Humans and machines join forces in Morgan Stanley’s credit trading revolution

Morgan Stanley has overhauled its credit trading unit with a groundbreaking merger between its human traders and the increasingly sophisticated computer programmes that are rapidly upending the way corporate bond markets operate.

The US bank has rolled out its corporate bond trading algorithm across its global corporate debt trading franchise over the past six months. The move to have traders and computers working side by side – sharing risk books, balance sheet resources as well as profit and loss accounts – marks a radical departure from the traditionally human-centric business of credit trading.

It puts Morgan Stanley at the forefront of the electronic revolution underway in these markets – and underlines how quickly corporate credit is following the now highly automated world of equities trading.

“There is an equitisation of the credit market and we’re embracing this overhaul,” said Rehan Latif, Morgan Stanley’s global head of credit trading.

“For a long time, credit market liquidity was a big question. People don’t worry about that anymore. The systematic trading that we’ve introduced has changed the dynamics of this market. It’s made our franchise a lot more open and transparent and facilitated a huge growth in trading volumes."

It’s hard to overstate how swiftly technology has transformed the way the multi-trillion dollar corporate bond market is organised and traded. Bonds were long considered the last bastion of the human trader, remaining resolutely manual in nature even as equities and foreign exchange migrated from over-the-phone trading to on-screen in the past few decades.

A confluence of factors has turned that conventional wisdom on its head. Technological advancements mean computer algorithms are adept at pricing bonds automatically. Exchange-traded funds have emerged as a crucial tool for managing credit risk, while the once unthinkable idea of investors transacting huge “portfolio trades” of hundreds of different securities in a matter of minutes is now commonplace.

Trading boom

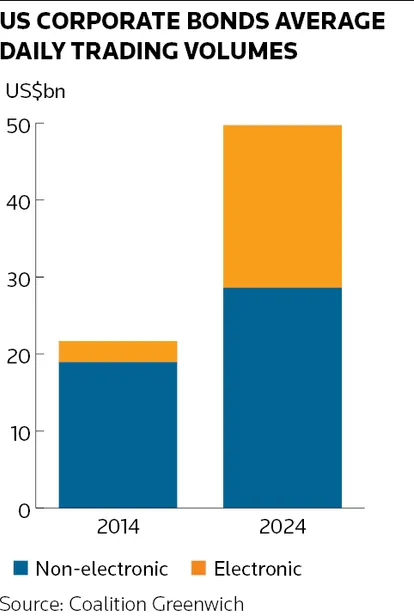

Trading activity has subsequently boomed. Average daily volumes in the US corporate bond market have more than doubled in the past decade to about US$50bn, according to data provider Coalition Greenwich, driven by an eightfold increase in e-trading volumes to US$21bn.

These developments have entrenched technology at the centre of the bond trading business and allowed tech-savvy firms – including non-bank trading specialist Jane Street – to establish themselves as major forces in the market. Traditional banks have had to invest heavily – or risk falling behind permanently.

“This shift has been happening for the best part of a decade, but it’s accelerating now. Bid-offers have compressed considerably and banks have to move quickly – and that’s not easy,” said Latif. “The barriers to entry around technology have gotten bigger and bigger. If you don’t have the coordination between traders and machines, it’s very difficult to win the large trades from the largest clients.”

Morgan Stanley’s early embrace of e-trading has put it in the vanguard of this movement. The initiative traces its origins to 2016 when the bank noticed its corporate bond traders weren’t responding to around 80% of enquiries it received on trading platform MarketAxess. They were mostly small tickets under US$100,000 so the bank started looking at ways to price these odd lots automatically using computers.

Morgan Stanley launched its US algo in April 2017 to cover 100 of the most liquid bonds. It gave the computer its own trading book after human traders baulked at the idea of an alliance – which turned out to have been "an excellent decision", according to David Massingham, who led the development.

“We could make mistakes with the algo and learn from them – and people didn’t mind. We were able to show the performance, P&L and volumes of the algo and see the positive feedback we were getting from clients,” said Massingham, who leads credit automated trading globally at the bank.

The algo continued to expand and gain sophistication over time to become a bigger part of Morgan Stanley’s credit business, helping the bank to double its average daily corporate bond trading volumes since 2017 despite its trader headcount remaining more or less static.

The algo can price more than 30,000 bonds across the US, Europe and Asia. It is also programmed with an array of functions to replicate how human traders are taught to keep their risks in check, whether that's limiting exposure to different sectors, maturities, interest rates or other factors. That means it can adjust prices depending on the bank's appetite for a bond.

Man and machine

More recently, Morgan Stanley realised that the standard bank practice of keeping the algo separate from traders was becoming increasingly inefficient. “We would compete over flows and balance sheet while being inconsistent in our handling of portfolio trades and client [enquiries]," said Massingham.

Bringing humans and machines together into a single trading book was a “very big change”, he said. Traders still have some loose controls, such as being able to notify the algo when they’re working on a particular client order. But after eight years of watching the algo develop an impressive track record and bringing in more client business, there has been less of a culture shock for traders who have seen the benefits it brings.

“There were some teething issues but it has definitely added value to the traders,” Massingham said. “It helps them with their pricing and gives them key insights. It means they no longer have to worry about competing with the algo, or about hedging a block trade or hedging interest rate risk – the algo will do that for them. It means the whole business is working together on the best way to manage risk and that allows us to reduce the spread we charge clients.”

It’s also made traders better at their jobs. “The quality of trading has improved immensely. Traders are performing better and doing larger size tickets,” said Latif.

“We still need human traders, particularly on some of the larger, less liquid trades. What the algo has done is enable traders to go in for much larger blocks and freed up time for them to talk to clients, and that has enabled a much higher quality of service across every business.”

Fixed-income expansion

So what next for these fast-moving markets? Latif said he and his team spend a lot of time talking to their equities colleagues at Morgan Stanley, noting that credit is "consistently on the same trajectory" as those markets – just a few years behind.

Broadening the e-trading revolution across fixed income looks to be a natural next step in a world where the largest asset managers routinely look across different markets in search of their next investment.

“Credit is now leading the way in the equitisation of fixed income. We’re seeing multi-asset portfolio trades with rates, securitised products, munis, and we’re starting to connect our capabilities across fixed income,” said Massingham. “The traditional silos are crumbling down. We’re now thinking about how we transform the structure of the fixed-income business and whether there should be a central risk book across all of fixed income.”