‘Software-mageddon’ underlines the K-shaped environment for tech bankers

The AI boom has been backed by investor enthusiasm – and their money – on an unprecedented scale. Investment bankers have high hopes of a huge year for deals. But just like the broader economy, will this be a K-shaped market for tech deals?

In 2025, technology was the busiest sector in both M&A and ECM. According to LSEG statistics, tech M&A rose more than 60% year on year to US$827bn and tech ECM deal volume rose more than 35% to US$133.4bn. Even in DCM, where tech is a relatively small sector, dealflow doubled.

So the outlook is rosy – at least for those in the upward sloping part of the “K”. Late last year I wrote about “the excitement around IPOs of the ‘fantastic five’: SpaceX, OpenAI, Anthropic, Databricks and Stripe”. Of these, the largest valuation and most intriguing equity story is SpaceX, which is literally out of this world, with CEO Elon Musk looking at a potential June IPO to coincide with his birthday and planetary alignments.

Mega-cap IPOs like this are events that have a huge FOMO effect on investors. And we have never seen so many jumbo deals lined up near the start line.

At the same time, there is no shortage of capital in private markets, which are less valuation-sensitive and the easy availability of private capital may encourage some of these companies to choose to wait until 2027 and beyond rather than list in 2026.

Should this happen, it is unlikely that the traditional software sector can pick up any of the shortfall in expectations.

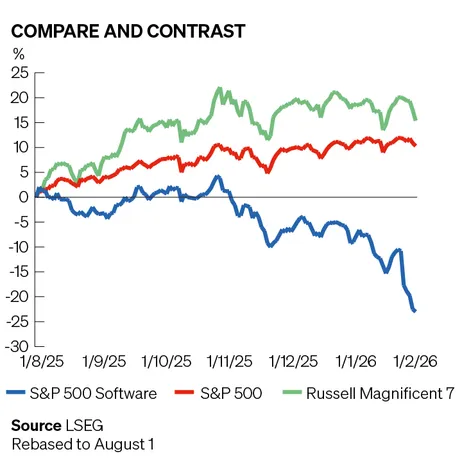

The dire performance of the largest software IPOs of 2025 will be a warning sign for any software company hoping to come to market to consider. Many of these stocks had drifted lower in recent months – before falling off a cliff in this week's so-called software-mageddon.

The largest of these, design software maker Figma, has seen its share price fall by 50% over the past three months and is down 84% from its post IPO highs. It is now 32% below its IPO price. The shares of other newly listed tech companies SailPoint and Netskope are down 35% and 50%, respectively, from where their IPOs priced.

Even blue-chip companies like Salesforce, Adobe and ServiceNow have seen their shares trade off significantly – between 44% and 52% – in the past year. Price-to-earnings valuation multiples across the sector have shrunk significantly, as investors price in the risk that AI could be an enterprise software killer.

It was little surprise, therefore, to see Blackstone's last-minute postponement of the Nasdaq IPO of software company Liftoff Mobile. The deal was due to raise up to US$762m but was abandoned on Thursday.

So if ECM is looking tricky, what about M&A, which is an equally important area for software dealmakers? The likes of Microsoft are all in on AI and, with capex eating into most free cashflow, are unlikely to be looking at legacy software.

But very attractive valuations can create opportunities for private equity investors or midsize industry consolidators. Given the former always rely on debt leverage and the latter, considering the depressed share prices, are likely to prefer debt over equity funding, the cost of debt financing matters. In recent days we have seen a further dramatic selloff in the bonds of software companies such as CDK Global and McAfee.

The deluge of bond offerings coming from big tech is likely to have some crowding-out effect as well. The dreadful performance of Oracle’s bonds – which are related to its AI infrastructure buildout costs rather than its software business – is unlikely to help investor sentiment, even if prices have stabilised in the past week or so.

Private credit, another potential source of funding, has been struggling with his own scandals and markdowns. Moreover, industry leader Apollo has been reducing its exposure to software loans.

At a mid-November Bloomberg conference, Apollo CEO Marc Rowan said: “Technology change is going to cause massive dislocation in the credit market. I don’t know whether that’s going to be enterprise software, which I could make the case is going to benefit or be destroyed by this. As a lender, I’m not sure I want to be there to find out.”

The software-as-a-service sector is still well entrenched, and deals will happen at the right price. But it is a K-shaped technology sector with AI names at the top. The test for the SaaS sector will be in the IPO of Canva likely later this year, which was priced in the private markets more conservatively than Figma. As for M&A, this might well be a good time to be a large SaaS business sitting on a pile of excess cash.

Rupak Ghose is a corporate adviser and former financials research analyst. Read his Substack blog here.