Aussie dollar and Swedish krona tipped to benefit from geopolitical upheaval

Foreign exchange markets have a new favourite trade.

Faced with a febrile geopolitical environment, major investment banks are encouraging investors to pile into the currencies of countries with strong finances, with many backing the Australian dollar and the Swedish krona as this year’s big winners.

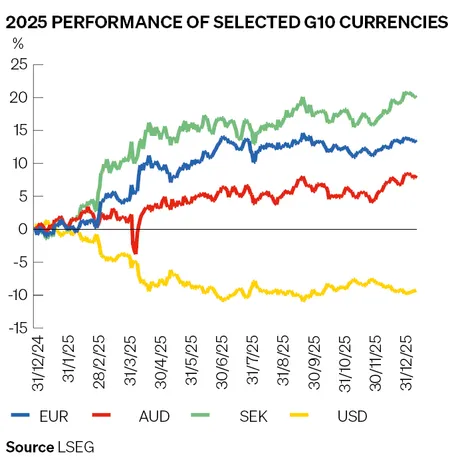

Deutsche Bank, Goldman Sachs, Morgan Stanley and Societe Generale are among the firms to place a buy signal on the two currencies as investors cast around for positive FX stories in the wake of the US dollar registering its worst annual performance since 2017.

Many FX traders and investors worry US president Donald Trump’s unpredictable foreign policy and economic agenda could weigh further on the greenback in the months ahead. That has only bolstered the investment case for currencies of countries with solid fiscal positions and bright economic outlooks such as Australia and Sweden.

“In an era where investors increasingly want to diversify away from the US, fiscal positions are going to become more important,” said Jane Foley, senior FX strategist at Rabobank.

“Last year, the Swedish krona was one of the best performing G10 currencies and the very strong Swedish fiscal position could look quite attractive to investors today ... Similarly, bullish rhetoric around the Australian dollar appears fairly clear cut given their decent fiscal position.”

Several US-initiated geopolitical surprises have spooked investors in recent weeks as Trump's foreign policy becomes increasingly interventionist. Chief among these was the capture of Venezuelan president Nicolas Maduro on January 3. Separately, Trump has ramped up his rhetoric on seizing Greenland from Nato ally Denmark.

Those moves have only reinforced the idea that US exceptionalism is over – at least as far as the US dollar is concerned. That concept first took root last year following the erratic rollout of Trump’s tariffs in April. The US dollar registered its worst first half of a year since 1973 in the wake of that announcement, before steadying later in 2025 as Trump rowed back the most draconian measures.

Time to thrive

Both the Australian dollar and the Swedish krona thrived in this environment. The krona was the best performing G10 currency last year, rising a whopping 20% against the US dollar. The Aussie dollar also fared well, appreciating almost 8%.

Analysts point to several tailwinds that could provide a further shot in the arm for both currencies. The Aussie dollar is currently the highest-yielding G10 currency, according to George Saravelos, co-head of FX research at Deutsche Bank – “a status that should attract flows and unwind long-held shorts”, he said in a recent note.

Improved terms of trade stemming from Australia’s copper exports should also provide a boost. Copper prices rose 44% in 2025 before hitting an all-time high on January 6 on expectations of surging demand from AI data centres and defence companies. S&P projects copper demand will increase 50% to 42 million tonnes by 2040.

Australia is the world’s eighth-largest producer of copper. The country’s department of industry, science and resources projects increased global demand should boost the country’s copper export value by 50% to A$18bn (US$12bn) by 2030.

“There are a number of themes creating quite a positive story for [the Australian dollar] right now,” said Dominic Bunning, head of G10 FX strategy at Nomura. “We’ve been long [the Australian dollar] since the end of October and recent news around the US certainly doesn’t hurt that trade.”

The Swedish krona looks to be in a similarly strong position. Alongside its surge against the US dollar, the krona appreciated over 6% against the euro last year, aided by the Swedish central bank pausing its interest rate cutting cycle.

The krona should also benefit from Sweden seeing “the fastest growth in the G10, with fiscal stimulus set to rapidly close the post-Covid GDP gap versus peers", according to Shreyas Gopal, FX strategist at Deutsche Bank.

Geopolitical uncertainty

Despite the general bullishness on Australia and Sweden, FX specialists caution there could be bumps in the road ahead. Morgan Stanley analysts are positive on both currencies but still warn of a potential pullback due to a “combination of stretched positioning and momentum”.

Overall, though, most paint an encouraging picture. That includes neither country figuring prominently on Trump’s ever-expanding foreign policy radar. By contrast, analysts warn that Europe's clash with the US over Greenland could hurt the euro – at least in the near term.

“Concerns around Greenland could undermine risk sentiment and weigh on [the euro] initially,” said Michalis Rousakis, FX strategist at Bank of America in a recent note. “However, second-round effects may turn out positive in [the] case European commitment to defence spending grew."