Major banks are investing heavily to expand their presence in fixed-income exchange-traded funds, an area dominated by non-bank market-makers that has emerged as a crucial part of the new ecosystem for trading corporate bonds.

Barclays, Citigroup, JP Morgan and Morgan Stanley are among the banks looking to make up ground in fixed-income ETFs as part of a broader push to bolster their electronic trading offerings in corporate credit.

The old guard faces a tall order in breaking the stranglehold that newer, non-bank trading firms have established over the US$2trn fixed-income ETF market over the past decade. Jane Street and Flow Traders hold a market share of about 80% in fixed-income ETF trading, industry experts estimate, giving them a significant head start in these fiercely competitive markets.

But senior bankers are determined to end that dominance, which they believe is undermining their efforts to expand in other parts of the credit e-trading universe such as portfolio and algorithmic trading.

“ETFs were a specialised product in the market for a long time and weren’t used by a lot of market participants. Banks were complacent and then woke up one day and realised ETFs are now actively traded,” said Alexis Besse, head of international fixed-income quantitative strategies at Jefferies, which is also investing in this space. “It’s definitely becoming crucial in terms of that pool of liquidity in fixed income. ETFs are getting bigger and becoming more relevant in the ecosystem.”

ETFs have become an integral part of corporate credit trading in recent years – despite still only accounting for about 1% of the US$206trn global bond market at the end of June, according to BlackRock. Long frustrated by the difficulties in trading individual bonds, institutional investors have embraced ETFs as an effective way to dial up or down their exposure to credit markets in quick order, particularly during periods of turbulence such as at the outbreak of the pandemic in 2020.

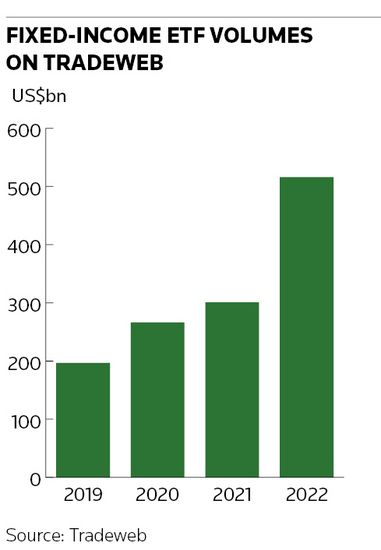

The number of clients trading fixed-income ETFs on Tradeweb’s trading platform has grown by a quarter since 2019 to 277 last year. This growing popularity among asset managers and hedge funds pushed up average credit ETF trading volumes in 2022 to equal 23% of the total amount of corporate bonds changing hands each day, according to analytics firm Coalition Greenwich. That has sent banks scrambling to catch up following years of neglect for a product they once viewed as mainly retail in nature.

But senior traders say there is more at stake than merely grabbing a larger share of the bond ETF pie. Many now see ETFs as an indispensable leg of a self-reinforcing set of activities that – taken as a whole – will determine a trading desk’s ability to absorb client orders and recycle risks across its broader corporate credit franchise.

“In isolation, it’s a product where we can do a good job market-making. But it's also part of a whole ecosystem of risk,” said Laurent Samama, head of flow credit trading for Europe at BNP Paribas. “If you want to trade credit in 2023 in a wholesale manner, you have to do the whole chain from a single bond to a portfolio, to an ETF, which also gives you a lot of flexibility in hedging and risk transformation.”

Three is the magic number

ETFs are one of a trio of businesses – alongside algorithmic and portfolio trading – that has revolutionised corporate credit markets in recent years. Computer algo programs have developed significantly to price odd lots of bonds in a fraction of the time that it would take humans. Portfolio trading has also accelerated, allowing investors to trade huge blocks of corporate bonds – sometimes up to US$2bn of hundreds of different securities – in the space of an hour.

Algos, portfolio trading and ETFs fit neatly together to form a virtuous circle of activities, traders say, each providing a different stream of client flows and an outlet for risks that credit desks accumulate. That allows, for instance, traders to recycle corporate bond positions they take on through their algo and portfolio businesses through the ETF create-and-redeem process, which lets them swap the bonds underlying an ETF for shares in the product.

This new dynamic has driven a surge in overall credit e-trading volumes, which have roughly doubled over the past few years to account for 40% of total activity in US investment-grade bonds in 2022, according to Coalition Greenwich.

‘Improvements in technology are revolutionising the way investors access fixed-income markets,” said Jason Warr, global co-head of ETF markets for BlackRock.

Dealers are increasing the breadth of bonds being quoted electronically into the thousands, Warr said, and developing program trading capabilities. “This broad inventory and portfolio trading is hugely complementary to a dealer’s ability to price and risk manage fixed-income ETFs and as such we are seeing these three areas accelerate together,” he said.

Catch up

Many banks have made significant headway in algo and portfolio trading, but still lag far behind in fixed-income ETFs. This is a space where specialist market-makers like Jane Street and Flow Traders have dominated for years, adopting a technology-driven approach to help process large numbers of tickets at razor-thin margins.

The two firms see as much as 95% of fixed-income ETF trades, experts estimate, giving them a material information advantage over rivals. Jane Street and Flow Traders didn’t respond to requests for comment for this article.

“There are huge barriers to entry. You compete with two extremely dominant players making it hard to break into it,” said Melvyn Merran, EMEA head of ETF, credit algo and portfolio trading at Jefferies.

Some of those barriers are technical. Banks have traditionally housed bond ETFs in their equities divisions and it has taken time and investment to shift activities to their more natural home on credit desks. There is also the sheer volume of fixed-income ETFs in existence to cover – more than 900 at the end of June, according to BlackRock – although most activity concentrates in a handful of products. Adam Gould, head of equities at Tradeweb, said specialist market-makers have forced banks “to step up their game".

“If banks are pricing individual bonds, portfolio trades, the ETF, they’re going to be natural buyers and sellers of credit a lot more because they can figure out the cheapest way to hedge,” Gould said. “And frankly, if they're not set up to kind of do all of this in one place, then they're going to be at a disadvantage on pricing relative to their peers.”

Banks may be hard pressed to loosen Jane Street’s and Flow Traders' grip over fixed-income ETFs, but senior traders believe that is precisely what they need to do to remain relevant as credit markets evolve. Merran at Jefferies said that profitability has, in general, been a challenge in credit e-trading.

“We think the answer is to realign and connect the books and products that contribute to all the liquidity avenues in this new ecosystem: having an ETF desk alongside an algo desk and a portfolio desk is the best way to do this,” he said. “We do believe this ecosystem is profitable, and that it’s very important to see the flow in one place.”