covers all the possible permutations around debt restructurings and defaults.

Prime example

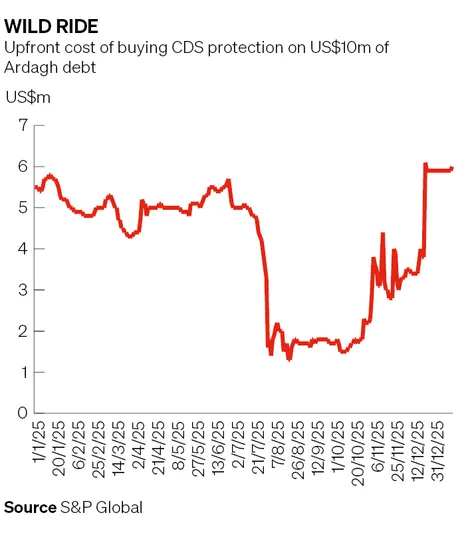

The wrangling over Ardagh has been a prime example. Ardagh CDS prices have swung wildly in recent months as investors have struggled to assess whether protection holders will be fairly compensated for losses on the company's bonds following its US$4.3bn debt-for-equity swap last year.

There was US$6bn of Ardagh CDS gross notional outstanding as of January 2, according to the DTCC, spread across more than 7,000 contracts. Lawyers say Ardagh's decision to reach an agreement with creditors directly, rather than engaging in a court-led restructuring, muddied the waters over exactly when the contracts had been triggered.

The CDS committee had to ask an external panel of legal experts to rule on the matter – a rare occurrence in these markets – after it failed to reach an agreement, needing a supermajority of 80% to make a decision. The external panel decided in December that there had been a CDS trigger on October 7. Ardagh protection costs subsequently jumped, suggesting the panel's ruling was unexpected.

“The external review panel disagreed with the majority of [the CDS committee]. That took the market a little bit by surprise [even though] you can justify both a yes and a no – it was a 50:50 [decision],” said a senior lawyer, who has advised both buyers and sellers of Ardagh CDS.

Bond debate

The panel's decision sparked another debate over which bonds could be used in an auction to calculate CDS payouts. Arini argued that Ardagh's unsecured bonds had no outstanding principal at the time of the October CDS trigger because the debt-for-equity swap had already occurred and that they should consequently be excluded. Laurion, through Milbank, and Tresidor Investment Management rejected Arini’s assertions and said the unsecured debt should be included.

The CDS committee's decision on Friday to include the unsecured debt – carried by a vote of nine to two – will have a material impact on CDS payouts. CDS prices currently imply a payout of about US$6m for every US$10m of Ardagh default protection held, according to S&P. That’s much higher than the roughly US$700,000 payout implied by the prices of Ardagh’s secured debt, which would have been the only remaining securities in the auction if the unsecured bonds had been excluded.

“It’s not unusual for people to challenge which bonds can be delivered into a CDS auction,” said Athanassios Diplas, a former senior bank trader who also helped design the modern CDS market architecture. “Whether a bond is included or not can obviously have severe consequences for CDS payouts."

Easy fix?

This is not the first time concerns have arisen over CDS not working properly because of bonds being exchanged before an auction takes place. Greece’s €206bn debt restructuring in 2012 was perhaps the most famous example.

Lawyers subsequently overhauled CDS contracts in 2014 to allow other securities resulting from a debt restructuring, known as the asset package, to be delivered into auctions for sovereign and financial names, although not for corporates like Ardagh.

"When you have an out-of-court restructuring process, the question of when the restructuring trigger occurs can become fuzzy,” said Williams. “In the 2014 definitions, that problem was mitigated by instituting the asset package delivery for sovereigns and financial CDS. But it wasn’t applied to corporates, so there was still this fear that the product might not work properly.”

Some believe the Ardagh debacle should prompt another reworking of CDS contracts to avoid a rerun of these events.

“The only reason we’re talking about this is because there is no asset package delivery for corporate CDS. The fix here is very easy: amend the product to allow for [that],” said the senior lawyer.

Arini, Laurion and Tresidor either declined to comment or didn't respond to requests for comment.