Trading firms take record share of global markets revenues

Non-bank trading firms took a record share of global markets revenues in 2024, new analysis showed, underlining the threat that companies such as Jane Street and Citadel Securities are posing to Wall Street’s old guard in sales and trading.

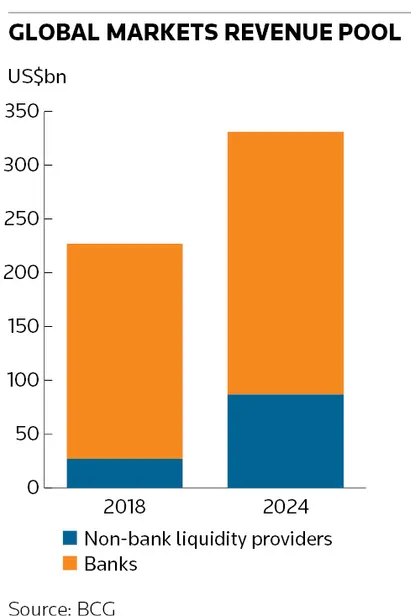

So-called non-bank liquidity providers accounted for 26% of the US$331bn of total industry revenues in global markets last year, according to Boston Consulting Group, illustrating how these tech-savvy firms are growing their trading presence across markets including stocks, bonds and currencies. The trading firms captured 12% of the US$227bn industry revenue pool in 2018.

“Non-bank liquidity providers continue to disrupt the trading ecosystem,” BCG said in a report. “These entities – ranging from proprietary trading firms to specialised marketmakers – are reshaping execution strategies and introducing tighter spreads across asset classes.”

The breakneck expansion of trading firms has unsettled traditional investment banks, which have become increasingly worried that their smaller rivals could prise away the core client business that has become the epicentre of banks’ trading units.

Trading firms have taken much of the multi-billion dollar business of trading US stocks after they stole a march on traditional investment banks following the rapid electronification of these markets over the past two decades. More recently, they have been threatening to break the stranglehold banks maintain over other markets such as trading bonds and currencies.

The BCG report highlighted sizeable increases in electronic trading across various markets in 2024. E-trading volumes in equity derivatives rose 31% from the previous year, in what was a particularly strong period for equities traders more broadly, while commodities e-trading volumes were up 32%.

The BCG report said the continued electronification of markets is “likely to lead to further margin compression, as well as increased value migration”.

“Despite variations in electronification maturity across asset classes, the overall trend remains clear. Non-bank liquidity providers continue to expand their intermediation footprint,” the report said. “Therefore, in response to potential margin compression and increased competition, banks must determine which areas they want to protect, and how best to operate over the short and long term.”

The report said banks already use trading firms to recycle their own risk, which can help them manage positions while still servicing their clients. It also highlighted the opportunities for banks to outsource some trading capabilities.

“Deeper partnerships can allow banks to reduce their own cost base (for example by utilising best-in-class technology), as well as to serve clients in certain asset classes where they may not have traditionally boasted leading capabilities,” the report said.