Yen rates hedging on the rise ahead of Japanese election

Rising Japanese bond yields have encouraged global investors and companies to increase their hedging of Japanese interest rate risk for the first time in years, banks and consultants say, ahead of Japan’s snap general election this weekend in which prime minister Sanae Takaichi’s Liberal Democratic Party is projected to win a landslide victory.

Takaichi’s promises of an expansionary fiscal agenda have already spooked bond markets and sent long-dated Japanese yields sharply higher since she took office in October. Those concerns intensified in January when 30-year yields jumped 30bp in a day to their highest level on record.

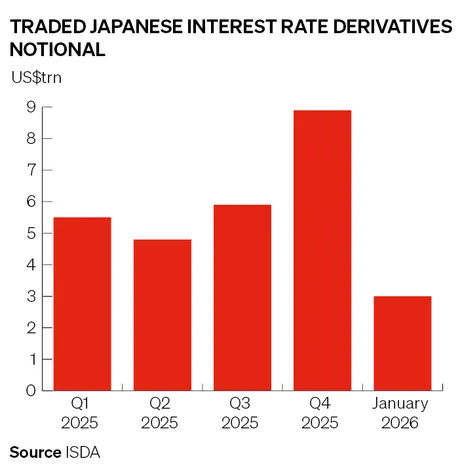

The uncertain outlook has also prompted a revival in interest rate derivatives trading in a market in which years of ultralow interest rates have long deterred such activity. A record US$8.9trn of Japanese interest rate derivatives notional traded in the final quarter of 2025, according to ISDA, roughly twice as much as a year earlier.

“The end of Japanese fiscal austerity and growing likelihood of tax cuts and greater fiscal spending is concerning people,” said Jackie Bowie, head of EMEA at hedging advisory firm Chatham Financial.

“Some people are questioning whether this might be Japan’s Liz Truss moment given the PM’s unfunded spending plans, which has encouraged a lot of our clients to think about hedging their Japanese rate risk for the first time in years."

Former UK prime minister Liz Truss’s so-called mini-budget in September 2022 triggered a crisis in UK bond markets, forcing the Bank of England to intervene to bring an end to a self-reinforcing doom loop of rising yields, spiralling margin calls and securities fire sales among UK pension funds.

Takaichi’s plans have ignited concerns among analysts over the fiscal discipline of a country whose public debt is already twice the size of its economy. Polling data suggests the LDP will secure more than the 261 seats required for an absolute parliamentary majority in Sunday’s election.

That should pave the way for Takaichi to roll out numerous tax cuts and government spending increases. Most analysts view these policies as inflationary, which may require the Bank of Japan to raise interest rates. One of Takaichi's landmark proposals – a two-year exemption of food items from Japan’s consumption tax – would more than double Tokyo’s ¥4.4trn (US$23.74bn) budget shortfall to ¥9.4trn, according to recent analysis by Jin Kenzaki, head of research for Japan at Societe Generale.

All this has reawakened international investors and companies to the risks of rising interest rates in a country long famed for deflation and rock-bottom bond yields. Banks say many clients have been loading up on derivatives hedges to better shield themselves from any upheaval.

“The market is currently pricing in a strong majority LDP government, which is a situation that global investors have been adjusting for in recent weeks,” said Derek de Souza, head of London yen rates trading at Nomura.

“It hasn’t been a panicked move, more a gradual understanding that Japanese yields and rates will be persistently higher going forward, necessitating a shift in hedging behaviour.”

“Under previous administrations, there was an expectation of a slower and smoother path to higher rates – one which didn't necessarily need to be more actively prepared for," he said.

Rising hedging activity

The Bank of Japan’s benchmark interest rate sits at 0.75%, its highest level in nearly three decades. The LDP’s expected majority has caused several banks to update their rate policy expectations in recent weeks. Natixis CIB now expects the BoJ to hike rates twice in 2026, while Morgan Stanley expects one rate hike in June and another in 2027.

More yen borrowers have looked to enter interest rate hedges to lock in their cost of funding, said Bowie, while others are considering adjusting the ratio of their debt mix so a greater portion of their exposures are at fixed rates.

Bowie said Chatham was also involved in its first ever deal contingent derivative trade for a client hedging Japanese rates risk. Deal contingent derivatives are common hedging strategies for companies and investors looking to shield themselves against adverse market moves around the time of major corporate events like mergers and acquisitions.

“We do a lot of work with deal contingent hedging for clients around the globe but these tools were not used in the Japanese market until recently," she said. "That really goes to show just how concerned people are about the likelihood of rates continuing to rise."

Michael Rothlin, head of APAC G10 linear rates and FX trading at Natixis CIB, similarly has “no doubt” that corporate borrowers have been increasingly seeking to hedge their loan structures through the swaps market.

“When you start seeing central banks hiking rates after a long cycle of low rates, you often see a lot of loan structure hedging,” he said. “It can often be as simple as a corporate loan, where the borrower wants to put on interest rate hedges as their cash rate is no longer zero.”