Investors rush to short sterling ahead of UK budget

Investors are piling into bets against the British pound, traders say, amid widespread pessimism over the outcome of the UK government’s budget later this month.

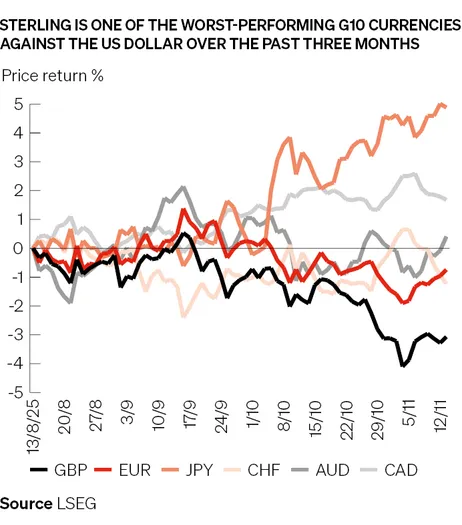

Price moves in FX options markets suggest traders have now amassed a short position in sterling, according to recent analysis from Bank of America, following a hefty reduction in bullish bets in recent weeks. Sterling is the second worst-performing major G10 currency over the past three months, slumping 3% against the US dollar to about US$1.315 on Friday.

The UK currency has come under increasing pressure amid concerns over how chancellor Rachel Reeves will plug a potential £30bn black hole in the public finances in the November 26 budget. A reported government U-turn on plans to raise income tax only added to the sense of disarray on Friday, pushing UK borrowing costs higher and the pound lower.

Jeffrey Yarmouth, head of FX options trading for the Americas at UBS, said macro hedge funds in particular have flocked to derivatives strategies such as sterling puts and put spreads to express their bearish views.

“Downside sterling to position for the UK budget is an opportunistic trade attracting growing interest from clients,” Yarmouth said.

The pound’s struggles come in the wake of a strong start to the year. A sustained bout of US dollar weakness as investors questioned the US exceptionalism story helped push the pound above US$1.37 in early July, its highest level against the US dollar since October 2021.

Even after its recent slide, the pound is still up about 5% in 2025, behind only the Australian dollar and the euro in its performance against the greenback. But there is no doubt a combination of investor angst over the UK’s finances and a series of disappointing data releases have weighed on the currency in recent weeks.

Mounting pressure

Rumours have swirled for months around potential spending cuts and tax rises the UK could implement to balance the books. That uncertainty has heaped pressure on Reeves and prime minister Keir Starmer, and prompted speculation over how they will plug the deficit and whether they will break an election pledge not to raise income tax, VAT or payroll taxes.

Signs of a slowing economy have created another headwind for the pound. On Thursday, the Office for National Statistics said the UK economy unexpectedly contracted in September, dragging down third-quarter GDP growth to 0.1%. That followed news that UK unemployment rose to 5% in the three months to September – the highest level since early 2021 – according to the ONS.

Traders say many investors had already started to ramp up bets on a weaker sterling after data released last month showed UK inflation in September came in below expectations, potentially clearing the way for the Bank of England to lower interest rates in its upcoming meetings.

“There is growing focus among clients on economic developments in the UK given the impending budget,” said Sagar Sambrani, senior FX options trader at Nomura, who said sterling trades have been “very popular” with directional players such as hedge funds. “Given the precedents in selloffs of the pound sterling and Gilts set by the UK budgets in 2022 and 2025, the budget this year is hotly anticipated.”

Sambrani said that betting on a strong US dollar against the pound is usually the trade of choice for sterling weakness. However, the higher volatility of sterling-dollar options makes those trades expensive compared to, for instance, betting that the euro will strengthen against the pound. Sterling is hovering at its lowest level against the euro in about two and a half years.

“EUR/GBP has broken new highs recently, not only because the market prefers the euro, but because they think it’s the best currency to play sterling weakness against, given low volatility,” Sambrani said.

Further to run?

Some investors have turned to more exotic structures to bet against the pound. They include hybrid derivatives, which allow clients to take a view on how different markets will move in relation to each other. That can cheapen the cost of their option as opposed to, for instance, an outright bet on weaker sterling.

“Clients have reasonable conviction on sterling, but they don’t have a strong conviction on the dollar,” said Sam Hewson, head of FX sales at Citigroup. “How do you express a bearish sterling view? Which currency is best for expressing that view? These are areas that have prompted discussion, leading to increased demand for hybrid derivatives.”

Not everyone believes sterling weakness has further to run. Some analysts argue that the overwhelmingly pessimistic expectations for the budget may have reduced the downside from here – and even primed the pound for a rally if investors approve of the government’s plans.

“That a government is considering raising taxes ... contrary to previous administrations, must be seen as a market positive,” said Kamal Sharma, FX strategist at Barclays, in a November 11 note. “[Should] the budget follow these contours, then we expect a GBP rally.”

Goldman Sachs analysts also cautioned in a recent note against betting on sterling falling in the near term. “[The pound] remains a highly cyclical currency, and any unwind of the several bouts of broader risk-off price action … should lend support to the currency versus both the euro and the dollar,” the analysts wrote.