Taking a position: AI debt frenzy gives birth to new CDS markets

Until recently, the idea of Meta Platforms going bust seemed so fanciful that no real market existed for traders to exchange bets on such an outcome.

That changed almost overnight in late October when the world’s largest social media company announced plans to sell US$30bn of bonds to finance its enormous AI investments – the second of a pair of blockbuster deals that effectively tripled its liabilities in the space of a week. Suddenly, one of the most cash-generative companies on the planet, generating US$60bn in annual profits, had become one of the most indebted. Investors wanted a way to protect themselves – and fast.

Within hours, a new liquid market for Meta credit default swaps emerged as banks reacted to a surge in enquiries from investors and traders wanting to buy and sell derivatives wagering on the prospect of the company defaulting – or, more immediately, fluctuations in its credit profile.

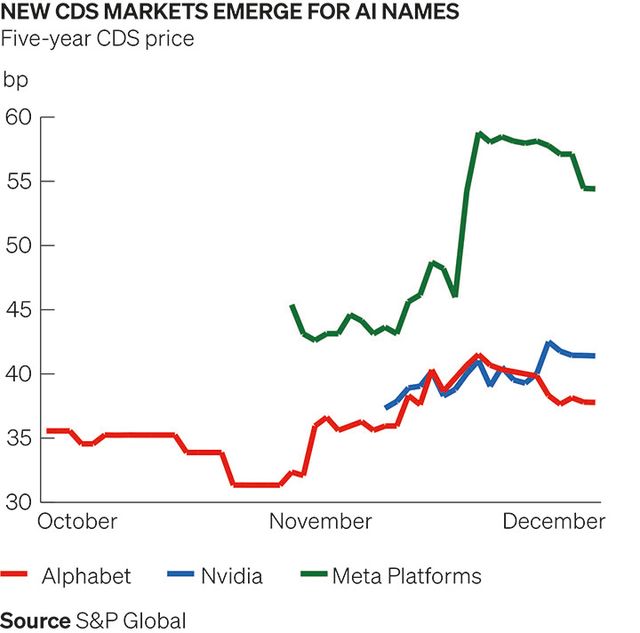

It isn’t alone. Over recent weeks, other new CDS markets have formed for various Silicon Valley names once seen as bulletproof. A CDS market for Nvidia, the world's most valuable company, emerged in mid-November, coinciding with news that its partner CoreWeave is facing delays with data centres. Investors had already been fretting about CoreWeave before that: a CDS market for it formed in late September.

“We’ve seen a huge uptick in CDS volumes in two-way trading on companies across the AI sector as there has been more debt issuance to fund data centre infrastructure," said Rehan Latif, global head of credit trading at Morgan Stanley. "The AI data centre debt investment is possibly the biggest thematic story in credit right now. Tech debt underwriting has never been greater, and clients are coming to us for different solutions using CDS, whether that’s hedging or going long these names.”

Defaults unlikely

Expectations of an actual default remain low for most of these companies. CDS markets are pricing in just a 5% probability of Meta being unable to pay its debts over the next five years, and only 4% for Nvidia. Although that rises to 10% for Triple B rated Oracle and a more worrying 48% for junk-rated CoreWeave, neither company has had any problem raising financing, with both selling billions of dollars of bonds this year.

In each case, though, there's no doubt over what's driving the growing demand for CDS protection: an unprecedented debt splurge from companies at the forefront of the AI boom that has left banks and investors potentially on the hook for billions. Alphabet, Amazon, Blue Owl Capital, Broadcom, Oracle and Meta have between them issued US$120bn of corporate bonds since September – and are raising another US$38bn in the loan market.

The debt binge shows no sign of abating, with JP Morgan predicting US$300bn of bond issuance next year – and US$1.5trn by the end of 2030. Another US$2.3trn could be raised in equity, structured finance and private capital markets over the next five years, as hyperscalers tap every available pocket of capital to finance the US$5.3trn of investments into AI they are expected to make.

Bespoke CDS contracts, negotiated on an ad hoc basis, have been around for years for credit investors seeking protection. But what has changed recently is that liquid markets have emerged. Data provider S&P Global, which requires at least three good-quality quotes from dealers for evidence that an observable CDS market exists, has begun publishing daily prices in many of these names.

"It’s quite rare in the investment-grade space to see this many CDS names to start trading and have genuine liquidity,” said Gavan Nolan, executive director at S&P Global. “The US tech sector in general has been fairly uninteresting from a credit perspective – it's been more of an equity story. Now it’s become more of a credit story due to the sheer amount of issuance and that's really fuelled that increase in CDS.

"We hear there’s a lot of banks hedging the credit they’ve extended to these firms. But it’s an interesting [theme] for many participants. There’s a lot of interest in who’s going to be the winners and losers from this rollout of AI, and obviously credit investors are very much focused on avoiding the bad credits that destroy value in a credit portfolio."

Transacting billions

Credit trading desks say they have been transacting billions of dollars of AI-linked CDS in recent weeks, with cloud computing provider Oracle, which has more than US$100bn of debt, proving one of the most popular. While its CDS contracts have traded since at least 2007, the cost of protection hit new highs in recent weeks after it struck a complex US$300bn deal with OpenAI.

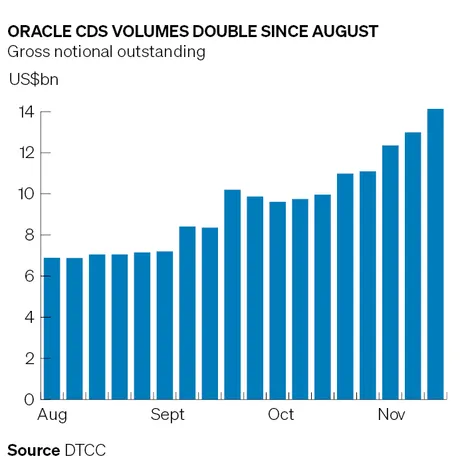

According to Depository Trust & Clearing Corporation, which collects data on CDS trades, the gross notional outstanding of Oracle CDS has doubled over the past three months to US$14.1bn. Gross notional outstandings for other names are much smaller: US$915m for Alphabet, US$627m for Meta, US$271m for CoreWeave and just US$35m for Nvidia, according to the latest DTCC data supplied to IFR.

“We’ve been extremely active across the most liquid tech names in CDS,” said Derek Hafer, global head of macro credit and systematic trading at Bank of America. “The single-name CDS business has really come to life as investors want to discuss credit and the risk premium in AI companies – and how that can evolve depending on the debt supply dynamics.”

While the increased demand for protection is notable, bankers involved with some of the most recent debt deals say that the surge in CDS volumes is nothing to worry about. The development of a liquid CDS market is very much standard practice for any major company that uses debt to fund its operations. It's also a welcome development in helping to price bonds that are already issued – as well as the deluge of supply that is projected next year.

“These companies that are issuing this debt are not like the big, classic, established investment-grade bond issuers who've been issuing bonds for years and years and years, and who have an established curve right across the maturities and an established CDS market to price off,” said a senior technology banker at an investment bank involved in some of the recent deals.

“I think there's a little bit of calibration going on in terms of what should be the established curves and also what should be the CDS market for that. I think we are seeing just some of the developments that you'd expect of what is a relatively new issuance market for companies that are not as frequent issuers or haven't done as much to establish that over time.”