Fed rate cuts set to trigger more US dollar hedging

Foreign investors are set to increase their currency hedging of US assets, traders believe, amid expectations that the cost of shielding portfolios against a weaker dollar will decline if the US Federal Reserve follows through with interest rate cuts next month.

Institutional investors across Asia and Europe materially upped their currency hedges on their holdings of US stocks and bonds in the first half of the year following concerns over US tariffs and their effect on the world’s largest economy. Those flows helped consign the US dollar to its worst start to a year since the early 1970s.

Traders believe overseas investors are eager to continue raising dollar hedging ratios after years of largely ignoring these risks. Many, however, have been deterred by the steep price tag that currently comes with hedging the dollar because of the negative carry created by the US’s comparatively higher interest rates.

The chances of the Fed cutting rates at its next meeting have increased in recent weeks following weaker-than-expected US jobs numbers. Such a move would narrow the interest rate differential to other developed countries in Europe and Asia. That, in turn, should cheapen the cost of dollar hedges, opening the door to more hedging activity from foreign investors.

"Now the US interest rate story has changed, shorter-dated rates are expected to come lower. So we expect much more hedging to take place between now and year-end,” said Chris Turner, head of FX strategy at ING.

Rising ratios

Foreign investors are a major presence in US markets, owning US$31.2trn in equities and bonds as of March, according to BIS data. The historic strength of the greenback previously encouraged these investors to leave their US assets unhedged.

But mounting concerns over tariffs and the economy sent both the greenback and S&P 500 tumbling in April – wreaking havoc on the investment portfolios of overseas asset managers, pension funds and insurance companies.

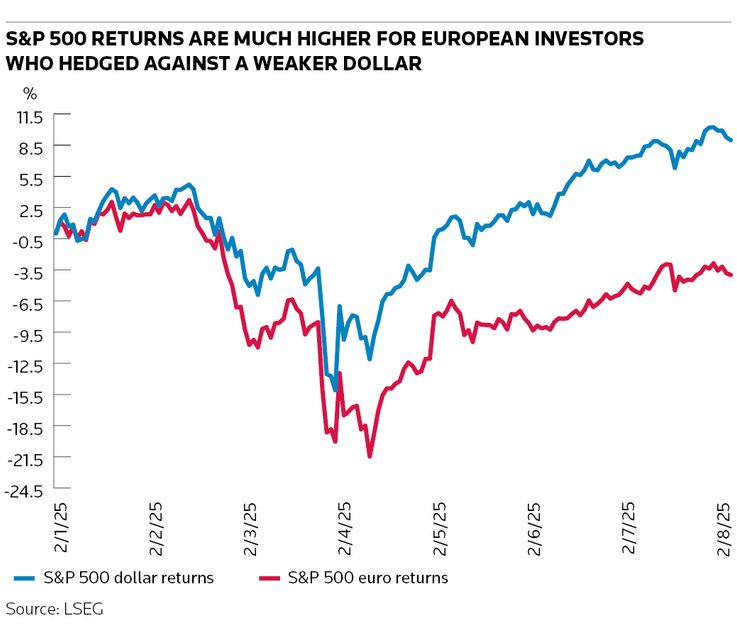

The S&P 500 has rallied since its April lows but is still down 4% this year in euro terms. That compares to a nearly 9% gain for dollar investors, showing how the greenback's decline has weighed heavily on overseas portfolios. That has prompted many to increase their US hedging ratios to protect themselves from a further leg down in the dollar.

“We’re living in a new world of dollar weakening rather than dollar strengthening so US hedge ratios are increasing quite significantly,” said Ales Koutny, head of international rates at Vanguard.

Ontario Teachers’ Pension Plan, one of the largest pension funds in Canada, cut its exposure to the dollar by 56% in the first half of the year. Danish pension funds have also reduced their greenback exposure by US$37bn, raising the industry's hedge ratio to 74% of its assets as of the end of April, according to analysis by BNP Paribas, compared to less than 65% in early 2025.

"Since April’s tariff shock triggered further weakness in the dollar, hedge ratios have increased across most developed economies," said Sagar Sambrani, senior options trader at Nomura. "We’ve certainly seen that in conversation with our Australian pension fund, Taiwanese life insurance company and [South] Korean investor clients.”

Costly hedges

Despite this widespread move to hedge the dollar, the prohibitive cost of doing so has proved a sticking point for some. This is largely a result of interest rate differentials between different markets. The Federal Reserve’s benchmark rate remains at about 4.3%, far above Japanese interest rates at 0.5% and the European Central Bank’s deposit facility rate of 2%.

As a result, it currently costs European investors around 2% a year to hedge their dollar assets, according to Turner. “That’s quite a hefty cost,” he said.

Should the Fed cut rates by 100bp by year-end, as UBS economists expect, US hedge ratios should rise in tandem, said Vassili Serebriakov, FX strategist at UBS. That's because narrowing interest rate differentials would see the cost of dollar hedges for foreign investors "fall significantly".

“[Cutting rates] would create an important incentive to hedge more, so the cost of hedging over the next few months – driven largely by what the Fed does – is really important,” he said.

Done deal?

Bond traders are treating a US rate cut in September as a done deal, although Fed chair Jerome Powell has yet to endorse such a move. Powell was due to speak at the Fed’s annual symposium at Jackson Hole on Friday, 22 August.

Either way, foreign investors have already demonstrated they’re not ready to give up on their addiction to US markets. In June, foreign purchases of US stocks and other long-term US securities grew by US$150.8bn, according to the US Treasury. Those bullish on US assets, but still bearish on the dollar, may have no choice but to pay up for their currency hedges, regardless of the cost.

“US markets have rebounded since April and, as these markets are performing, people are clearly putting money into them,” said a trader at a large investment bank. “Overall, the US remains an attractive place to invest with few real alternatives.”