Popular derivatives bet stumbles as Dutch pension shift begins

A sweeping overhaul of the €1.6trn Dutch pensions industry was billed as a big bang event for the €178trn euro swap market. So far, at least, it’s proven more of a whimper.

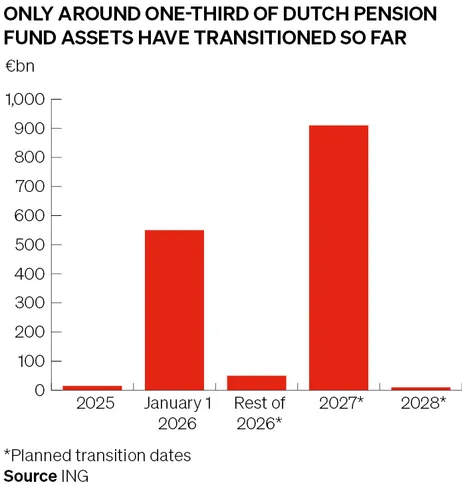

An estimated €550bn in Dutch pension fund assets started to transition to a new regulatory regime from January 1 in a shift expected to trigger a once-in-a-generation realignment of European fixed income markets. That is because the new framework encourages pension funds to ditch long-dated interest rate hedges that have created huge distortions in the euro swaps curve.

These shifting dynamics spawned a popular hedge fund bet: positioning for the curve to steepen sharply as long-dated rates rise relative to shorter-dated ones. However, the start of 2026 has instead seen a surprise flattening in the swaps curve amid signs the pensions industry is managing the transition smoothly – upending this consensus trade and reportedly sending some hedge funds running for the exits.

“It seems like the market overestimated how much flow Dutch pension funds had to transition at the same time that funds tried to minimise the noise of their transition as much as possible,” said the head of euro swaps trading at a European bank. “There were some signs of bond selling in mid-January but other than that, swap unwinds have been very limited so far.”

Derivatives traders have long braced for the impact of the Dutch government’s plans to revamp Europe’s largest pension system as it moves away from workers receiving a guaranteed payout on retirement.

Mathias Kpade, rates strategist at Societe Generale, estimated the difference between 10-year and 30-year rates should rise to more than 40bp by the end of 2026, compared with 32bp seen at the end of 2025. Instead, the 10s/30s curve flattened to a recent low of 25bp on January 16 before recovering to about 31bp on Friday.

Risk transfers

Analysts posit various theories for curve steepening failing to materialise. Earlier this month, PFZW – the second largest pension fund in the Netherlands – published a new strategy that included significantly higher hedging ratios than the market had anticipated. That, in turn, reduced its need to unwind long-dated hedges, according to Michiel Tukker, senior European rates strategist at ING.

Bankers also say some pension funds have unwound large amounts of hedges discreetly using so-called risk transfer trades. These are transactions in which bank trading desks absorb a pension funds’ hedge unwind before offloading the exposure to other clients in a way that leaves a smaller footprint in the market than a sudden bulk sale.

“It seems like more risk transfer trades took place across December and January than us, or others in the market, had expected – which prevented curve steepening by keeping Dutch transition flows away from the market,” said Steven Montgomery, senior G10 rates strategist at BNP Paribas.

He estimates that Dutch pension funds that began the transition in January have already unwound half the €60m in DV01 – a popular measure of fixed income risk – of hedges that they need to. Under “normal” conditions, euro swap markets can absorb roughly €5m in DV01 of hedge unwinds in a week, Rabobank analysis suggests.

Hedge funds may also have been their own worst enemy after piling into the euro steepener trade en masse. Some analysts say hedge funds decided to dump these bets when they failed to pay off earlier in the month, exerting further downward pressure on the euro swaps curve.

“Fast money players were looking to make a quick buck from the steepening trade, but it isn’t yet happening,” said Tukker. “As a hedge fund, are you willing to wait for any Dutch transition flows to materialise, knowing that they're probably going to be smaller than you initially anticipated? Or do you cut your losses by exiting your trade now? A lot of hedge funds have seemingly chosen the latter, causing even more flattening of the curve.”

Curve consensus

Nevertheless, banks still expect the 10s/30s curve to gradually steepen as Dutch pension funds continue to unwind the €200m in total DV01 associated with their interest rate hedges by the end of 2028. That’s equivalent to about five times the interest rate risk stemming from the Dutch government's €40bn of gross bond issuance in 2025.

Analysts point to the fact that the bulk of the pension transition isn’t expected until next year, when an estimated €1trn of additional assets will start making the move. By the end of 2027, Dutch pension fund activity should steepen the curve towards 75bp, Kpade estimates.

There are also other catalysts that could support curve steepening. Rising deficits across the globe and a reassessment of inflation risk could heavily influence the shape of the curve over the next few years, strategists say.

“Outside of Dutch pension fund transition, that global steepening bias remains and should continue to be supportive of steepening in the coming months,” said Montgomery.